Amidst the grand ball of the crypto world, Bitcoin, that enigmatic and often moody prince, stands near the $118,300 mark, neither advancing nor retreating in the past 24 hours. This, after his recent coronation at the all-time high of $123,000. Market analysts, those ever-so-wise and yet often contradictory sages, are divided. Has Bitcoin reached the zenith of his glory, or is there yet another surge to come? 🤔

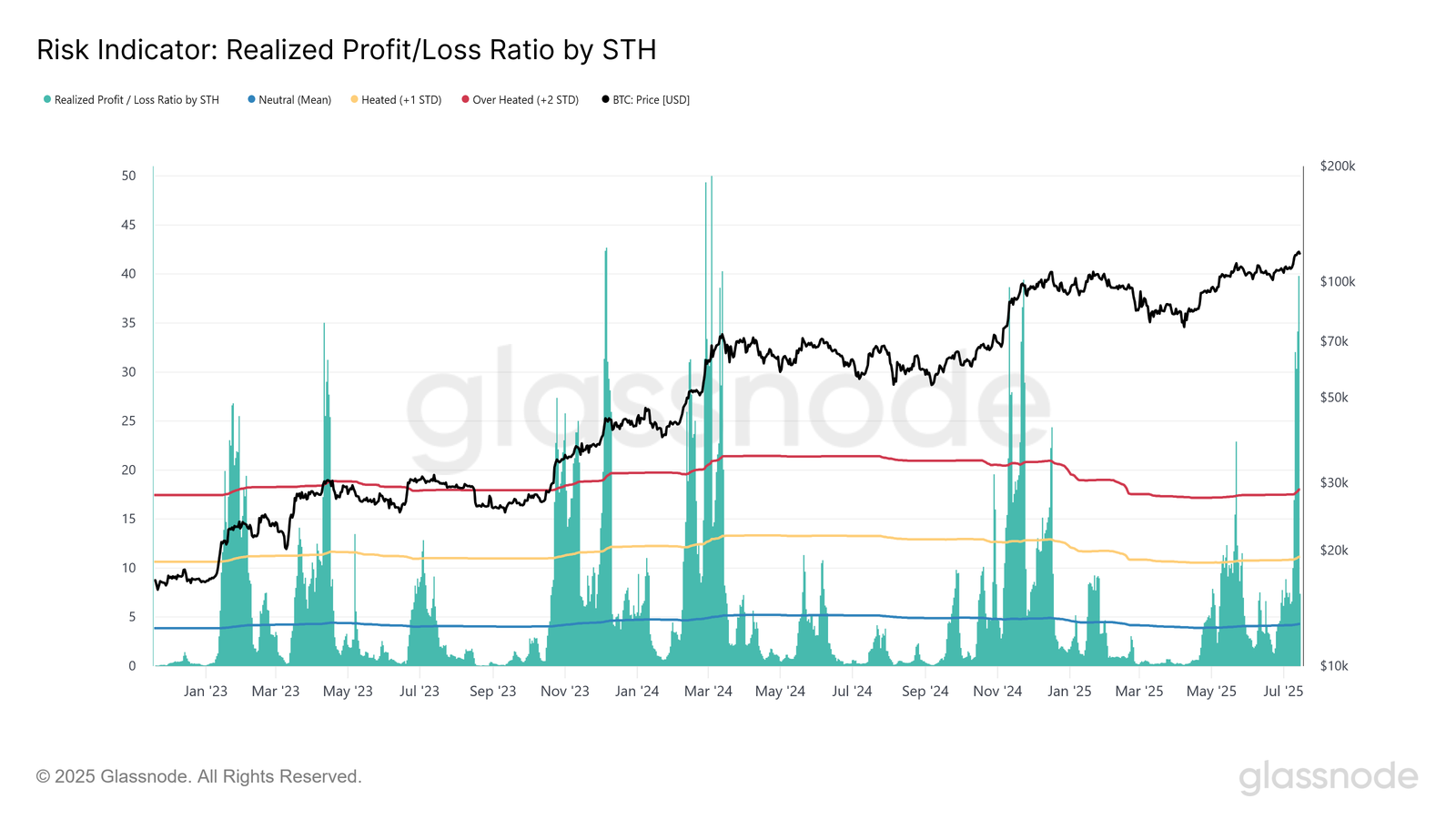

A recent missive from Glassnode, a beacon of insight in the crypto night, suggests that while historical trends whisper of further ascension, the prince is beginning to show signs of overheating. The Realized Profit to Loss Ratio, a measure of investor sentiment, spiked to 39.8, far above the +2 standard deviation threshold, a clear sign of intense profit-taking. Though this fever has since cooled to 7.3, it remains a symptom of a bull market in its twilight. 🌄

Bitcoin realized profit/loss ratio | Source: Glassnode

Glassnode, ever the cautious advisor, notes that while a definitive peak may not have been reached, such phases often come in waves. They suggest that traders keep a wary eye on the $130,000 level, the next major resistance for our prince. 🛡️

While Bitcoin ponders his next move, the altcoins, those lively and often overlooked courtiers, have seized the spotlight. Ethereum, the largest of the altcoins, has surged by 7% in the past 24 hours, trading around $3,350. This breakout from a period of consolidation is fueled by growing optimism regarding the advancement of crypto-related bills in the United States. 🇺🇸

Solana, another courtier of note, has also risen by 5%, trading around $172 with a market cap of $92.5 billion. This rally is perhaps spurred by Galaxy Digital’s $55 million purchase of SOL within a mere two-hour window. 🚀

US spot Ether ETFs reported a record daily net inflow of $717 million on July 16, bringing total ETH holdings across these ETFs to over 5 million ETH. The ETFs bought nearly 107 times the daily ETH issuance, a clear sign of heightened institutional interest. 🏦

Altcoin Season Ahead?

Investors, ever the eager dancers, are now looking for the next star to explode. Peter Brandt, a voice of authority in the crypto realm, declared “altcoin season” on X, sharing a chart that suggests a potential cup and handle pattern, hinting at a high likelihood of altcoin bulls taking over. 🌟

It’s altcoin season

— Peter Brandt (@PeterLBrandt) July 16, 2025

Analyst Cas Abbe, another sage of the crypto court, echoed this optimism. He noted that the altcoin market cap has broken out of its consolidation range, and that upcoming pro-crypto legislation could draw the attention of traditional finance. Abbe predicted that the coming months could be “life-changing” for crypto investors. 🌈

Altcoin MCap has broken out of its consolidation range.

This was the best time to accumulate, but still it’s not too late.

BTC has recently hit a new ATH, and pro-crypto bills will soon pass.

All this will bring crypto into TradFi attention, and they’ll bid in a big way.

I…

— Cas Abbé (@cas_abbe) July 16, 2025

At the time of writing, the crypto market’s total capitalization stands at $3.8 trillion, a staggering 61% increase in the past month. The ball continues, and the music plays on. 🎵

Read More

- Silver Rate Forecast

- Black Myth: Wukong minimum & recommended system requirements for PC

- Gold Rate Forecast

- USD CNY PREDICTION

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Grimguard Tactics tier list – Ranking the main classes

- Arknights celebrates fifth anniversary in style with new limited-time event

- Gods & Demons codes (January 2025)

- Maiden Academy tier list

- PUBG Mobile heads back to Riyadh for EWC 2025

2025-07-17 11:54