Ah, dear reader, welcome to our humble abode of crypto news! Grab a cup of coffee, sit back, and revel in the absurdity of it all. For today, we shall regale you with tales of Bitcoin‘s meteoric rise, and the institutional shift that’s got everyone in a tizzy 🤯.

It appears that Bitcoin has reached new heights, a staggering $118,909 on the Coinbase exchange. But fear not, dear reader, for this is not just a fleeting moment of market madness. No, no! According to OKX Europe CEO Erald Ghoos, this marks a strategic turning point in how institutions view digital assets 📈.

“Bitcoin’s surge to a fresh all-time high isn’t just noise, it reflects its emergence as the ultimate digital macro hedge,” Ghoos said with a straight face 😏.

But what’s behind this sudden shift, you ask? Ah, it’s quite simple really. Rising global trade tensions, looming tariffs, and a liquidity-driven policy environment have pushed institutions to adopt Bitcoin as “digital gold” 💃. And who can blame them? After all, who needs actual gold when you can have a digital equivalent that’s just as shiny and valuable? 💎

Meanwhile, with volatility at decade lows and ETF inflows accelerating, July is shaping up to be “a defining moment” for Bitcoin 📆. And Ghoos is not alone in his enthusiasm. Marcin Kazmierczak, co-founder and COO of RedStone, also chimed in, saying that Bitcoin can add diversity to a portfolio, but won’t reliably protect against stock market crashes 🤔.

“Bitcoin can add diversity to a portfolio but won’t reliably protect against stock market crashes since it doesn’t consistently move in the opposite direction,” Kazmierczak said with a shrug 🤷♂️.

But fear not, dear reader, for this is not just a case of crypto-madness. No, no! This is a sign of a broader economic shift, where Bitcoin is emerging as a core hedge against fiat debasement and geopolitical instability 🌟.

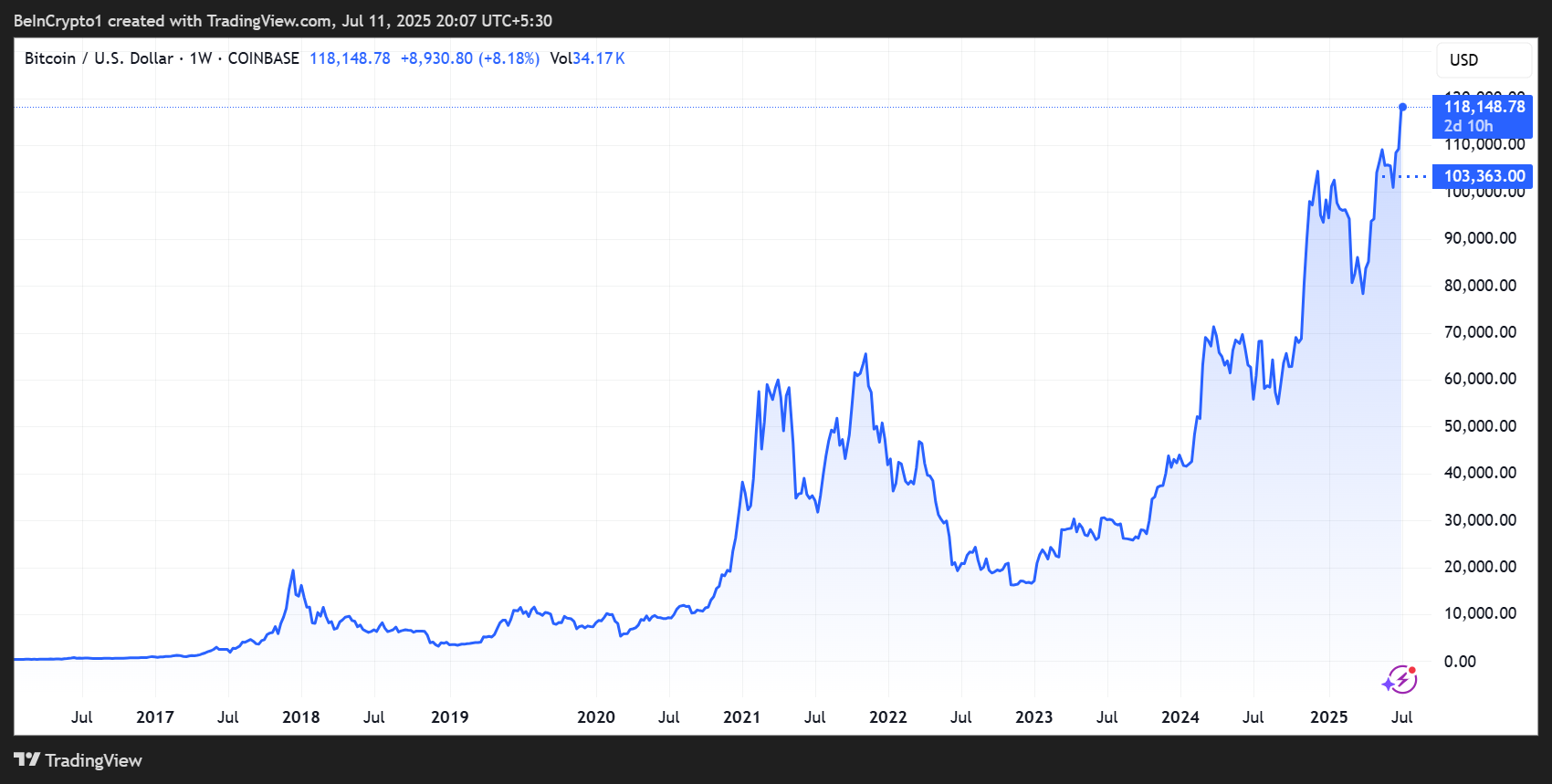

Chart of the Day

Byte-Sized Alpha

And now, for the pièce de résistance, our crypto equities pre-market overview 📊:

Crypto Equities Pre-Market Overview

| Company | At the Close of July 6 | Pre-Market Overview |

| Strategy (MSTR) | $421.74 | $435.12 (+3.11%) |

| Coinbase Global (COIN) | $388.96 | $394.53 (+1.45%) |

| Galaxy Digital Holdings (GLXY) | $20.41 | $20.80 (+1.91%) |

| MARA Holdings (MARA) | $18.99 | $19.72 (+3.77%) |

| Riot Platforms (RIOT) | $12.59 | $13.00 (+3.18%) |

| Core Scientific (CORZ) | $13.18 | $13.03 (-1.14%) |

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Silver Rate Forecast

- “Golden” Moment: How ‘KPop Demon Hunters’ Created the Year’s Catchiest Soundtrack

- Castle Duels tier list – Best Legendary and Epic cards

- Black Myth: Wukong minimum & recommended system requirements for PC

- Mech Vs Aliens codes – Currently active promos (June 2025)

2025-07-11 19:12