As a seasoned crypto investor with a knack for interpreting market trends and a touch of humor, I find myself intrigued by the current state of Bitcoin. The consolidation phase we’re witnessing is akin to a rollercoaster ride – exhilarating one moment, nerve-wracking the next.

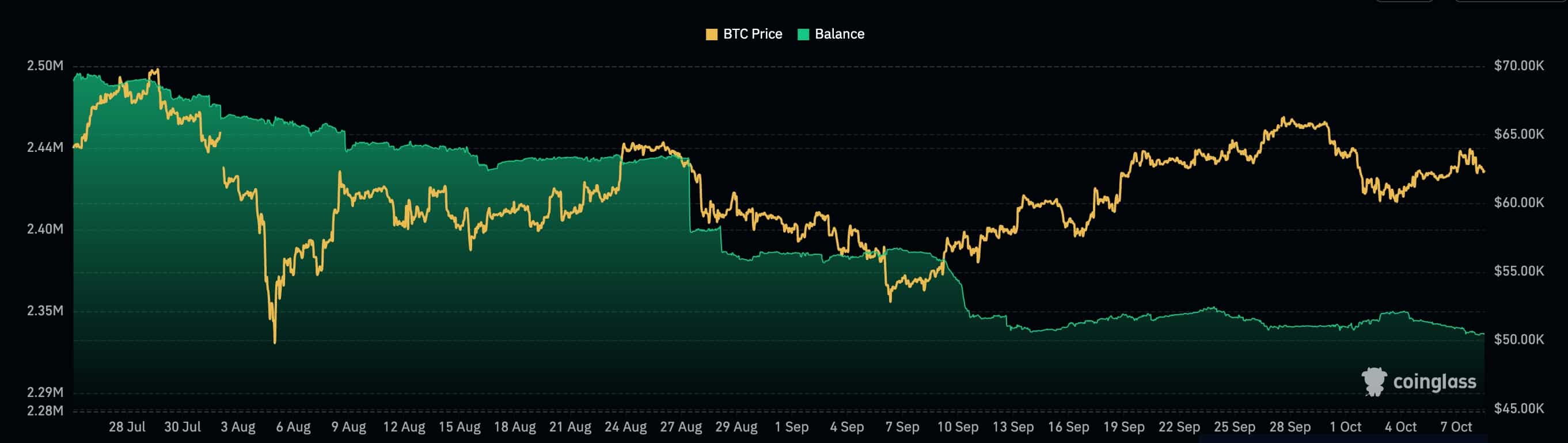

Despite being in a period of stability, the value of Bitcoin didn’t show significant fluctuation, while the quantity kept on the cryptocurrency exchanges was steadily decreasing.

On October 8th, the price of Bitcoin (BTC) was observed at approximately $62,540, which is a slight dip compared to its weekly high of $64,500. At present, it’s experiencing a correction as it has dropped by around 15% from its peak this year.

There are still several factors that might boost Bitcoin’s price in the near future, one of them being the decreasing amount of Bitcoin held on exchanges, which has currently dropped to a minimum for this year, standing at approximately 2.34 million.

Approximately $31 billion worth of Bitcoins are believed to have been withdrawn from exchanges since February. The majority of these coins seem to have been taken into personal control through self-managed wallets, with the rest possibly being moved to exchange-traded funds.

Transactions moving from exchanges to wallets typically indicate that many investors are optimistic (bullish), as they’re likely holding onto their assets for potential price increases. Companies like MicroStrategy, Marathon Digital, Block, and Tesla, being significant players in the industry, demonstrate a high level of bullishness due to their substantial investments.

In a recent accumulation spree, MicroStrategy now owns approximately 252,000 dollars’ worth of Bitcoins, while Marathon Digital Holdings possesses around 26,842 coins. Tesla and the rebranded Square (now Block) have amassed 9,720 and 8,211 Bitcoins respectively.

