As a seasoned researcher with over two decades of experience in the financial markets, I have witnessed numerous bull and bear cycles, and I must admit that the current state of Bitcoin (BTC) is quite intriguing. The coin’s recent surge above the crucial psychological level of $60,000 has sparked renewed interest among investors, with analysts predicting further upside in the coming weeks.

The price of Bitcoin remained stable above the significant threshold of $60,000, according to cryptocurrency experts who foresee potential growth in the upcoming period.

On this particular day, the price of Bitcoin reached an elevation not seen since August 27, hitting $60,200, as investors began to reallocate funds towards riskier assets in anticipation of the upcoming Federal Reserve decision.

Analysts are upbeat

Gold reached an all-time peak as the Dow Jones and Nasdaq 100 indices experienced their strongest week in quite some time.

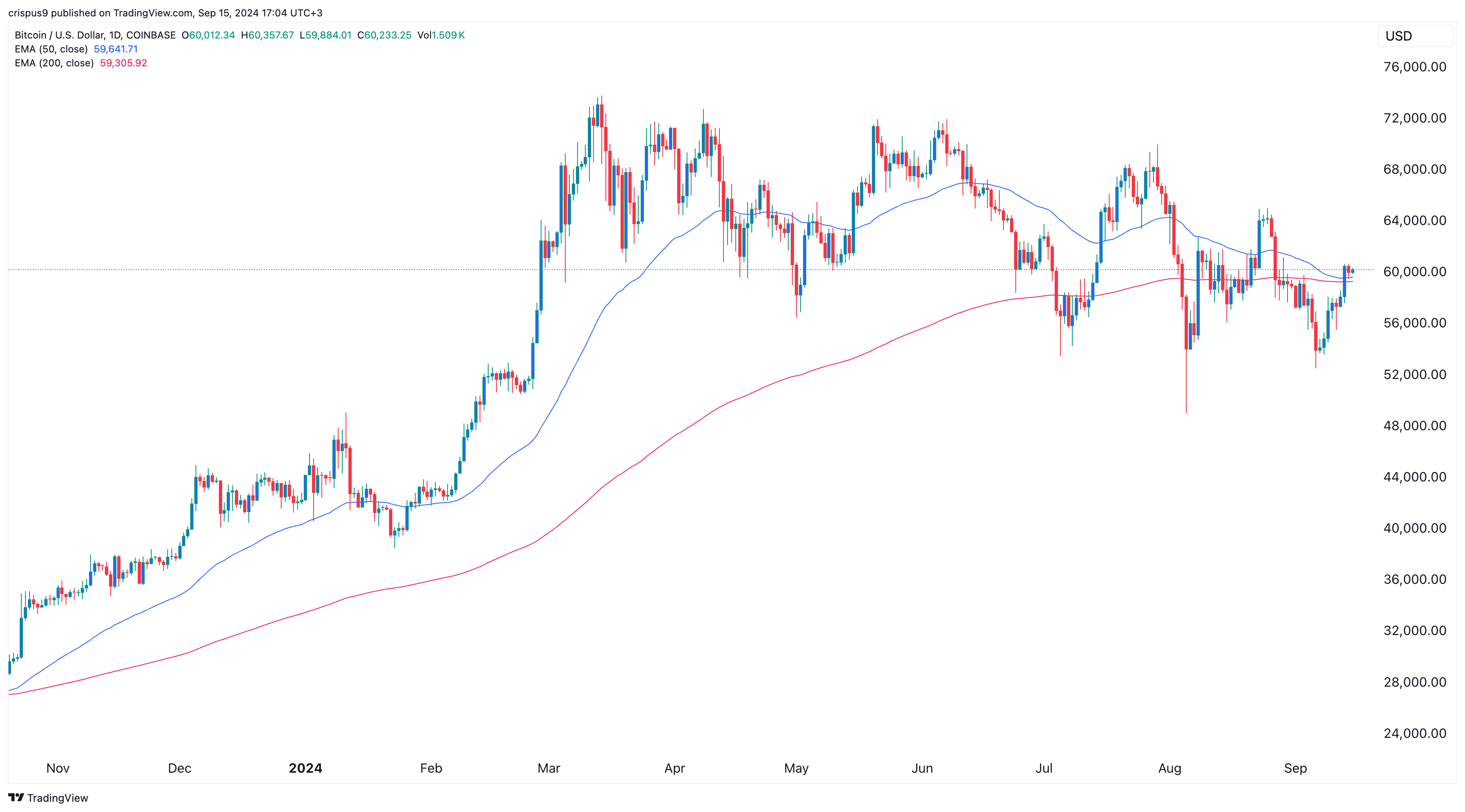

Remarkably, Bitcoin doesn’t appear to have created what’s known as a “death cross,” a situation where the longer (200-day) and shorter (50-day) moving averages intersect. Instead, it has managed to stay slightly above these averages, which is a promising indication.

Currently, several well-known cryptocurrency experts are optimistic about the potential growth of this digital coin. On a recent Reddit post, a prominent yet anonymous crypto expert known as Titan hinted at the possibility of the coin reaching an impressive price point of around $92,000.

His theory is that Bitcoin tends to move by at least 40% whenever it flips the 50-day simple moving average. He expects that the coin will jump by 71% in the coming months.

