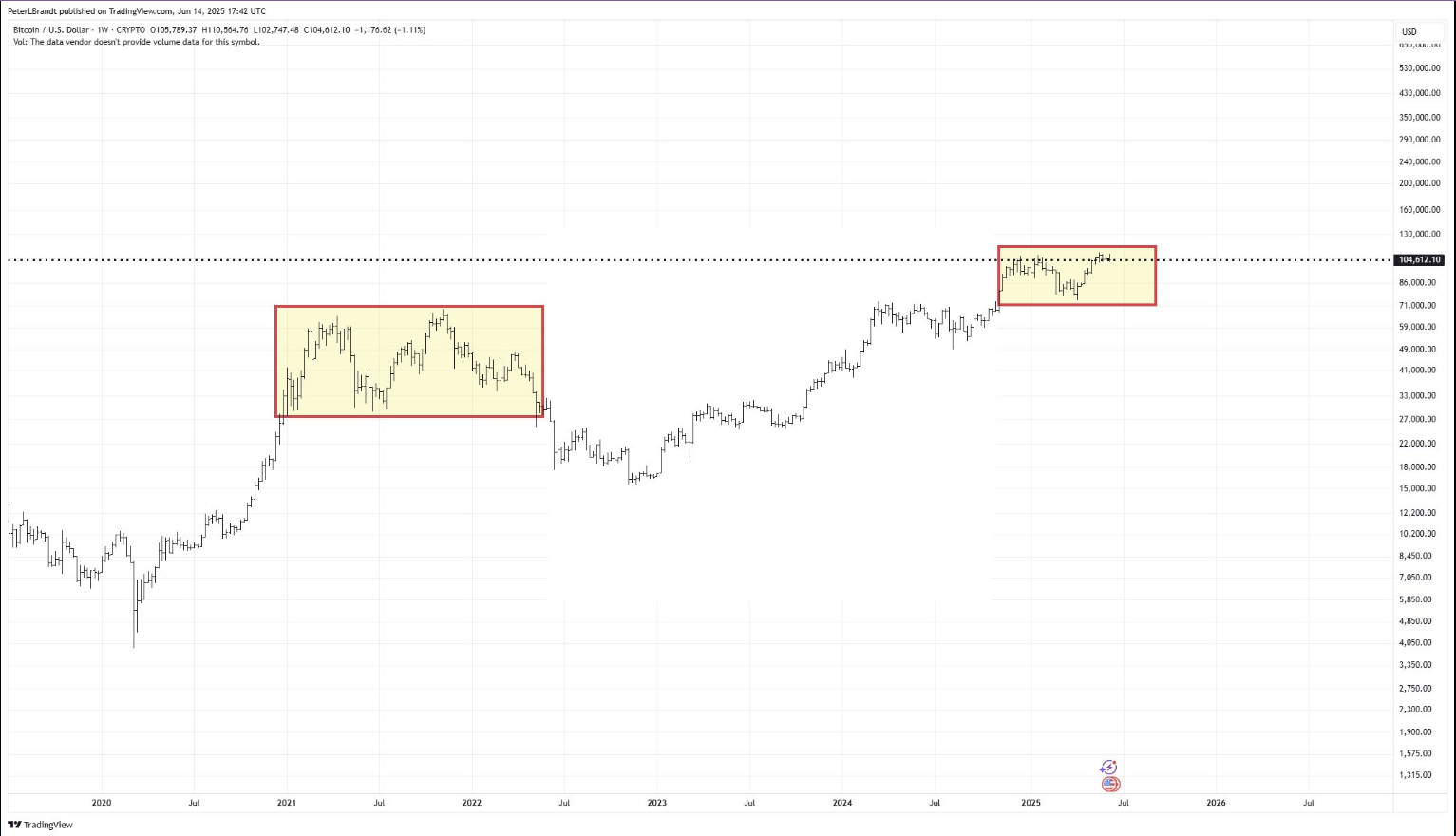

And so, dear reader, we find ourselves at the crossroads of fate, where the capricious cryptocurrency, Bitcoin, teeters precariously between the Scylla of $61,000 and the Charybdis of $104,000. For seven long months, it has been thus, a veritable déjà vu of the $31,000–$64,000 sideways waltz that preceded the great plummet of early 2022. The augurs, those self-proclaimed seers of the market, are at odds over whether history shall repeat itself or if the cavalry of fresh demand shall arrive in time to save the day 🤔.

Observe, if you will, the eerie parallels between the present and the “distribution zone” of 2020–2021, when Bitcoin tarried between $31,000 and $64,000 for nigh on a year. And then, the inevitable happened: a precipitous drop from $69,000 to $15,600, a gut-wrenching 78% plunge that left many a speculator in ruin 💸.

Fast-forward to the present, and we find Michaël van de Poppe, that wily chart whisperer, warning of a failed breakout above $106,000. The rejection, he notes, was swift and merciless, triggering a cascade of long-side liquidations that sent the price scurrying back to the $104,000–$105,000 zone 📉.

November 2021 all over again? 🤔

— Peter Brandt (@PeterLBrandt) June 14, 2025

And now, dear reader, the pièce de résistance: Peter Brandt, that grizzled veteran of the trading wars, warns of a steep slide, a calamitous 78% drop that would send Bitcoin tumbling toward $23,600 🚨. His math, as ever, is simplicity itself: a repeat of the last cycle’s move from $69,000 to $15,500.

But fear not, dear investor, for there are those who believe the floor is firmer now, buoyed by the influx of spot ETFs and the growing appetite of institutions and governments 📈. And yet, those technical barriers remain, taunting us like the Sirens of old.

And so, we turn to Trader Tardigrade, that indefatigable optimist, who notes that Bitcoin’s 50-day and 200-day simple moving averages have formed a golden cross, a harbinger of gains past 📊. But will it be enough to stem the tide of caution?

Thus, dear reader, we find ourselves at the mercy of the markets, torn between the Scylla of pattern watchers and the Charybdis of strong hands 🤯. Will the break below $104,000–$105,000 open the door to a move toward $23,500, or will a clean break above $106,000 signal the next leg up? Only time will tell, but one thing is certain: volatility shall reign supreme, and risk management shall be the watchword of the wise 📝.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- USD CNY PREDICTION

- Silver Rate Forecast

- “Golden” Moment: How ‘KPop Demon Hunters’ Created the Year’s Catchiest Soundtrack

- Castle Duels tier list – Best Legendary and Epic cards

- Black Myth: Wukong minimum & recommended system requirements for PC

- Mech Vs Aliens codes – Currently active promos (June 2025)

2025-06-15 22:17