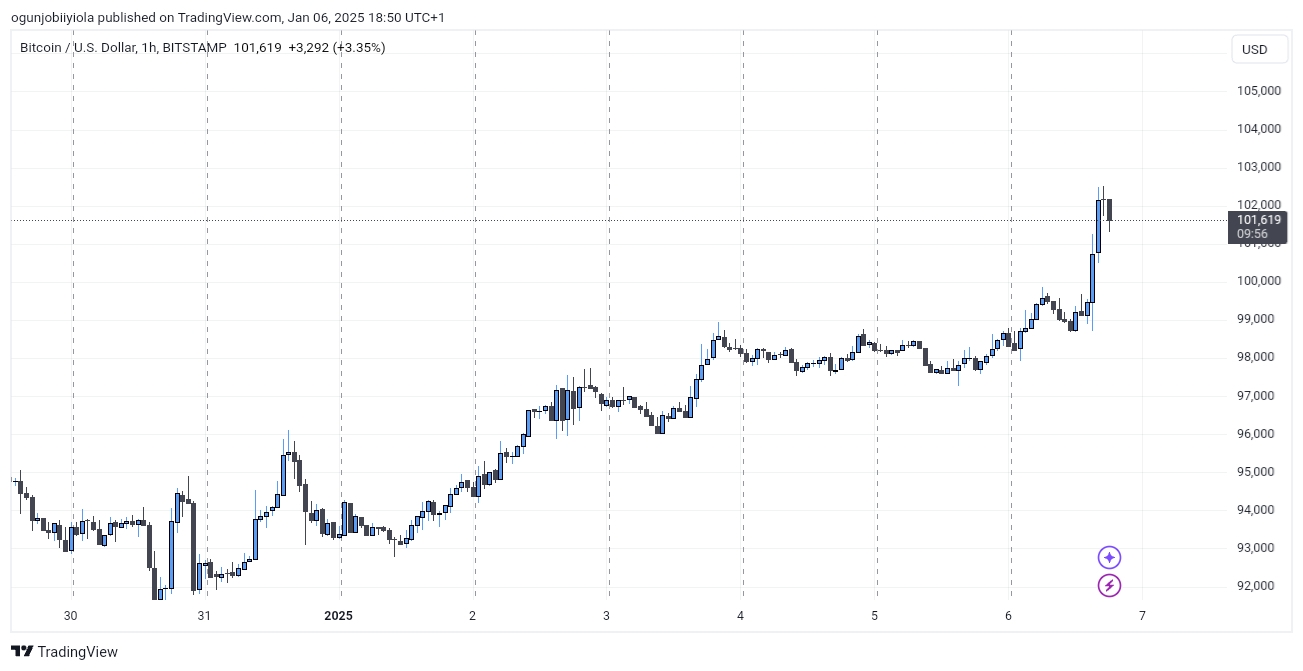

For the first time in 2021, Bitcoin surged above the $100,000 mark on Monday, peaking at $101,184 intraday. This surge comes after it briefly dipped below $92,000 during the holiday season. Over the past week, its value has increased by nearly 11%. Some analysts are now speculating that Bitcoin could potentially reach $200,000 this year.

A significant factor that could realize this prediction is the increasing institutional investment in Bitcoin. Notably, data from Farside Investors reveals a substantial $908.1 million inflow into Bitcoin exchange-traded funds (ETFs) last Friday – the highest since mid-December. This suggests that these large investors’ renewed interest is fueling a rise in price once more.

One significant aspect to consider is the diminishing availability of Bitcoin on trading platforms. Data from Santiment shows an increasing trend of Bitcoin being held off these exchanges, while quantities on prominent platforms such as Coinbase and Binance are dwindling. Analysts at 10X Research have pointed out that substantial withdrawals of Bitcoin from exchanges suggest that holders do not plan to sell, which they interpret as a positive indicator for the digital currency.

Moving forward, there are several significant occurrences that might impact Bitcoin’s value even more. One such event is the scheduled release of the Consumer Price Index (CPI) by the U.S. Bureau of Labor Statistics on January 15. This index gauges inflation rates within the economy.

A positive inflation data might boost investor confidence, potentially causing an increase in interest towards Bitcoin as a protective measure against inflation. According to 10X Research analysts, this could spark renewed optimism and trigger a surge of investments leading up to the inauguration of President Trump on January 20th.

The surge in Bitcoin’s value is additionally fueled by the imminent inauguration of President-elect Donald Trump on January 20th. Traders believe that his supportive views towards cryptocurrencies could lead to beneficial policies within this sector, thereby boosting optimism and driving Bitcoin’s growth.

From a technical perspective, Bitcoin has surpassed significant barriers in its price progression. As per the analysis by trader Rekt Capital, Bitcoin must maintain its position above the $101,000 threshold for its bullish trend to persist.

For Bitcoin to break through its previous high of $101k, it must first close daily at or above that level, or revisit that high again, similar to what happened in early December 2024.

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Honor of Kings returns for the 2025 Esports World Cup with a whopping $3 million prize pool

- PUBG Mobile heads back to Riyadh for EWC 2025

- USD CNY PREDICTION

- Kanye “Ye” West Struggles Through Chaotic, Rain-Soaked Shanghai Concert

- Arknights celebrates fifth anniversary in style with new limited-time event

- Every Upcoming Zac Efron Movie And TV Show

- Hero Tale best builds – One for melee, one for ranged characters

- Mech Vs Aliens codes – Currently active promos (June 2025)

2025-01-06 22:28