Oh, Bitcoin—still more dramatic than a telenovela and just as unpredictable! The market is a neurotic mess, with traders biting their nails over Big Scary Macroeconomic Factors, ETFs, and “liquidity grabs” (aka “Help! Somebody moved my cheese!”). BTC got rejected at 110K—again! Honestly, it’s starting to feel like that one guy who keeps asking his crush to prom every year: “Maybe next time, champ.” So, the price is stuck in what the technical folks call “a tight range”—what I call “the world’s most boring ping-pong game” with opportunistic traders ready to jump on anything that wiggles.

By ShayanMarkets (who, by the way, probably needs a vacation).

The Daily Chart

On the daily chart, our dear BTC is wobbling between two zones. The 100K–110K range is the site of a royal rumble between buyers and sellers. You got the 100- and 200-day moving averages acting like bodyguards near 95K, with the possibility of a “bullish crossover”—which is either very exciting or just a fancy way of saying, “These lines might bump into each other soon.”

That 110K level? It’s like the velvet rope outside a club. BTC keeps trying to sweet-talk the bouncer, but so far—no dice. A daily close above 110K might actually get us into the VIP bull room. Until then, we’re stuck outside reminiscing about better rallies—and probably bracing for a correction that’ll remind us we’re not as smart as we thought.

The 4-Hour Chart

Now, let’s squint real hard at the 4-hour chart. BTC is ricocheting between a bullish fair value gap at 103K and a bearish one around 106K—kind of like your friend who can’t decide between cake and a salad. It’s smashing into resistance, but lo and behold, it’s poking above it (cue dramatic music). Maybe we get a bullish leg up, maybe we just trip. The RSI is tiptoeing up at 56—which is like your mom saying she’s “not mad, just disappointed.”

If bulls want a parade, they gotta break and hold 106K–107K, preferably with a little confidence this time. If not, it’s back to the sad 100K block, where dreams go to sulk. Traders, get ready for more “liquidity hunts”—Wall Street lingo for “awkward snipe hunts in candle charts.”

On-Chain Analysis

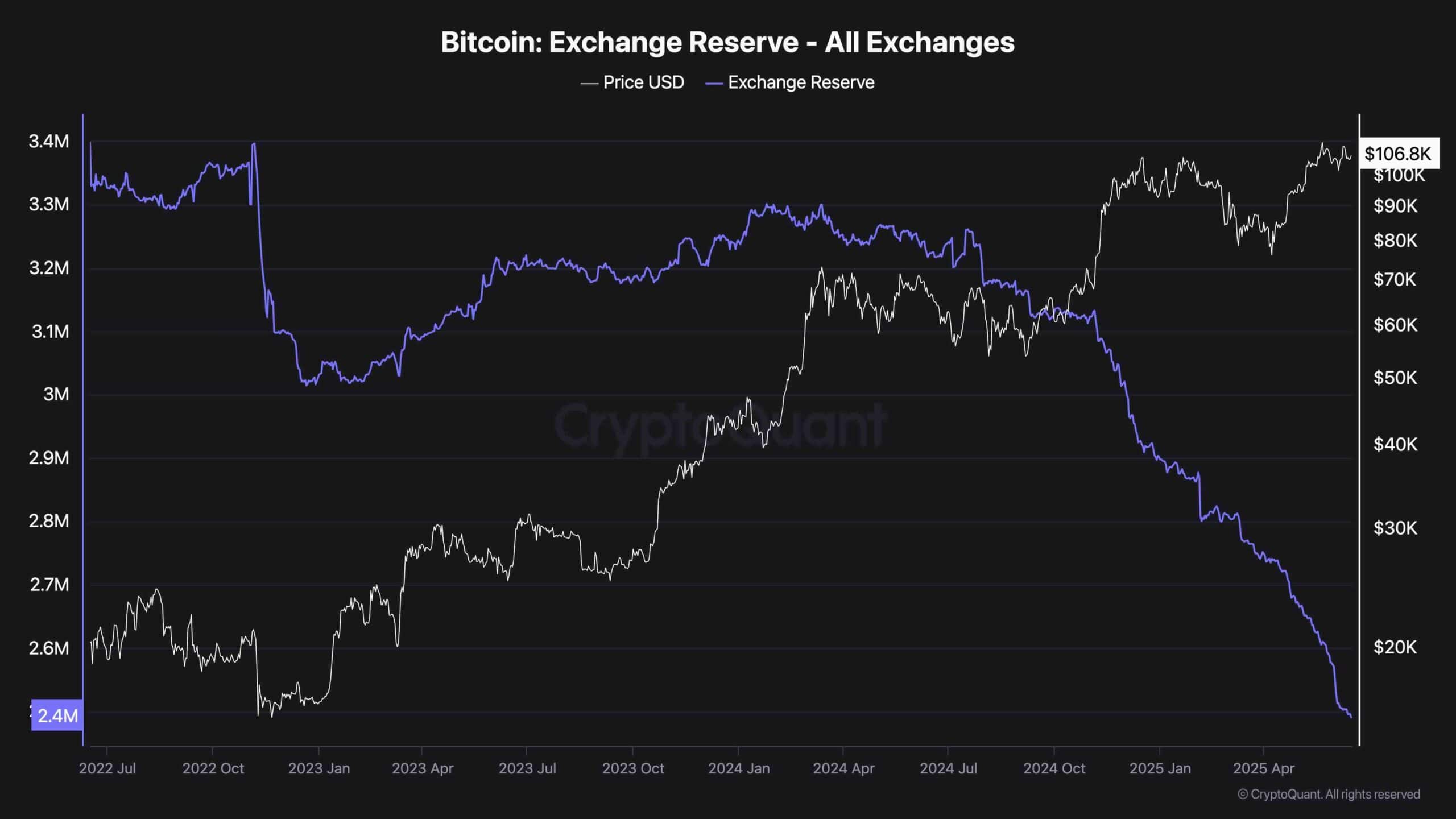

Exchange Reserve

Since New Year’s, Bitcoin exchange reserves are dropping faster than my patience at the DMV. Lowest in years! Apparently, everyone’s stashing their coins in cold wallets, Grandma’s cookie jar, maybe under the mattress—anywhere but the exchange. Why? Because if you’re holding, you’re bullish and you want to brag about it at dinner.

Low exchange reserves = less sell pressure, more volatility, and the possibility that some random news headline could launch BTC to the moon… or straight into a pothole. When supply gets this tight, even retail FOMO or a billionaire’s sneeze can send the market spinning. Explosive moves, wild volatility, and traders either sobbing or popping champagne—now that’s entertainment!

Stay tuned for the next thrilling candle—will it be breakout, breakdown, or, just maybe, a song-and-dance number with tap shoes and jazz hands? 🕺💥🪙

Read More

- Silver Rate Forecast

- Black Myth: Wukong minimum & recommended system requirements for PC

- Gold Rate Forecast

- USD CNY PREDICTION

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Grimguard Tactics tier list – Ranking the main classes

- Arknights celebrates fifth anniversary in style with new limited-time event

- Gods & Demons codes (January 2025)

- Maiden Academy tier list

- PUBG Mobile heads back to Riyadh for EWC 2025

2025-06-16 16:11