Amidst the swirling mists of the market, where the winds of fortune blow with capricious abandon, Bitcoin has once again ascended to new heights, defying the skeptics and the faint of heart. Yet, in this realm of digital gold, one company, Strategy, continues to march to the beat of its own drum, accumulating Bitcoin as if it were the last oasis in a desert of doubt.

Strategy’s Gambit: 4,225 Bitcoin in the Latest Stash

Michael Saylor, the enigmatic chairman of Strategy, has once again taken to the digital pulpit, this time to announce a fresh acquisition of 4,225 Bitcoin. In a world where the price of Bitcoin has reached new all-time highs (ATHs), Saylor’s move is nothing short of a bold statement. The SEC filing reveals that the purchase, made between July 7th and July 13th, came at an average cost of $111,827 per BTC, totaling a staggering $472.5 million. “Short Bitcoin if you hate money,” Saylor quipped, a sentiment that seems to resonate with the company’s unwavering faith in the digital currency.

With this latest buy, Strategy’s total Bitcoin holdings have swelled to 601,550 BTC, a treasure trove amassed at a cost of $42.87 billion. Today, the value of this digital hoard stands at $72.25 billion, a profit of 68.5% that would make even the most hardened investor crack a smile. 🤑

But Strategy is not alone in its quest for Bitcoin dominance. Metaplanet, another player in the Bitcoin treasury game, has also added to its stash, purchasing 797 BTC to bring its total holdings to 16,352 BTC. Unlike Strategy, however, Metaplanet’s average cost basis is a bit steeper, sitting at $100,191 per BTC. 🤔

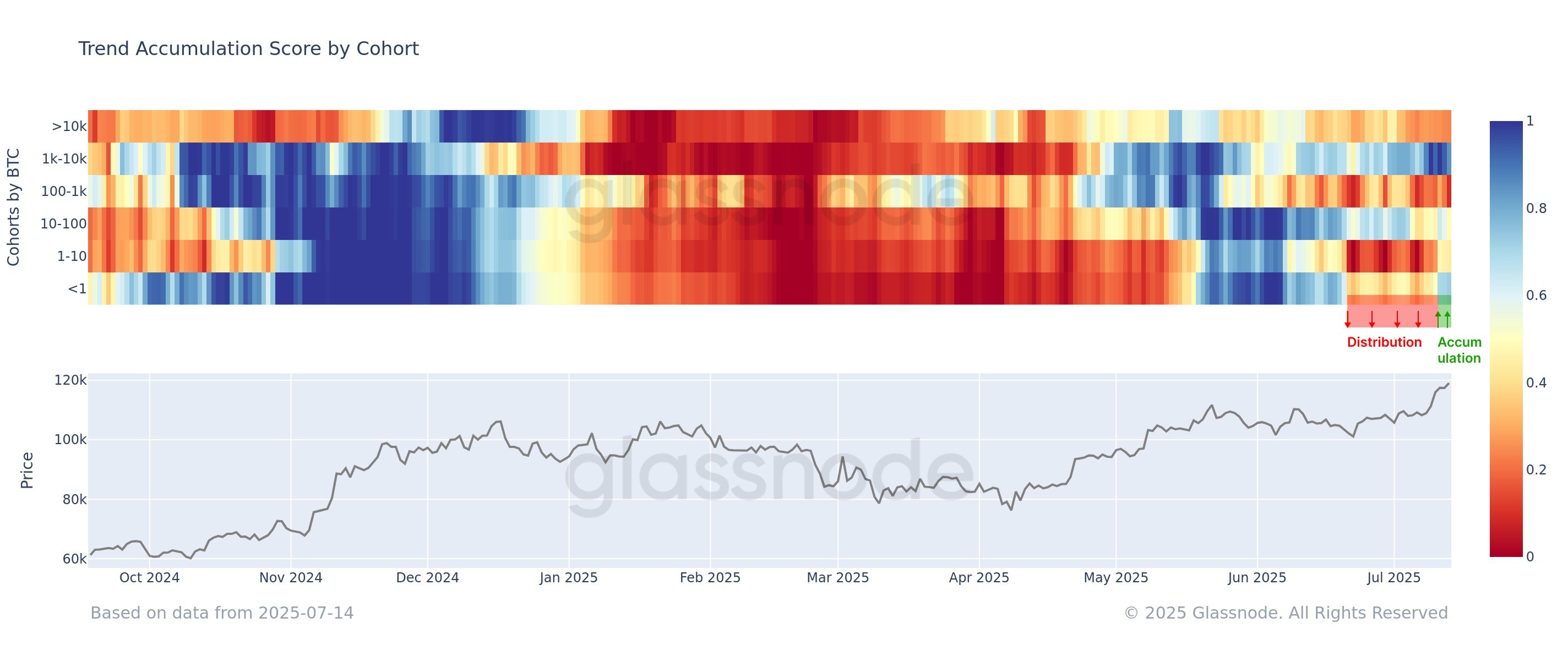

While the big players have been feasting on Bitcoin for some time, the on-chain analytics firm Glassnode has noted a new trend: retail investors are finally joining the party. The Accumulation Trend Score, a metric that tracks whether investors are buying or selling, shows that the 1,000 to 10,000 BTC cohort, known as the whales, have been on a near-perfect accumulation spree. The latest rally in Bitcoin may well be a testament to their unshakable belief in the digital currency.

However, the rest of the Bitcoin market, including the mega whales with over 10,000 BTC, have been more inclined to distribute, with an Accumulation Trend Score of around 0.3. The retail investors, those with less than 1 BTC, have also shifted gears, moving from a phase of distribution to one of accumulation. It seems the recent surge in Bitcoin’s price has finally caught their attention. 🚀

BTC Price: A Rollercoaster Ride

Bitcoin’s price, like a wild stallion, has galloped to $123,000, only to be reined in and brought back to $119,900. The volatility of the market is a constant reminder that in the world of cryptocurrencies, the only certainty is uncertainty. 🎢

Read More

- Silver Rate Forecast

- Grimguard Tactics tier list – Ranking the main classes

- Former SNL Star Reveals Surprising Comeback After 24 Years

- USD CNY PREDICTION

- Black Myth: Wukong minimum & recommended system requirements for PC

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Hero Tale best builds – One for melee, one for ranged characters

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Mech Vs Aliens codes – Currently active promos (June 2025)

2025-07-15 11:16