As a seasoned researcher with years of experience tracking the cryptocurrency market, I find myself intrigued by the recent trends in Bitcoin. The price surge to $60,100 and the subsequent consolidation phase is reminiscent of the rollercoaster ride that Bitcoin often takes us on.

Earlier today, Bitcoin momentarily reached a nearby peak of approximately $60,100, but as of the latest update on Sunday, it’s holding steady around $58,894.

The leading cryptocurrency is up for three straight days, but still in a consolidation phase.

Bitcoin (BTC) daily trading volume decreased by 42% and is currently hovering around $14.7 billion.

A decrease in the trading volume of an asset often indicates a period of reduced activity and less price fluctuation ahead.

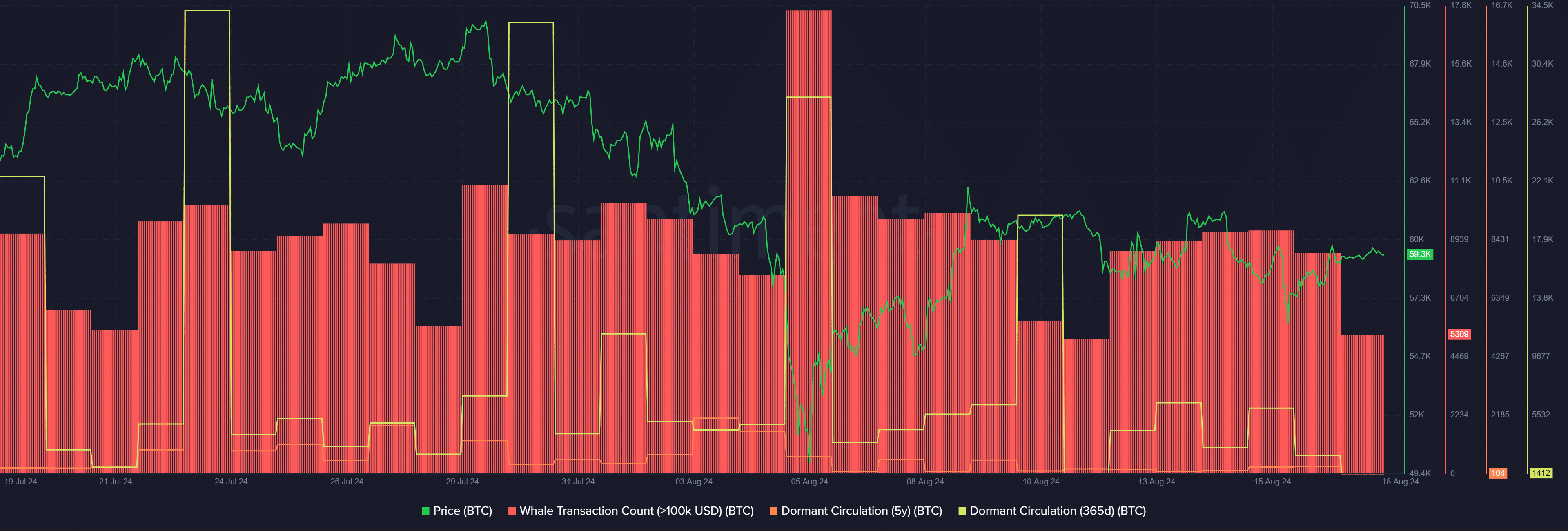

Based on information from Santiment, the amount of Bitcoin that hasn’t been active for five years is at approximately 104 coins, which is among the lowest figures recorded in 2021.

Remarkably, the value of this metric peaked at 16,592 BTC on July 23, coinciding with the Bitcoin price being approximately $66,000.

Additionally, the quantity of this asset sitting idle for a year decreased significantly, dropping from 6,040 Bitcoin on August 15th to just 1,412 Bitcoin as of the current report.

As a long-time crypto investor, I’ve noticed that decreasing dormant circulation tends to suggest that long-term investors are cashing out their profits, particularly when prices are high. This means that many of the long-term Bitcoin holders have either sold their coins or temporarily withdrawn them from circulation, perhaps waiting for another opportunity to strike.

According to Santiment’s data, there has been a steady decline in the number of large Bitcoin transactions (worth more than $100,000) over the past three days. The count dropped from 9,295 transactions on Aug. 15 to 5,309 unique transactions at the time of reporting.

A decrease in the active involvement of whales typically leads to reduced price fluctuations for an asset, since investors anticipate fewer opportunities for manipulation by these large-scale token holders.

Based on an article from crypto.news published on August 17th, there was a significant increase in investment in Bitcoin spot exchange-traded funds (ETFs) within the U.S., totaling over $36 million in net inflows for the week. This surge in investment played a major role in fostering optimistic feelings towards BTC, contributing to its ability to regain the $59,000 level.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Silver Rate Forecast

- USD CNY PREDICTION

- Black Myth: Wukong minimum & recommended system requirements for PC

- 10 Most Anticipated Anime of 2025

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Hero Tale best builds – One for melee, one for ranged characters

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Gold Rate Forecast

- “Golden” Moment: How ‘KPop Demon Hunters’ Created the Year’s Catchiest Soundtrack

2024-08-18 17:38