In a separate post, he noted that Bitcoin had reclaimed the Tenkan Kijun and moved above the Kumo cloud of the Ichimoku cloud indicator. Also, the Relative Strength Index broke above the multi-month trendline, pointing to more upside.

#Bitcoin Surpasses Key Technical Levels and Signals Potential Bull Run 💥#BTC recently regained its Tenkan line (🔴), Kijun line (🔵) and broke above the Kumo Cloud.Simultaneously, the RSI has broken a prolonged trendline.Should this hold, we might witness an increase in bullish sentiment in the near future. 🚀— Titan of Crypto (@Washigorira) September 15, 2024

According to a previous update by analyst Michael van de Poppe who boasts over 724,000 followers, there’s a possibility that Bitcoin could continue its current holding pattern and potentially make a strong surge upward towards the end of this month or early October.

What do I anticipate will happen in the markets?

— Michaël van de Poppe (@CryptoMichNL) September 14, 2024

According to renowned cryptocurrency analysis company, Santiment, there are possible factors that could drive an upward trend in Bitcoin prices.

The post highlighted an increase in Bitcoin being stockpiled by large investors (whales and sharks) while the amount of Bitcoin available on exchanges was decreasing.

Bitcoin volume in exchanges is falling

According to data from CoinGlass, the trading volume for cryptocurrencies has decreased to approximately 2.34 million, marking a drop from its highest point this year which was around 2.72 million.

This suggests that a large number of Bitcoin owners are not planning to offload their Bitcoins in the near future. In fact, prominent holders such as MicroStrategy are even increasing their possession.

