In a revelation that shocked precisely no one, CryptoQuant analyst Crypto Dan has declared that Bitcoin’s current trajectory is about as thrilling as a tea party with your accountant. According to Dan, macroeconomic factors and a market structure that’s apparently been sedated are to blame for this yawn-inducing phase of BTC growth.

Where’s the FOMO?

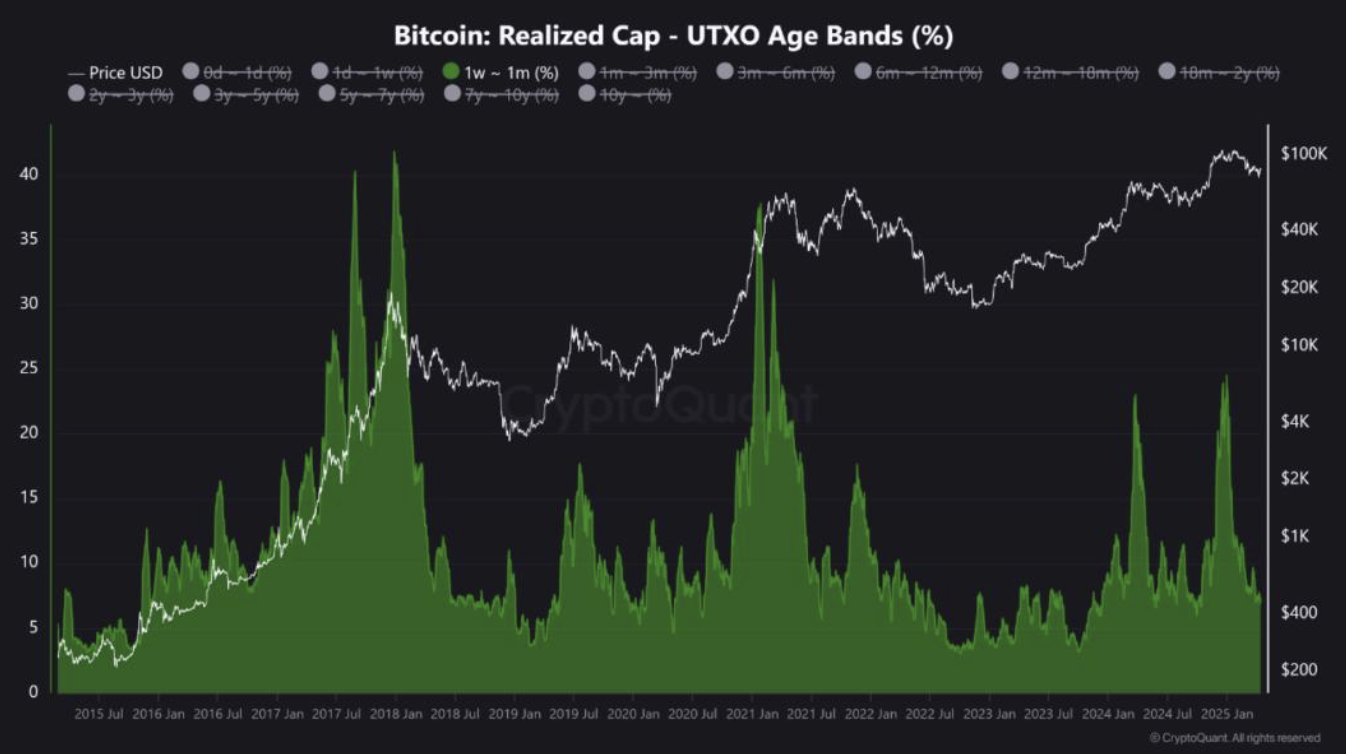

Dan, with the gravitas of a man who’s seen too many charts, points out the glaring absence of speculative capital and short-term participants. Gone are the days when retail investors would throw their life savings into Bitcoin like it was a carnival game. “In past cycles,” Dan mused, “the market would heat up faster than a microwave burrito. But now? It’s more like a slow-cooked stew.” He attributes this to macro tightening and the institutionalization of the crypto market — because nothing kills a party like a suit with a spreadsheet.

Tighter Liquidity, Slower Moves

Remember the post-COVID boom? When interest rates were so low they might as well have been negative, and quantitative easing was the financial equivalent of a free bar? Well, those days are over. Dan explains that we’re now in a high-interest rate environment where liquidity is tighter than a pair of skinny jeans after Thanksgiving. “Capital flows are no longer free,” he lamented, “and large-scale swings are as rare as a unicorn at a donkey convention.” As a result, Bitcoin’s price action has become slower, more deliberate, and about as exciting as watching paint dry.

Institutions Now Call the Shots

One of the most significant shifts this cycle has been the rise of institutional capital, particularly through spot Bitcoin ETFs. Unlike retail investors, who would buy Bitcoin like it was a limited-edition sneaker drop, institutions are more cautious. They buy in stages, like someone carefully assembling a piece of IKEA furniture. “Individual investors used to drive the momentum,” Dan said. “Now, with institutions in charge, we’re seeing a more controlled, ladder-like rise in Bitcoin price. It’s less ‘rocket ship’ and more ‘escalator.’” This shift is also visible in on-chain data, where whale inflows and ETF allocations dominate, while retail participation is about as active as a sloth on a Sunday afternoon.

A New Kind of Cycle

Despite the lack of euphoria, Dan doesn’t believe the current market action suggests a looming crash. Instead, he predicts a longer, more complex cycle — one that may extend well into 2025. “ETF inflows are still ongoing,” he said, “and if the macro environment gradually eases, we could see meaningful trends emerge in 2025.” While it may not feel like previous bull markets, this new phase could offer more sustainable growth. And for many, that’s exactly what crypto needs — even if it’s about as thrilling as a tax audit.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Silver Rate Forecast

- Gold Rate Forecast

- Black Myth: Wukong minimum & recommended system requirements for PC

- Mech Vs Aliens codes – Currently active promos (June 2025)

- “Golden” Moment: How ‘KPop Demon Hunters’ Created the Year’s Catchiest Soundtrack

- Hero Tale best builds – One for melee, one for ranged characters

2025-04-16 13:46