As a seasoned researcher with a knack for deciphering market trends and a penchant for understanding Bitcoin’s volatile nature, I find myself cautiously eyeing the current state of affairs. The recent recovery has been promising, but the stalled progress at the $62,000 resistance and the loss of key support at $60,000 have me worried.

With the current halt in Bitcoin‘s price increase, there’s a potential for a 25% decrease in its value within the next few weeks.

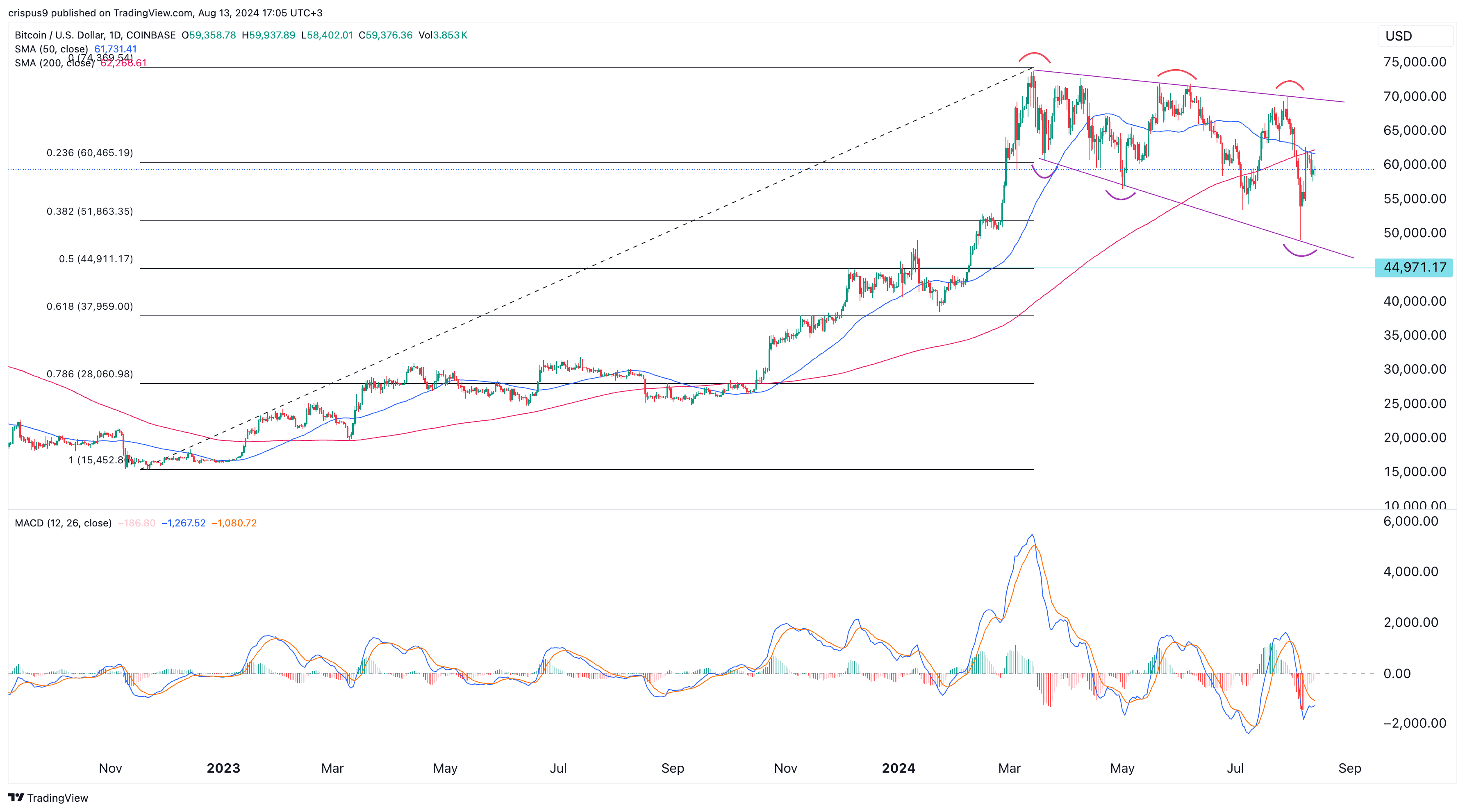

Bitcoin (BTC) saw a surge of approximately 27% from its lowest point on August 5, but encountered significant resistance at around $62,000. In recent days, it has dropped crucial support at $60,000 and was trading at roughly $59,000 as of August 13.

According to CoinGlass, Bitcoin’s daily trade volume on spot markets has settled around $34 billion. Interestingly, the open interest in the futures market has been holding steady, currently at about $28 billion. This figure represents a decrease from last month’s peak of over $37 billion.

A possible explanation for the low open interest could be that numerous Bitcoin investors experienced significant sell-offs when the price dipped down to $49,000 before swiftly rising back up to $62,000, leaving them with less interest in continuing their trades.

Concerns are also rising regarding the upcoming U.S. presidential election, as many polls suggest a tight competition among candidates. However, betting markets such as Polymarket seem to favor Kamala Harris, with her appearing to have an edge in crucial states like Michigan and Pennsylvania.

Donald Trump has voiced his support for Bitcoin and made clear that his government won’t offload the substantial amount of Bitcoins in its possession. Furthermore, he has indicated that he would dismiss Gary Gensler, the head of the Securities and Exchange Commission, who has been predominantly engaged in legal actions during his term.

In simpler terms, Bitcoin is currently experiencing significant potential risks. It’s showing a worrying trend known as the “death cross” pattern, where its short-term and long-term moving averages have crossed each other. Moreover, the Moving Average Convergence Divergence (MACD) lines have dropped below their neutral point, indicating bearish sentiment in the market.

Simultaneously, as displayed earlier, Bitcoin has been creating a pattern of decreasing lows and low highs, suggesting a decline in its trend.

In simpler terms, if the price drops below the current month’s low of $49,000, it could indicate that the bears (those expecting a decline) have taken control and the downward pattern we’ve been seeing might not hold true anymore. This drop could potentially lead to a further fall, reaching the 50% Fibonacci Retracement point at $44,900, which is approximately 25% less than the price on Aug. 13.

Read More

- Silver Rate Forecast

- Grimguard Tactics tier list – Ranking the main classes

- USD CNY PREDICTION

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- Black Myth: Wukong minimum & recommended system requirements for PC

- Hero Tale best builds – One for melee, one for ranged characters

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Mech Vs Aliens codes – Currently active promos (June 2025)

2024-08-13 17:28