As a seasoned analyst with over two decades of experience in the financial markets, I’ve seen my fair share of market fluctuations and trends. The recent surge in whale transactions and inflows, coupled with a decline in outflows among retail holders, paints a bullish picture for Bitcoin.

It appears that major Bitcoin holders, or ‘whales’, are showing optimism by buying more Bitcoin as we approach the release date for the U.S. Consumer Price Index figures.

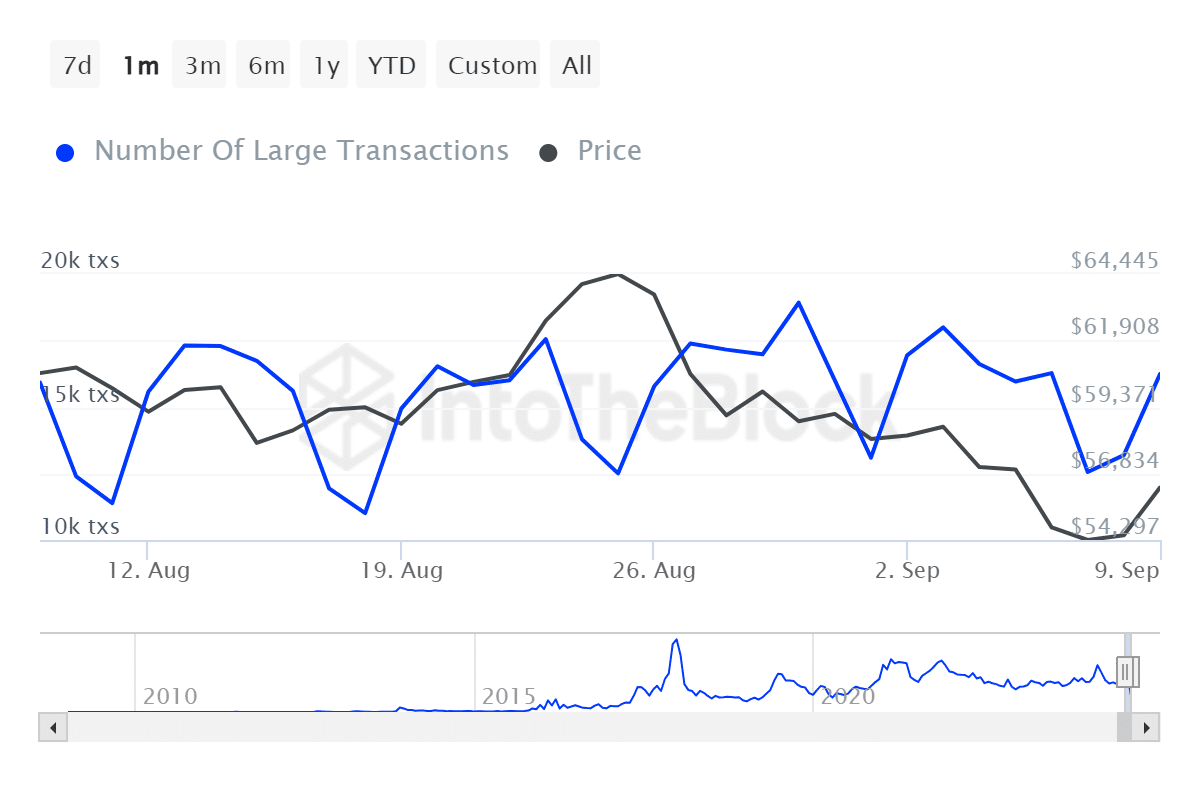

Data from IntoTheBlock shows a significant increase in the number of large Bitcoin transactions, specifically those valued at over $100,000. From September 7th to 9th, this figure climbed from approximately 12,560 to 16,240.

After Bitcoin’s price dropped below $54,000, there was a surge in whale activity around it, which followed a rise in selling pressure.

According to ITB’s data, these significant Bitcoin investors, known as “whales,” have transferred approximately $70 billion of their Bitcoin holdings over the last week.

It’s worth mentioning that a rise in whale activity (large traders) often results in significant price volatility for Bitcoin. However, it appears that these big players are currently buying more Bitcoin as a result of increased incoming flows.