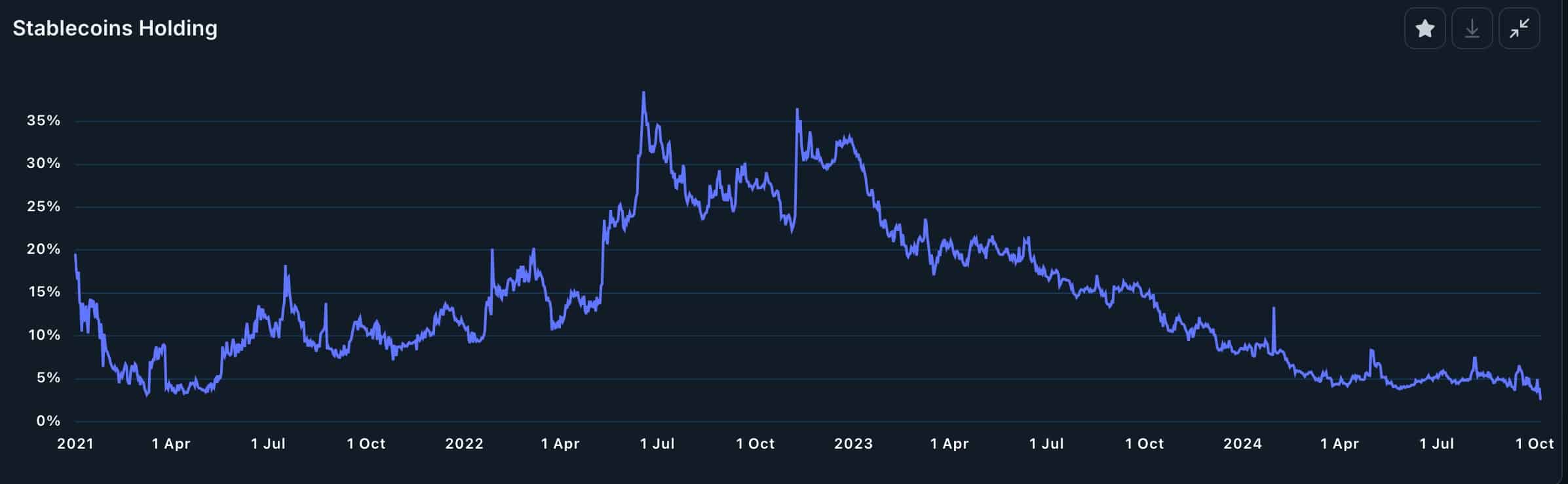

The latest figures from Nansen indicate a significant decrease in the holdings of stablecoins by ‘smart money’ investors, reaching a multi-year low.

In May 2022, the figure reached its highest point at 38.5%, marking Terra’s collapse and subsequent recovery to 35.7%. This was followed by another dip in November after FTX fell, but since then, it has been on a steady decline, indicating that most savvy investors are optimistic about the future of cryptocurrencies.

