As a seasoned analyst with over two decades of experience in the financial markets, I’ve seen my fair share of market cycles and trends. The recent performance of Bitcoin this year has certainly caught my attention, outpacing traditional indices like the Nasdaq 100 and S&P 500. However, the recent pullback to $97,000 from its all-time high is a reminder that even the most promising assets can experience corrections.

This year, Bitcoin’s value has significantly increased, climbing an impressive 120%. It surpassed well-known investment options such as the Nasdaq 100 and S&P 500 stock market indices.

After the Federal Reserve indicated only two potential interest rate reductions in 2025, Bitcoin (BTC) has dropped back to approximately $97,000 from its previous record high of $108,427.

MVRV score shows Bitcoin price is still cheap

The recent Bitcoin pullback affected investors, as evidenced by spot ETF flows.

As reported by SoSoValue, these funds experienced withdrawals totaling $276 million on Friday, following a loss of $680 million in assets the previous day. This suggests that certain investors might be anticipating that Bitcoin has reached its peak.

Despite hitting an all-time high recently, the Market Value to Realized Value suggests that Bitcoin’s current price might be undervalued.

Based on CoinGlass data, the MVRV-Z score decreased to 2.84 this week from its previous high of 3.3. Typically, an MVRV-Z score less than 3.7 indicates that the asset might be underpriced.

The MVRV-Z score serves as a significant benchmark, examining both the market worth and the comparative value of a cryptocurrency. To calculate this score, first, we subtract the realized market capitalization from the current market value in circulation. Next, we divide this result by the standard deviation.

Bitcoin had an MVRV score of 3.03 in the last big correction in March this year, and 7 in the previous major correction in January 2021.

Consequently, this score indicates that the coin might experience a substantial recovery within the upcoming weeks, as hinted by our latest Bitcoin forecast. The cup and handle pattern suggests an upward trend towards $122,000 during this bullish phase.

BTC faces other strong fundamentals

Additionally, it’s worth noting that the circulating supply of this particular coin is currently at a relatively low level compared to previous years. Specifically, as of now, there are approximately 2.24 million Bitcoins in circulation – the lowest figure in multiple years. Just nine months ago, in September, there were over 2.72 million coins in circulation on exchanges.

As a researcher, I’ve observed an increasing trend among investors: they are purchasing and safeguarding Bitcoins using personal wallets. Some of these investors are the same ones amassing ETFs, which currently manage over $109 billion in assets. Companies such as Marathon Digital and MicroStrategy have consistently added more Bitcoins to their portfolios this year.

MicroStrategy now holds over 439,000 coins.

Another possible trigger for Bitcoin could be the significant increase in the total value of stablecoins, which now stands at nearly $210 billion, representing a rise from about $122 billion just a year ago.

An increase in the value of stablecoins often signifies a good trend, demonstrating that more and more investors are taking notice of and becoming interested in the world of digital currencies like cryptocurrencies.

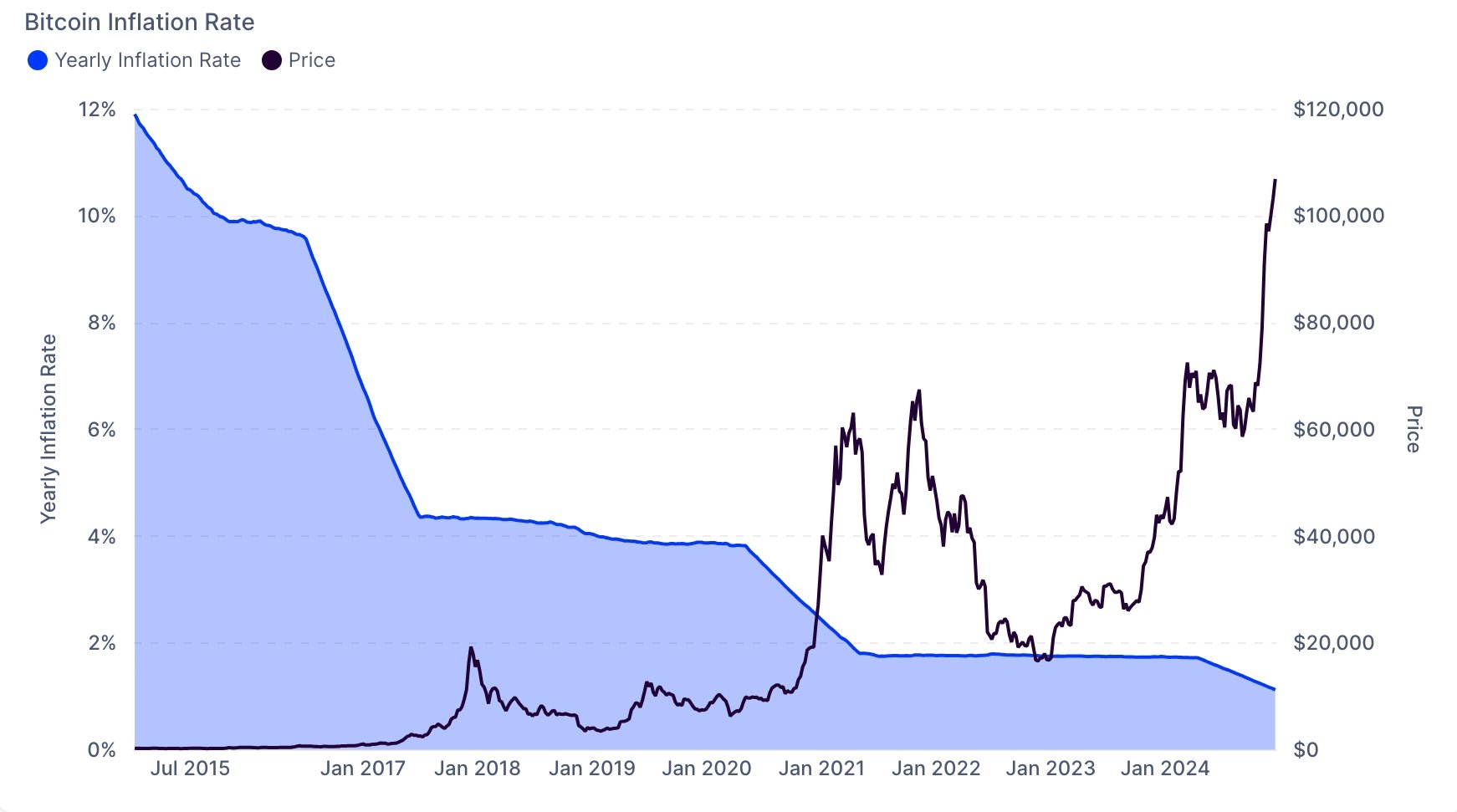

Over time, the annual inflation rate associated with Bitcoin has consistently decreased, shifting from a peak of nearly 12% in 2015 to its current level of 1.12%. The main reasons for this decline are halving events and an increase in mining difficulty.

Consequently, although Bitcoin might still experience a dip, its positive MVRV rating and robust foundations suggest it could climb further in the long run.

Read More

- 10 Most Anticipated Anime of 2025

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- USD CNY PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

- Castle Duels tier list – Best Legendary and Epic cards

- Maiden Academy tier list

- Cookie Run Kingdom: Lemon Cookie Toppings and Beascuits guide

- Silver Rate Forecast

- USD MXN PREDICTION

2024-12-22 19:30