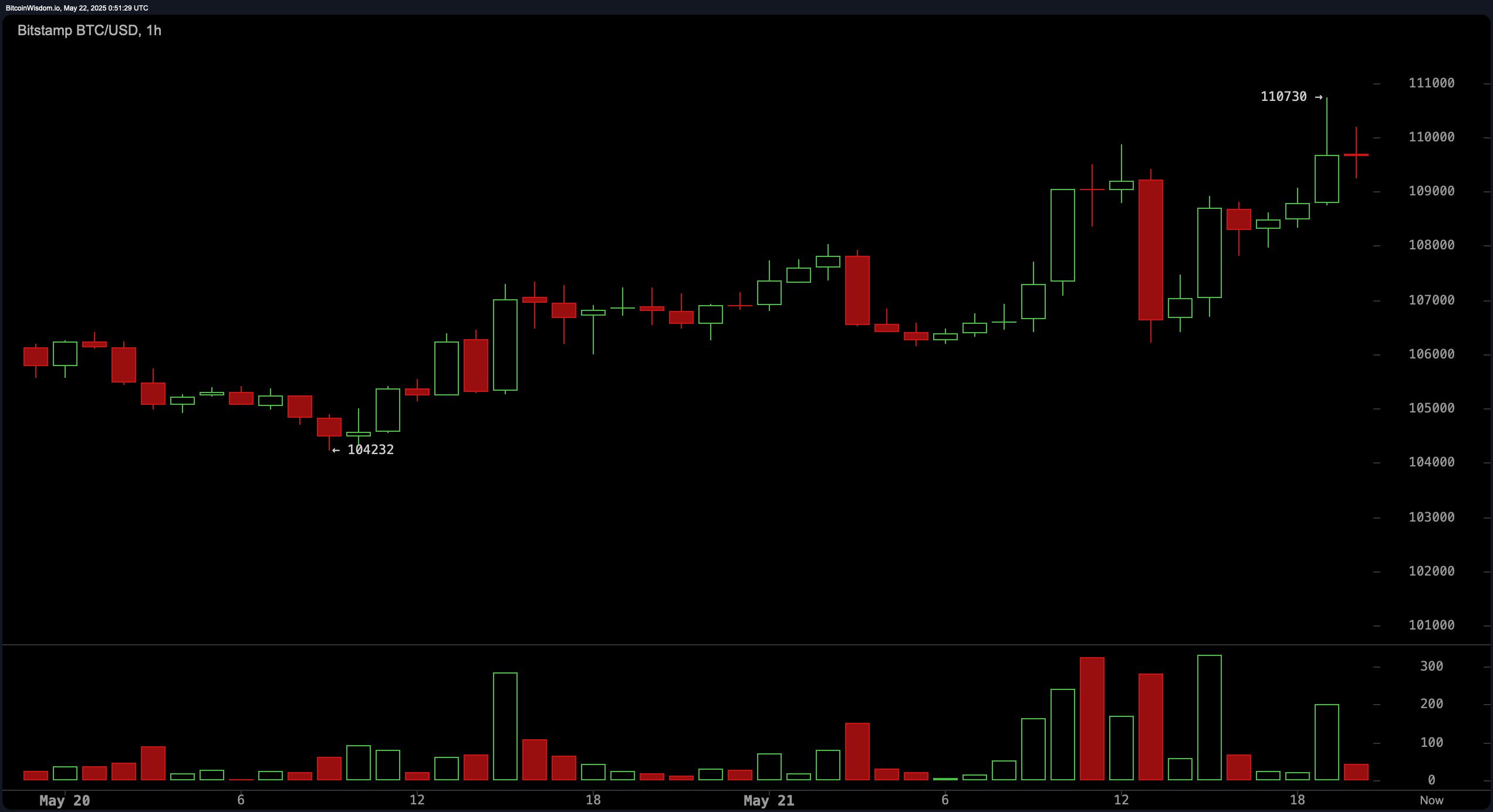

On this fine Wednesday, our dear friend bitcoin, the illustrious crypto asset, has leapt over yet another price barrier, reaching the astonishing sum of $110,730 per coin! What a spectacle! 🎉

Bitcoin Soars to $110,730 — Are We Off to the Moon? 🌕

Throughout the day, bitcoin has been tapping fresh highs like a bard at a tavern, with the latest peak hitting $110,730 per unit. At that moment, BTC seemed to settle, hovering just below the $110,000 level at 8:58 p.m. The top digital asset has soared 47.82% since it was last seen languishing at $74,434 on April 6—an upswing of over $35,000! What a transformation! 🤑

Bitstamp recorded the $110,730 milestone at precisely 7:15 p.m. Eastern on May 21. The wise analysts at Bitfinex attributed this rally to a steady, organic buying pressure in the spot market. “This move has initially been a squeeze—like a jester in a tight costume—since we moved up on short liquidations, and the first break can be reversed on lower timeframes,” they quipped to our newsdesk.

The market strategists added:

“However, when we refer to our rally from 75k until now, it’s driven by clean spot demand, ETF inflows, and a macro backdrop that continues to favor risk-on assets. The recent geopolitical de-escalation (Russia–Ukraine), dovish undertones from global central banks, and softening inflation prints have all created an ideal environment for bitcoin to act as a macro momentum asset. Quite the charade, isn’t it?”

Bitcoin’s surge reflects its deepening integration into mainstream finance, fueled by structural shifts like institutional exchange-traded fund (ETF) participation and macroeconomic recalibration. The rally’s foundation in spot demand—rather than leveraged speculation—hints at enduring confidence, though vulnerabilities persist. As global liquidity conditions evolve, bitcoin’s dual identity as a risk asset and inflation hedge faces tests, balancing speculative fervor with its nascent role in diversified portfolios. A delicate dance, indeed! 💃

“From here, the next zones to watch are $114K–$118K (minor liquidity walls) and then $123K–$125K, where large options open interest is building,” the Bitfinex analysts concluded in their note on Wednesday. “As long as ETF flows hold and macro doesn’t deliver a shock, this rally has room to extend. Pullbacks should be seen as entry opportunities—not signs of reversal. A wise man knows when to leap!”

Read More

- Gold Rate Forecast

- Grimguard Tactics tier list – Ranking the main classes

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Castle Duels tier list – Best Legendary and Epic cards

- Silver Rate Forecast

- PUBG Mobile heads back to Riyadh for EWC 2025

- Cookie Run Kingdom: Lemon Cookie Toppings and Beascuits guide

- USD MXN PREDICTION

- Pi Network (PI) Price Prediction for 2025

2025-05-22 04:35