As a seasoned analyst with over two decades of experience in the financial markets, I’ve witnessed countless market cycles and trends, from the dot-com bubble to the global financial crisis. The current Bitcoin surge to $68,000 is indeed intriguing, given its link to political factors ahead of the U.S. elections.

The cost of a single Bitcoin soared up to $68,000, with traders capitalizing on optimistic market vibes prior to the forthcoming U.S. elections. Following a tough month in September, investors seized opportunities presented by price drops, leading to an increase in values.

On the other hand, investors holding their coins for a shorter period seem to be offloading them near the $68,000 level, potentially building up significant resistance. This could potentially trigger a dip in prices.

The increase in Bitcoin’s value can be attributed to political influences, as data from Polymarket indicates that Donald Trump has a 60.9% chance of winning the election, while Kamala Harris stands at 39.1%. This political landscape seems to make Bitcoin more appealing to investors.

Despite an 11% gain this week, some traders worry about a potential price dip before Bitcoin reaches new heights. Increased market volatility is making trading riskier and borrowing more expensive.

As a researcher delving into the intricacies of Bitcoin, I find it intriguing that approximately half of the circulating Bitcoin supply (50%) is currently showing a loss, whereas the other half (50%) appears to be profitable. This trend implies that as prices continue to climb, there might be an increase in profit-taking among Bitcoin holders.

Over a span of three days, there was a substantial increase in investments into U.S.-traded Bitcoin Spot ETFs, amounting to approximately $1.38 billion. On one of those days, specifically Wednesday, the inflow reached an impressive $456.9 million.

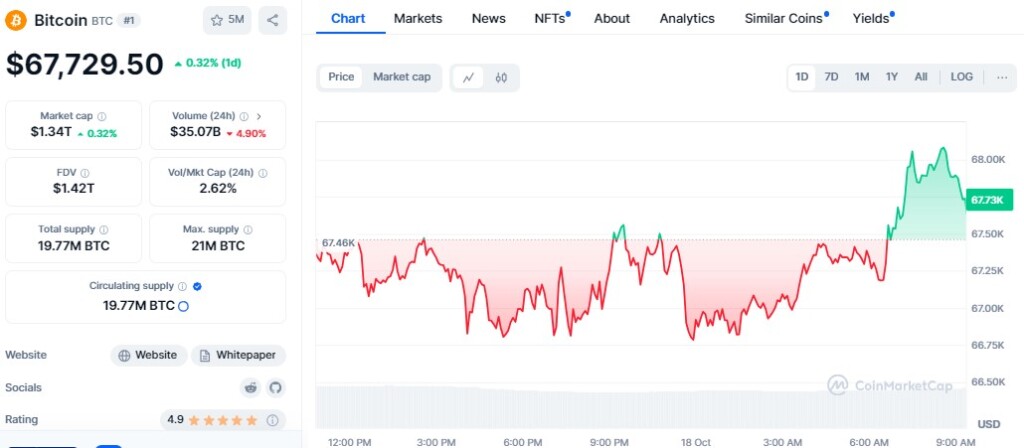

At present, the price of Bitcoin is standing at approximately $67,729, having risen by 0.32% over the past day. It’s essential to keep an eye on the support level around $65,000. If purchasers can maintain their position above this point, there could be a move towards $70,000. Conversely, a fall below $65,000 might indicate potential further decreases.

1) The increasing value of Bitcoin is indicative of a surge in investor trust, fueled by optimistic market conditions and political aspects. As dealers capitalize on these opportunities, potential resistance at $68,000 might present hurdles for further profits.

Read More

- Silver Rate Forecast

- Gold Rate Forecast

- Gods & Demons codes (January 2025)

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Honor of Kings returns for the 2025 Esports World Cup with a whopping $3 million prize pool

- Grimguard Tactics tier list – Ranking the main classes

- Superman: DCU Movie Has Already Broken 3 Box Office Records

- Former SNL Star Reveals Surprising Comeback After 24 Years

- USD CNY PREDICTION

- Kanye “Ye” West Struggles Through Chaotic, Rain-Soaked Shanghai Concert

2024-10-18 09:08