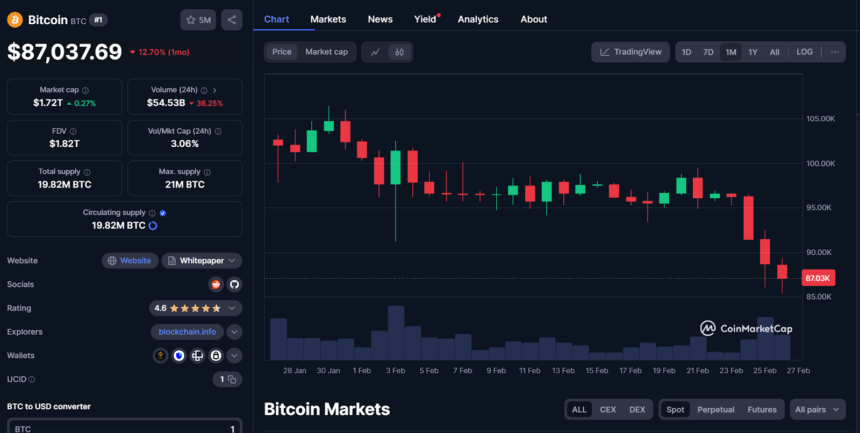

In recent weeks, the esteemed Bitcoin has endured a series of unfortunate events, plummeting from a lofty $105,000 to a rather disheartening $87,037. This descent has instilled a palpable sense of trepidation among traders, who find themselves in a state of uncertainty, pondering whether this is indeed the nadir of Bitcoin’s fortunes. 😱

Alas, many a hapless investor has been compelled to part with their Bitcoin holdings at a loss, with short-term holders relinquishing a staggering 43,600 BTC, valued at a lamentable $3.9 billion. Such a quantity has not been witnessed since the previous August, as reported by the ever-reliable Glassnode. 📉

The total losses incurred from these transactions amount to a staggering $1.8 billion, marking the most significant one-day loss in many moons. Yet, amidst this chaos, some sagacious experts posit that Bitcoin may be nearing its lowest point, poised for a potential resurgence. Is this truly the bottom, or shall we witness further declines? Let us consult the wise sages of the market. 🤔

One such sage, Andre Dragosch, the Head of Research at Bitwise Europe, has declared that the Crypto Asset Sentiment Index has reached its lowest ebb since August 2024. He boldly asserts, “The Crypto Asset Sentiment Index has just emitted a most fortuitous contrarian buy signal for Bitcoin. The widespread bearishness across flows, on-chain data, and derivatives suggests that the risks of further decline are rather limited.” 🧐

Meanwhile, the total value of the crypto market has dwindled to a mere $2.9 trillion, a full $1 trillion less than its peak in December 2024, as per the diligent data from CoinMarketCap. 📊

Yet, one must consider the multitude of events that have precipitated this calamity. Notably, a $1.4 billion hack on the Dubai-based exchange Bybit has raised grave concerns regarding security within the market, prompting many traders to withdraw their funds with all due haste. 🏃♂️💨

Furthermore, the proposed tariffs by none other than Donald Trump on our neighbors to the north and south have unleashed a wave of uncertainty upon the market. Many are also apprehensive that the Federal Reserve’s policies may exert additional pressure on the crypto realm in the months to come. 😬

Despite the prevailing atmosphere of fear and panic, a few optimistic souls remain steadfast in their belief in Bitcoin’s future. The investment firm Bernstein is convinced that Bitcoin shall ascend to the remarkable height of $200,000 within the next year. “We perceive the current correction as yet another opportunity to engage in this cycle,” analysts Gautam Chhugani, Mahika Sapra, and Sanskar Chindalia have proclaimed in their report. They maintain that while Bitcoin’s ascent may be delayed, robust growth is anticipated in the long run. 🌟

Geoffrey Kendrick from Standard Chartered suggests that Bitcoin may yet dip into the low $80,000s before embarking on its recovery. He further notes that Bitcoin ETFs must witness $1 billion in outflows before a genuine bottom can be confirmed. Meanwhile, data from basedmoney.io reveals that many traders are still wagering on Bitcoin reaching the lofty sum of $120,000 by March 28. 🎲

Moreover, Bitcoin has a storied history of rebounding after significant declines. Yet, at this juncture, the market remains shrouded in uncertainty. Some traders are convinced that the worst is behind us, while others await a semblance of stability. 🤷♀️

Read More

- Silver Rate Forecast

- Black Myth: Wukong minimum & recommended system requirements for PC

- Gold Rate Forecast

- USD CNY PREDICTION

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Grimguard Tactics tier list – Ranking the main classes

- Arknights celebrates fifth anniversary in style with new limited-time event

- Gods & Demons codes (January 2025)

- PUBG Mobile heads back to Riyadh for EWC 2025

- Maiden Academy tier list

2025-02-26 22:38