As a seasoned analyst with over two decades of market observation under my belt, I can confidently say that the recent Bitcoin rally is nothing short of intriguing. Having witnessed numerous bull and bear markets, I’ve learned to read between the lines, and this latest surge seems to be more than just a random price fluctuation.

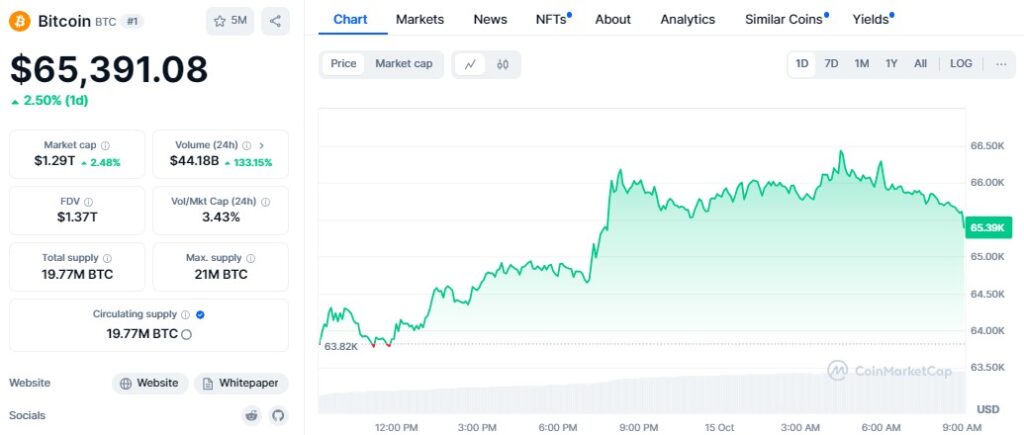

As an analyst, I found myself taking note on October 15 when Bitcoin soared by a remarkable 6%, hitting an impressive peak of $66,400 – its highest since July 30. This uptrend had a favorable ripple effect on U.S.-based publicly traded companies with ties to cryptocurrency, as several firms reported substantial increases in their market value.

As an analyst, I’ve observed a noteworthy correlation: Cryptocurrency prices seem to spike during election periods, particularly when contenders like Kamala Harris and Donald Trump advocate for stricter regulations in the crypto sector. Notably, Harris appears to have a more favorable stance towards cryptocurrencies compared to President Biden, while Trump is generally supportive of the industry.

CleanSpark (CLSK), a Bitcoin miner, was the top performer of the day, ending with a 12.72% increase at $10.81 and further increasing by 1.72% in extended trading, as per Google Finance data. Coinbase (COIN), a crypto exchange, came in second, experiencing a 11.33% surge to $196.35 – reaching a seven-week high – and gaining an additional 1.71% post-market hours.

Similar to other cryptocurrency miners, Iris Energy (IREN) surged by 10.21%, TeraWulf (WULF) increased by 6.65%, and Marathon Holdings (MARA) went up by 5.6%.

Simultaneously, Semler Scientific (SMLR), having adopted a Bitcoin purchasing approach like MicroStrategy, remained unchanged during regular trading but jumped by 4.3% after the market closed. On the other hand, Block Inc. experienced a 2.8% growth, as reported by Yahoo Finance.

As a crypto investor, I found myself in an unusual position today when the business intelligence firm I’ve invested in, MicroStrategy (MSTR), went against the market trend. Despite holding more than 252,000 Bitcoins, MSTR saw a dip of 5.1%, ending the day at $201.67. However, there was a glimmer of hope after hours as the stock prices began to recover ever so slightly.

Over the last day, Bitcoin experienced a 5.7% increase, fueling discussions on the possible beginning of “Uptober,” a traditionally strong period for Bitcoin in October. As Bitcoin College’s analyst highlighted, it managed to surpass crucial resistance levels, hinting at an impending price surge.

At present, the price of Bitcoin stands at approximately $65,395. This is 12.76% lower than its highest point of $73,612 recorded on March 14, as reported by CoinMarketcap. As we inch closer to the 2024 halving event, some experts speculate that it may propel Bitcoin beyond its existing all-time high in the last quarter of the year.

Bitcoin’s recent rise indicates a rising sense of optimism among investors and a possible improvement in regulatory conditions. As contenders like Harris and Trump advocate for beneficial regulations, the cryptocurrency market could experience growing confidence in the future.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Silver Rate Forecast

- PUBG Mobile heads back to Riyadh for EWC 2025

- USD CNY PREDICTION

- Maiden Academy tier list

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Castle Duels tier list – Best Legendary and Epic cards

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

2024-10-15 08:04