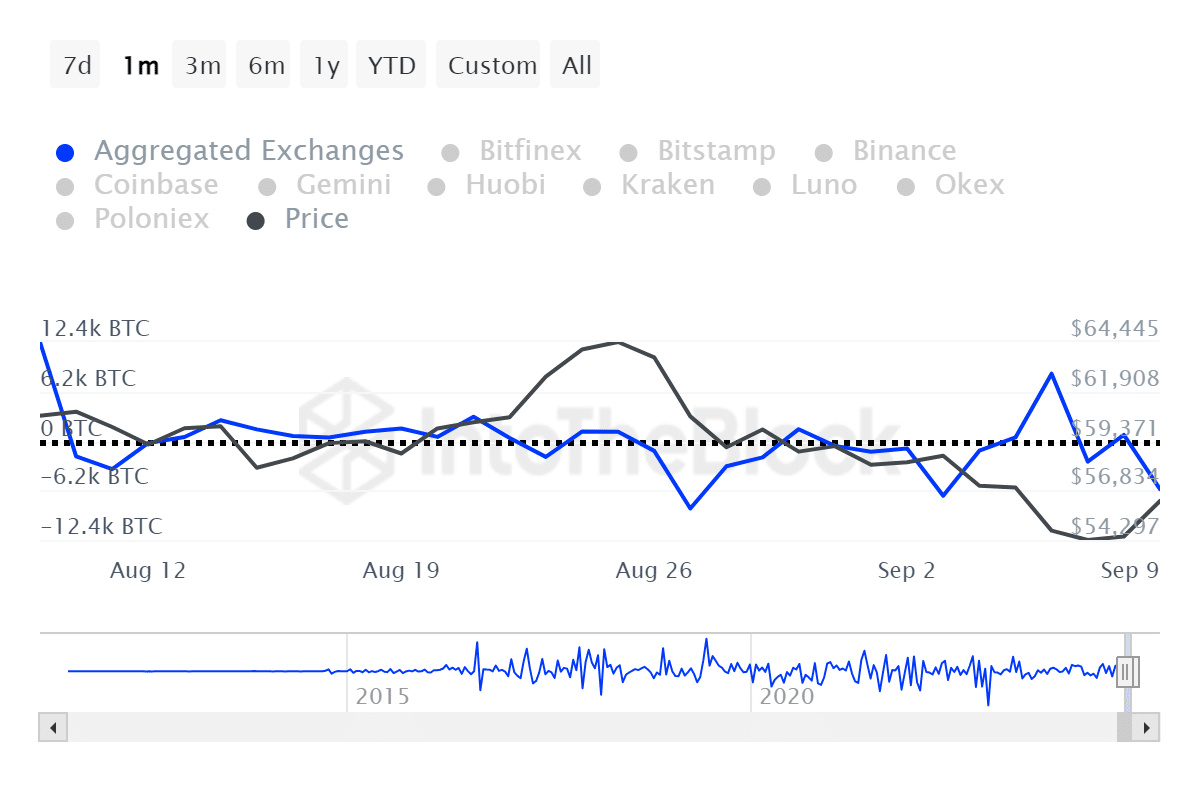

On September 7th, the amount of large Bitcoin holders adding to their holdings dropped significantly from 11,570 BTC to just 1,100 BTC, and it decreased even more to 469 BTC the following day. This dramatic drop in inflow suggests a substantial selling off of Bitcoin, as reported by data from ITB. Interestingly, there was a significant increase in the amount of Bitcoin held by whales (large individual holders) to 1,580 BTC on September 9th.

The indicator shows that the whale selloff might have come to an end.

It appears that both whales and retail investors are adding Bitcoin to their portfolios, as reported by ITB. Yesterday, Bitcoin experienced a net outflow of more than 6,000 coins on exchanges.

Currently, Bitcoin has climbed by approximately 3.5% and is being traded at around $56,950. Earlier today, this leading cryptocurrency momentarily reached a local peak of $58,000 before stabilizing near the $57,000 region.

currently, investors seem optimistic because it’s anticipated that the Consumer Price Index (CPI) figures for the U.S., representing the nation’s inflation rate, will be around 2.6%

If the inflation rate for August is equal to or less than the predicted level, many economists anticipate that a reduction of 0.5% in the interest rate could occur this week.

As an analyst, I can foresee that a rate cut might ignite a positive trend in various financial sectors, including cryptocurrencies and equities markets. In simpler terms, the rate cut could potentially spark a bullish wave across these marketplaces.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- USD CNY PREDICTION

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Silver Rate Forecast

- Black Myth: Wukong minimum & recommended system requirements for PC

- Mech Vs Aliens codes – Currently active promos (June 2025)

- “Golden” Moment: How ‘KPop Demon Hunters’ Created the Year’s Catchiest Soundtrack

- Castle Duels tier list – Best Legendary and Epic cards

2024-09-10 10:01