- Bitcoin‘s Short-Term Holders (STHs) are sitting on an average unrealized loss of 6%. Ouch, right?

- But hey, if BTC decides to grow up and move above their cost basis, maybe things will change. What’s the likelihood? 50/50?

So, Bitcoin (BTC) has been doing a little hop, skip, and jump past four key resistance levels in the last two weeks, pulling a bunch of folks out of the red and back into profit. 🎉

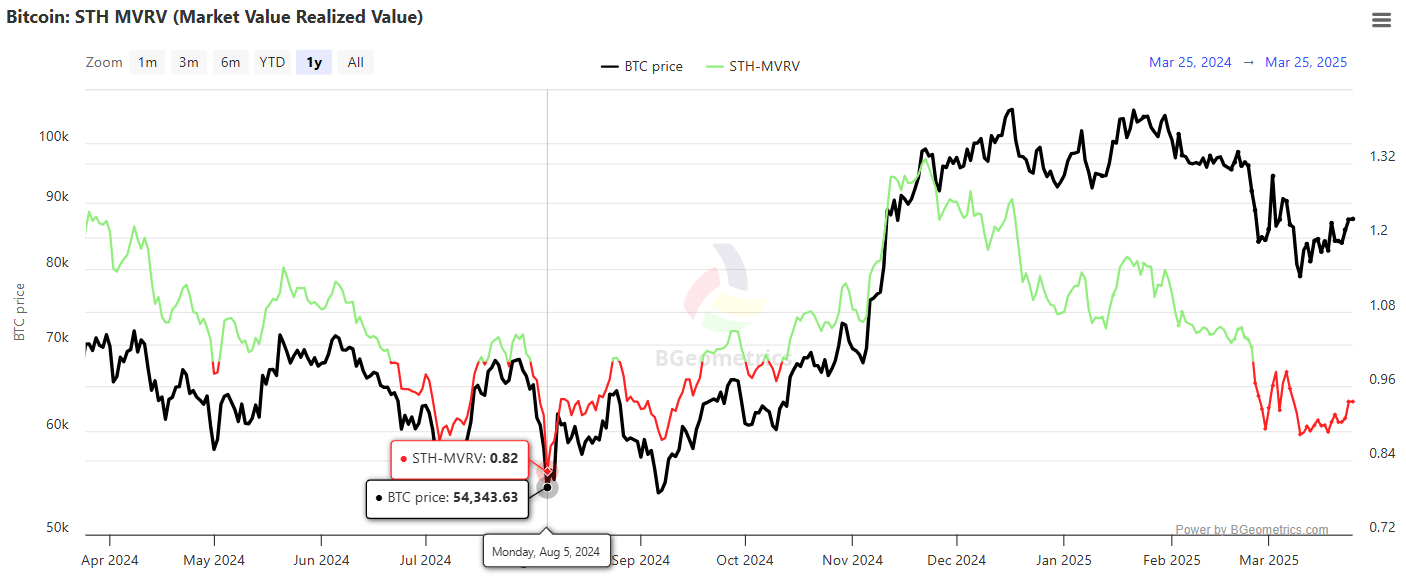

But hold your horses—despite all this action, the Short-Term Holder Market Value to Realized Value (STH MVRV) ratio is still chilling in negative territory. Looks like short-term holders are still stuck in the “unrealized loss” club. Not exactly the VIP section, huh?

For Bitcoin to really light the fireworks 🎇, it’s going to need to sustain a move above the break-even point, which, spoiler alert, is sitting pretty at $93.5k. Glassnode says that’s the magic number. No pressure, BTC! 😬

If BTC can just hang around $88,041 and extend the rally, bulls need to avoid scaring off short-term holders. If they panic-sell, well, things could get…awkward. Forced liquidations aren’t really a party, folks. 😬💸

Remember that time in early August 2024 when a negative STH MVRV reading turned into a dramatic nosedive from $68,525 to $54,343 in two weeks? Yeah, BTC’s got to avoid that déjà vu situation. 🙈

So the bulls have one job: flip that $93.5k resistance level into support like flipping pancakes. 🍯 If they do, we might just see the STH MVRV ratio go positive, bringing all those short-term holders into the “unrealized profits” club. It’s like a financial pep rally. Go team! 💪

This breakout is especially crucial as Q2 looms. You know what that means—macroeconomic shifts and liquidity fluctuations could stir the pot. BTC, you better confirm this as a solid demand zone if you want to avoid a fire drill later. 🔥🚨

A Critical Week Ahead…Get Ready!

Bitcoin’s little dip to $78k on March 10th triggered a full-on “extreme fear” episode. But hey, historically, that’s been a pretty solid accumulation zone. Fear and greed, the two oldest trading buddies. 🧟♂️

And look at this—since then, BTC has bounced back by 12.82%, putting a nice little chunk of stakeholders into net unrealized profit. Hey, look at that, things are looking up! ☀️

As a result, market sentiment has shifted from “panic mode” to the “belief” phase. You know, that lovely moment when people start HODLing like their lives depend on it. “Diamond hands” for the win! 💎✋

In simpler terms, people are more into holding onto their BTC rather than throwing it out there for sale. Because who wouldn’t want to hold on to a digital goldmine? 💰

Meanwhile, Open Interest (OI) is making a dramatic comeback, climbing back to its November peak of $57 billion. With $12 billion in new leveraged positions in just two weeks, clearly, there’s some serious speculation going on. Ka-ching! 💥

But wait—there’s a catch. Bitcoin’s $93.5k level is still in play, and whether it can reclaim it is a big question mark. If it gets rejected? Oh boy, prepare for some serious selling pressure. That’s how you get a liquidation party, folks! 🥳💸

If the STH MVRV ratio dips even lower, we could see weak hands give up and just exit stage left. Yikes! That’s when you know the bears are taking over. 🐻

With macroeconomic uncertainty looming, Q2 could be a rollercoaster ride. Don’t get too comfy trading on just those shiny bullish metrics. Buckle up, it’s gonna get bumpy! 🎢

Read More

- Grimguard Tactics tier list – Ranking the main classes

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- USD CNY PREDICTION

- Castle Duels tier list – Best Legendary and Epic cards

- Silver Rate Forecast

- PUBG Mobile heads back to Riyadh for EWC 2025

- Maiden Academy tier list

- Cookie Run Kingdom: Lemon Cookie Toppings and Beascuits guide

- USD MXN PREDICTION

2025-03-26 18:20