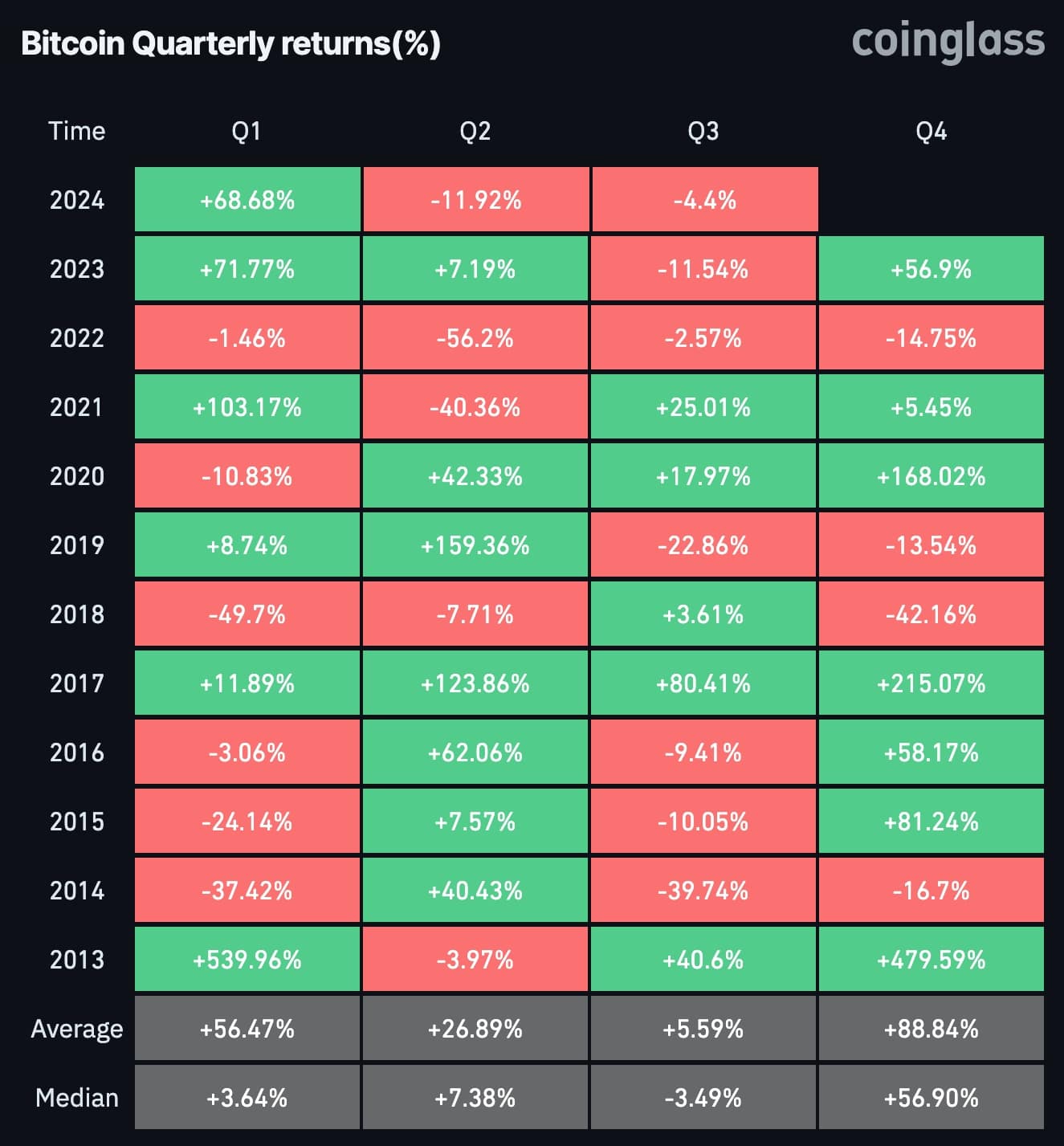

It’s worth noting that Bitcoin often experiences downward trends during the third quarter, followed by a recovery in the fourth quarter based on data from CoinGlass.

It has dropped in seven third quarters since 2013 and risen in five quarters.

In the third quarter, the typical return was 5.59%, but during the fourth quarter, the average return jumped to 88%. Historically, September has been the least favorable month for Bitcoin investments, whereas October and November have tended to be the most profitable.

An additional factor, as mentioned on September 14, is the persistent decrease in stablecoin holdings by savvy investors this year.

Following the FTX crash in November 2022, the percentage reached a high of 35.17%, but has since decreased significantly to only 3.92%. This indicates that many shrewd investors have already committed their capital into cryptocurrencies such as Bitcoin and Ethereum (ETH).

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- USD CNY PREDICTION

- Silver Rate Forecast

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Castle Duels tier list – Best Legendary and Epic cards

- “Golden” Moment: How ‘KPop Demon Hunters’ Created the Year’s Catchiest Soundtrack

- Maiden Academy tier list

2024-09-15 19:44