Crypto whisperer Burak Kesmeci confidently suggests Bitcoin (BTC) isn’t done showing off—it’s aiming for a cool $124,000, thanks to the mystical “Golden Ratio Multiplier” price model. If that sounds like some ancient math prophecy, you’re not wrong. After last week’s price fireworks, BTC might just keep climbing like your caffeine-fueled motivation every Monday morning.

Will Bitcoin Really Hit the 1.6x Accumulation Peak, or Is This Just Wishful Thinking?

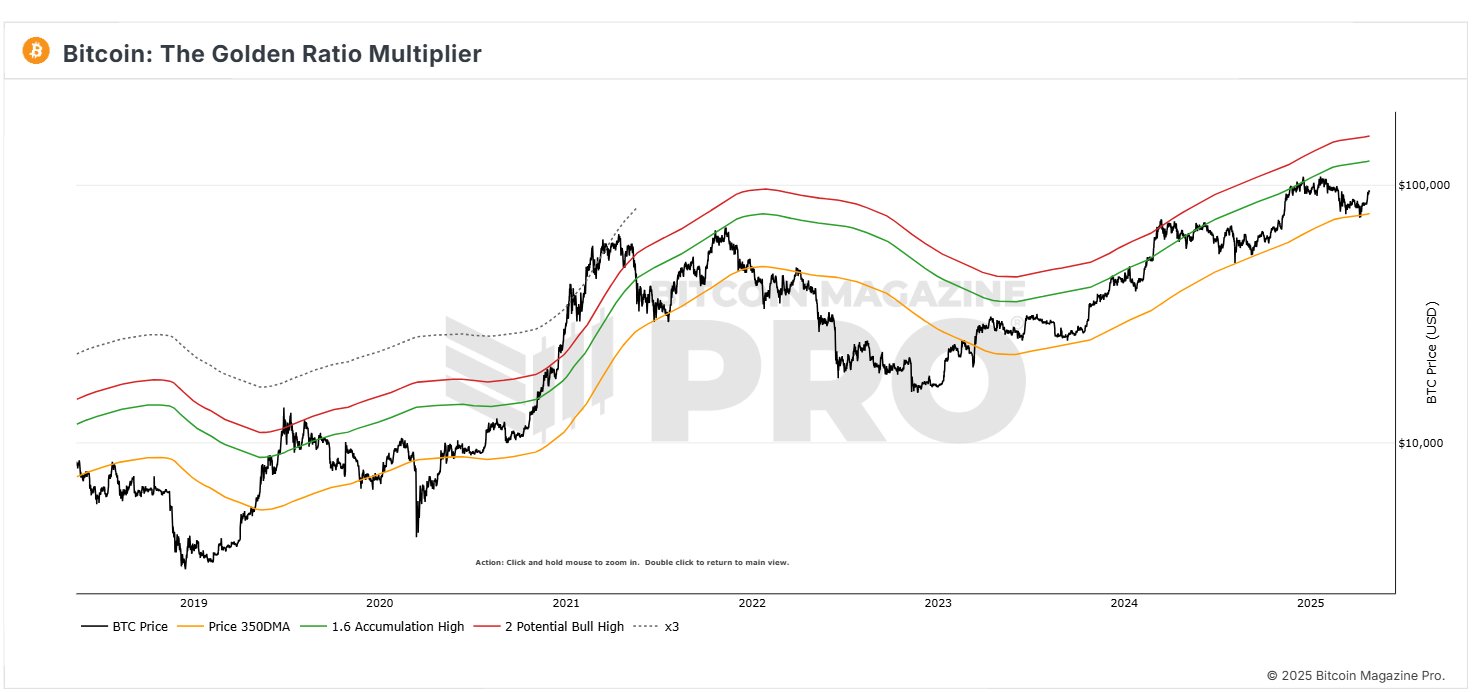

On April 26, Burak popped onto X (because Twitter needs to rebrand every 5 minutes) to flex some data from Bitcoin Magazine Pro. The Golden Ratio Multiplier – basically Fibonacci plus moving averages – tries to predict when BTC is playing hard to get or just begging for attention on the price charts. Spoiler alert: It’s great at sounding smart.

Bitcoin’s been cozying up to the 350 daily moving average (350DMA) lately, chilling around $77,000. For those not fluent in finance, 350DMA means the average of BTC prices over almost a year—because why not make charting sound like a college exam? Touching or dipping below this number usually means, “Hey, maybe buy now before it’s cool.”

After a brief dip to $75,000 (a classic fake-out move), Bitcoin bounced back like a pro, hitting as high as $96,000. Take a bow, BTC.

According to the Golden Multiplier, BTC’s next goal is 1.6 times that 350DMA, which is the fancy way of saying $124,000. So, even though Bitcoin is playing the calm, patient type right now, it’s actually gearing up for another rally—because who doesn’t love a good comeback story?

Whenever BTC gets close to or passes this $124k mark, it’s usually a sign the “accumulation phase” (aka the crypto equivalent of storing snacks for winter) is over, and the big bulls come out to party. So, hitting $124,000 might just open the floodgates for Bitcoin to pretend it’s the star of every financial forecast.

BTC Miners Just Made $18.6 Million — Time to Upgrade the Rigs or Throw a Party?

Meanwhile, Ali Martinez, another crypto sage, reports miners are cashing in big time—$18.6 million in profit as Bitcoin zoomed past $94,000. Those early adopters who mined BTC back when it was cheaper than your daily latte are now probably debating whether to buy private islands or just pay off their credit cards.

Despite miners selling their BTC treasure chests, Bitcoin keeps flexing its bullish muscles, thanks in part to strong inflows into spot ETFs. Translation: some serious money wants in, and BTC isn’t ready to let go.

At print time, Bitcoin was hanging out at $94,393, down a modest 0.76% in the last 24 hours—because crypto wouldn’t be crypto without a little drama.

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Honor of Kings returns for the 2025 Esports World Cup with a whopping $3 million prize pool

- PUBG Mobile heads back to Riyadh for EWC 2025

- Kanye “Ye” West Struggles Through Chaotic, Rain-Soaked Shanghai Concert

- Arknights celebrates fifth anniversary in style with new limited-time event

- USD CNY PREDICTION

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Every Upcoming Zac Efron Movie And TV Show

- Superman: DCU Movie Has Already Broken 3 Box Office Records

2025-04-27 22:17