As a researcher with a background in cryptocurrencies and financial markets, I find the recent Bitcoin price action and spot ETF activity intriguing. The plunge in Bitcoin prices following the halving has led some to question the sustainability of the bull market. However, I believe that the current situation is not as straightforward as it may seem.

As a researcher studying Bitcoin‘s market behavior, I have observed that following the halving event, the cryptocurrency’s prices either took a significant downturn or remained relatively stable. This stagnation in price action has led some analysts to speculate that the cooling trend in Bitcoin could continue due to ongoing outflows from spot Bitcoin Exchange-Traded Funds (ETFs).

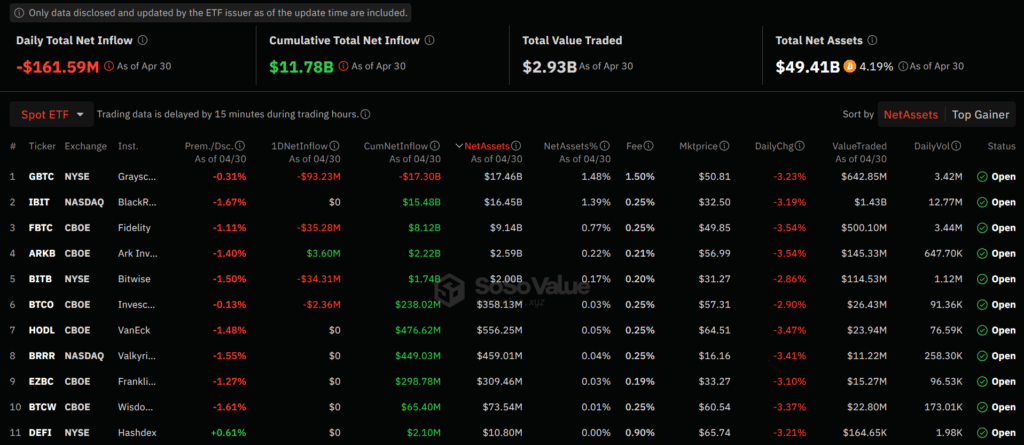

On April 30, data from the U.S. revealed that over $93 million in Bitcoin (BTC) left Grayscale Bitcoin Trust (GBTC) through single-day redemptions. This marked a significant addition to the total of approximately $162 million withdrawn from these four Bitcoin investment funds.

The deceleration of Bitcoin ETF outflows from Grayscale is noteworthy lately, yet the historical withdrawals from its GBTC product are still remarkable, amounting to approximately $17.3 billion since its conversion in January.

Michael Sonnenshein, the CEO of Grayscale, has predicted that outflows from their investment products will lessen as the year progresses. Regarding GBTC’s high fees, he has assured that these costs will decrease over time.

As a researcher studying the trends in the American stock market, I’ve come across an interesting observation: six specific funds experienced no new investments last week. However, it’s important to note that this is a frequent occurrence on Wall Street, considering there are approximately 2,000 Exchange-Traded Funds (ETFs) in operation in the U.S. One notable exception was the ARK 21Shares product, which bucked the trend and attracted over $3 million in new investments.

According to recent data, the combined value of all bitcoin exchange-traded funds (ETFs) in terms of net asset value has dropped below $50 billion. This decrease can be attributed to a combination of Grayscale’s outflows and declining Bitcoin prices.

Spot ETF activity correlates with Bitcoin Prices

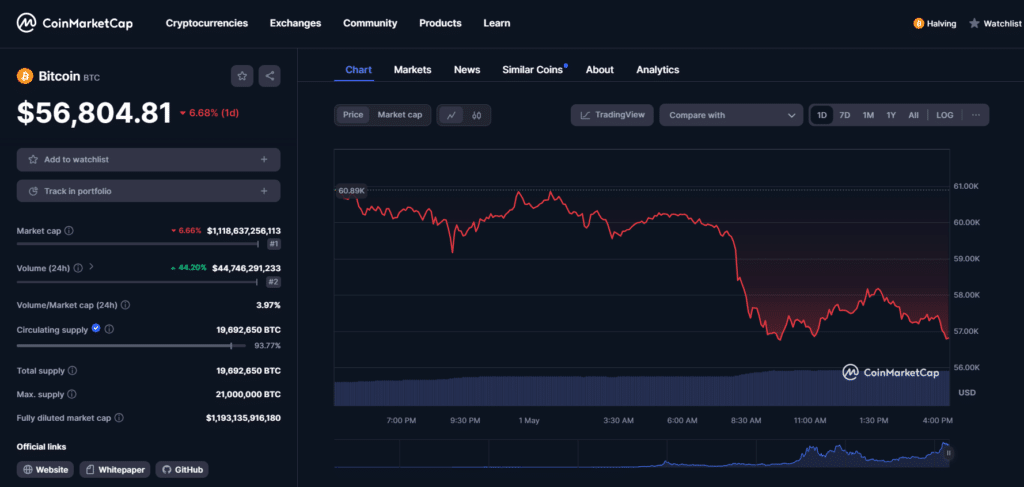

Based on CoinMarketCap’s data, Bitcoin’s value dipped below $57,000 after experiencing a significant decrease of over 6% within the past 24 hours. Nuklai CEO Matthijs de Vries shared his perspective with crypto.news, expressing that the cryptocurrency market may encounter a pause in price escalation following Bitcoin’s halving event.

In simpler terms, discovering the price in off-exchange speculative markets isn’t easy due to complex supply conditions that establish a fresh market equilibrium and a new pricing consensus. This ambiguity results in extended periods of sideways market movement, as observed following previous Bitcoin halvings.

Matthijs de Vries, Nuklai L1 blockchain CEO

Several people believed that the approval of a Bitcoin ETF at spot B might fuel a surge in the cryptocurrency’s price. But according to a blockchain authority, some on-chain signals suggest stagnant prices and potential market corrections instead.

As a researcher studying the cryptocurrency market, I’ve noticed some intriguing trends. The open interest on Bitcoin futures has dropped from a notional value of $39 billion to $30 billion recently. This decrease suggests that traders are less certain about the future price direction of Bitcoin.

Matthijs de Vries, Nuklai L1 blockchain CEO

Despite the general agreement being that U.S. spot ETFs and the Bitcoin halving will have a positive effect in the long run, as crypto.news previously noted, Bitwise CIO Matt Hougan explained that taking out approximately $11 billion in annual Bitcoin supply due to the change in block rewards and token emissions could strengthen market prices within a year.

Read More

- Silver Rate Forecast

- Gold Rate Forecast

- Grimguard Tactics tier list – Ranking the main classes

- USD CNY PREDICTION

- Gods & Demons codes (January 2025)

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Maiden Academy tier list

- Superman: DCU Movie Has Already Broken 3 Box Office Records

- Honor of Kings returns for the 2025 Esports World Cup with a whopping $3 million prize pool

- PUBG Mobile heads back to Riyadh for EWC 2025

2024-05-01 19:22