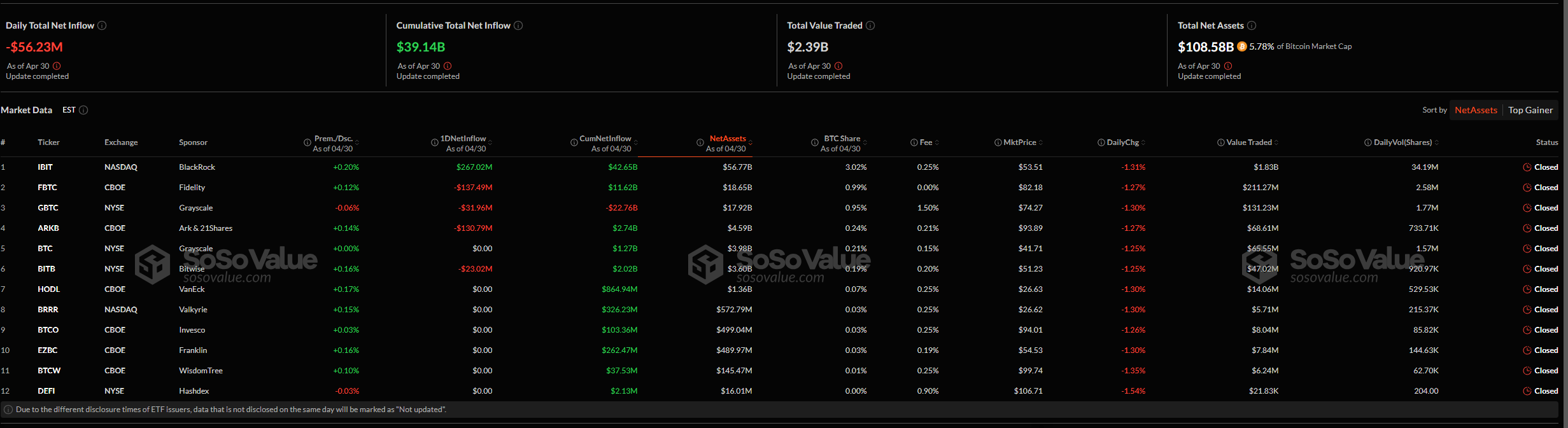

The air hung heavy—laden, one might say, with the distinct melancholy of April in St. Petersburg—over the price of Bitcoin, which, with the obstinacy of a provincial landowner, still lingered just above the formidable $95,000. One could almost sense the sighs of investors swirling in the digital ether. Technically, there was much to be bullish about, if one had the heart for such modern mercantile romance. But alas! The stream of ETF inflows, so recently a roaring Volga, had slowed to a mere trickle, as institutional enthusiasm began to fade like the memory of a summer affair. April 30 greeted us with the bitter news: $56.23 million had flowed not in, but out, from Bitcoin spot ETFs. One wonders if these millions have gone in search of meaning in the countryside.

Strangely—though is anything strange in this world, dear reader?—BlackRock’s IBIT reported a hearty net inflow of $267 million, drinking deep while its peers stared vacantly at their empty bowls. This was not a matter of public mood; no, the malaise was more selective, like an old aunt refusing everyone’s cooking but her own. Ark Invest’s ARKB and Fidelity’s FBTC each suffered as though caught in a bad Chekhov play, shedding $137 million and $130 million, respectively. And let us spare a thought, if only a sardonic one, for Grayscale’s GBTC, which continued its long, slow march of despair after converting to an ETF, losing another 0.31%. One imagines the holders sitting by candlelight, pondering the inevitability of loss.

Should you think, as some naive souls might, that all is well simply because the total ETF market still boasts $3.914 billion in net inflow, the reality is sober, like tea with no sugar. Yesterday’s one-day outflow was enough to make even the bravest hodler long for the simplicity of an 1860s serf revolt. Bitcoin cannot seem to conquer the $95,000 barricade—each attempt proving as fruitless as a poet’s love—while trading volume sinks lower, a boatman with neither oar nor ambition.

The technicals, too, tease a tragic fate. The RSI, ever the mysterious fortune teller, circles about 66, hinting that perhaps—perhaps!—we are nearing overbought territory. Yet, alas, there are no great whale inflows rolling in to save the day. Institutional faith, per the ETF oracle, is flaking away quicker than the varnish on a Dacha windowpane in November. Should this continue, we may be doomed to wander a dull landscape of consolidation or, worse, correction—even as the fabled golden cross between the 50- and 200-day moving averages dances on the horizon, promising what only a mirage can promise.

Ethereum trudges along a parallel path—what else could you expect in these modern times? Fidelity’s FETH was the lonely candle in the window, with a modest inflow, while the rest of the Ethereum ETFs saw $2.36 million quietly slip away. It is not only Bitcoin laboring beneath this existential pressure; all cryptocurrencies find themselves exposed, as if caught in a sudden Petersburg downpour without an umbrella.

The chart offers hope, perhaps even audacity. But the capital, that fickle child, seems inclined otherwise. Unless institutional inflows return—armed, one hopes, with strong boots and thicker wallets—this rally may retire to its estate before ever seeing six figures. And so, dear reader, we wait. After all, what is modern finance if not the art of waiting for Godot, with more charts and fewer cigarettes?

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Silver Rate Forecast

- USD CNY PREDICTION

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Black Myth: Wukong minimum & recommended system requirements for PC

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Hero Tale best builds – One for melee, one for ranged characters

2025-05-01 12:06