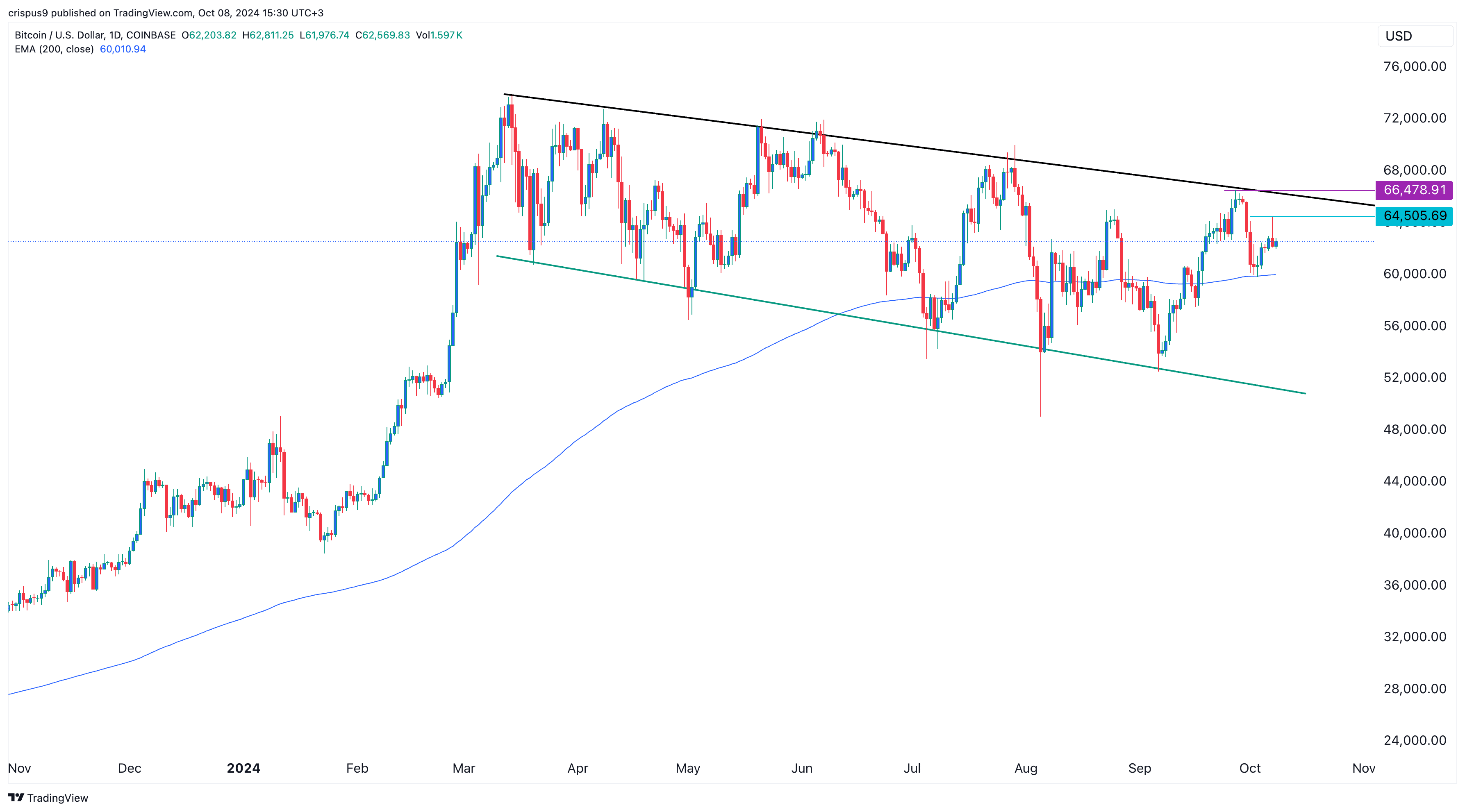

Bitcoin has found support at the 200 EMA

Over the past day, Bitcoin has been contained within a downward sloping black band connecting its highest and lowest points since March. This band, which forms like a falling broadening wedge, is often seen as a bullish signal by traders.

Additionally, it’s worth noting that Bitcoin has been backed up by the 200-day Exponentially Weighted Moving Average, suggesting a favorable outlook. Yet, Bitcoin has developed a miniature evening star candlestick configuration, marked by a tiny red body and a lengthy upper wick, which could potentially signal a reversal in its price trend.

Consequently, for Bitcoin to maintain its upward momentum, it must surpass the upper boundary of the shadow pattern, currently at approximately $64,500. Following this, strong buying pressure is required to break past the downward trendline and then exceed its all-time high of $73,800 to sustain the bullish trend.

In another possible situation, if Bitcoin falls beneath the 200-day Exponential Moving Average (EMA) at around $60,000, it could potentially boost the likelihood of a decline towards the lower boundary of the wedge at approximately $52,000.

Read More

- Silver Rate Forecast

- Grimguard Tactics tier list – Ranking the main classes

- USD CNY PREDICTION

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- Black Myth: Wukong minimum & recommended system requirements for PC

- Hero Tale best builds – One for melee, one for ranged characters

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Mech Vs Aliens codes – Currently active promos (June 2025)

2024-10-08 16:19