Ah, dear friends! The wise analysts of Bitfinex have proclaimed that those who dared to purchase Bitcoin in the last month are now the most unfortunate souls amidst the recent crypto market calamities. What a tragicomedy! 🎭

Lo and behold! Bitcoin (BTC) has shed a staggering 13.5% of its value in the past thirty days, and it has plummeted over 29% from its glorious peak in January. Such a spectacle! This, my friends, is the grandest correction of our current bull cycle, as revealed in the illustrious Bitfinex Alpha Report, released on this fateful day of March 17. 📉

In days of yore, we have witnessed similar misfortunes, with drawdowns ranging from 30% to 50%. Yet, some optimists dared to dream of a different fate this time, thanks to the newfound institutional adoption of spot BTC exchange-traded funds on Wall Street. Oh, the folly of hope! 🌈

Indeed, the U.S. spot BTC ETFs have experienced a veritable blitz, amassing over $100 billion in assets under management within a mere year, as titans like BlackRock and Fidelity lured in vast sums of capital. What a feast for the eyes! 🍽️

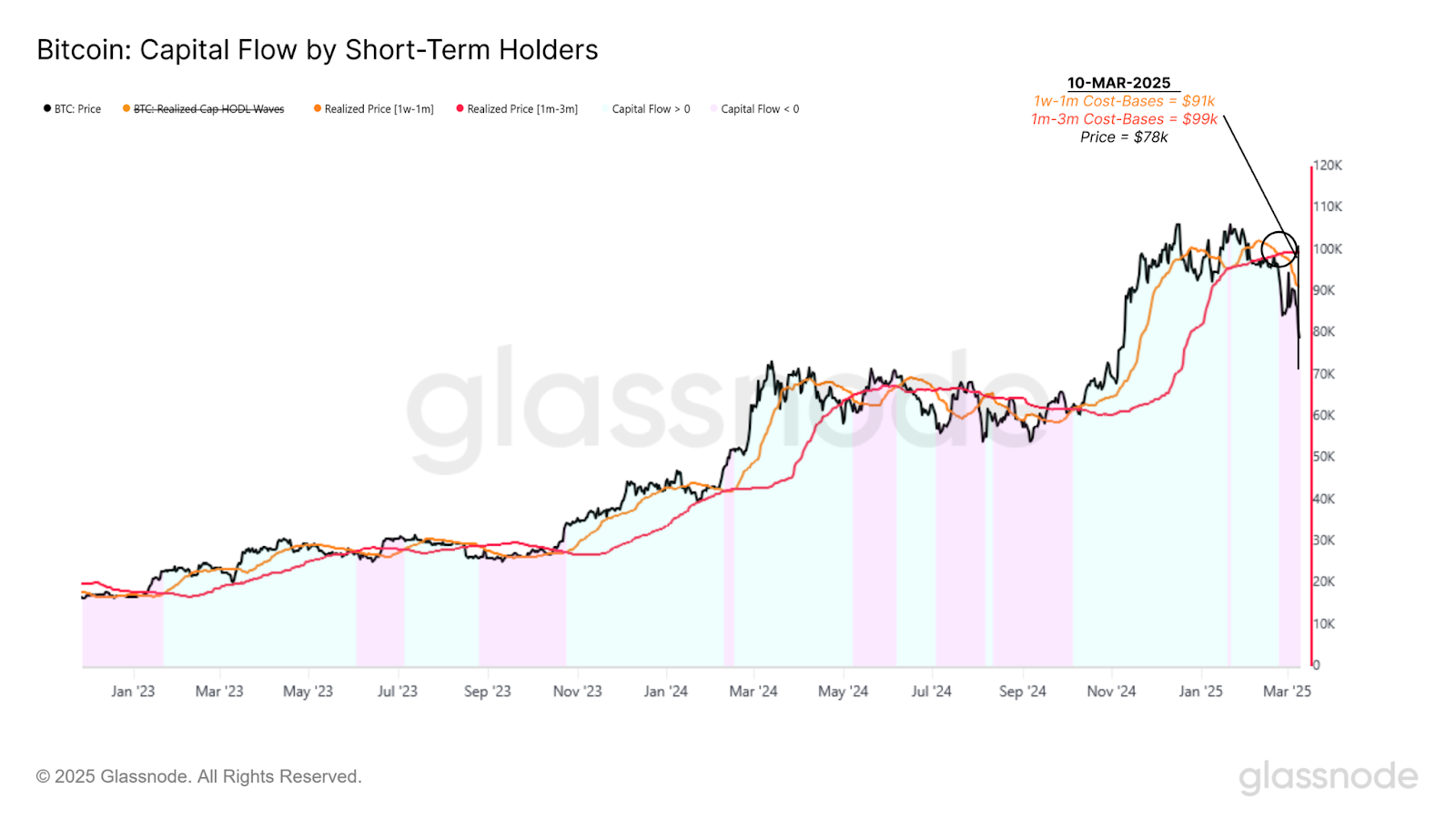

Short-term Bitcoin holders capitulating

Alas! The cash allocated to these ETFs has trickled down like a sad stream over the past few weeks, with consecutive outflows now setting records. Just last week, nearly $1 billion fled these products, signaling that “institutional buyers have not yet returned with sufficient strength to counteract selling pressure,” as the Bitfinex sages have noted. 🏃♂️💨

Oh, the tepid price action has rattled the spirits of crypto enthusiasts! The Fear & Greed index has plummeted to multi-year lows, “exacerbating sell-side pressure” as our short-term holders throw in the towel, according to the Bitfinex report. What a sight to behold! 😱

Data from the oracle known as IntoTheBlock supports the lamentations of the Bitfinex analysts. The “Global In/Out of the Money” metric reveals that 20% of all BTC holders are now in a state of unrealized losses. Most of these unfortunate buyers acquired their Bitcoin between $85,700 and $106,800, as per the wise IntoTheBlock. What a tragic tale! 📉

Historically, when the fresh capital inflows slow and the cost basis trends shift, it signals a weakening demand environment. This trend has become increasingly evident as Bitcoin struggles to hold above key levels. Without new buyers stepping in, Bitcoin risks extended consolidation, or even further downside as the weaker hands continue to exit their positions. Such drama! 🎭

— The Bitfinex analysts

Possible turn around

Further downside price action may also ensue as the financial markets digest the results of Trump’s tariffs and U.S. macro data. What a tangled web we weave! 🕸️

While inflation has cooled and the jobs market shows signs of resilience, a rise in underemployment and macro uncertainty has led many investors to adopt a hands-off approach. However, the Bitfinex analysts remain hopeful, believing that a bullish outcome may still be possible if the right factors align. Hope springs eternal! 🌱

The key factor to watch is whether long-term holders or institutional demand re-emerge at these lower levels. If deeper-pocketed investors begin absorbing supply, it could signal a shift back toward accumulation, potentially stabilizing price action and reversing sentiment. A twist in the tale, perhaps? 🤔

Read More

- Silver Rate Forecast

- Black Myth: Wukong minimum & recommended system requirements for PC

- Gold Rate Forecast

- USD CNY PREDICTION

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Grimguard Tactics tier list – Ranking the main classes

- Arknights celebrates fifth anniversary in style with new limited-time event

- Gods & Demons codes (January 2025)

- Maiden Academy tier list

- PUBG Mobile heads back to Riyadh for EWC 2025

2025-03-17 23:44