Ah, dear reader! According to the wise sages at Bitwise, it appears that the illustrious BTC may soon be graced with a staggering $180 billion in institutional inflows by the year 2026! This, my friends, is not merely a trickle from the common folk, but a veritable deluge from the esteemed Registered Investment Advisors (RIAs), pensions, and wirehouses. A most delightful shift from the raucous retail rallies of yore to a more dignified affair, steeped in the long-term capital of the professionals! 🎩💼

But lo! The on-chain data whispers secrets of this grand transformation. The UTXO (Unspent Transaction Output) analysis — a most clever method to track the clandestine activities of Bitcoin wallets — reveals that our institutional friends have begun to accumulate their positions with the stealth of a cat burglar! 🐱👤

Some analysts, with a twinkle in their eye, proclaim this to be the “stealth phase” before a potential parabolic price move. Oh, how thrilling! 📈

Chart Analysis: Bitcoin ETFs Are Outpacing Gold

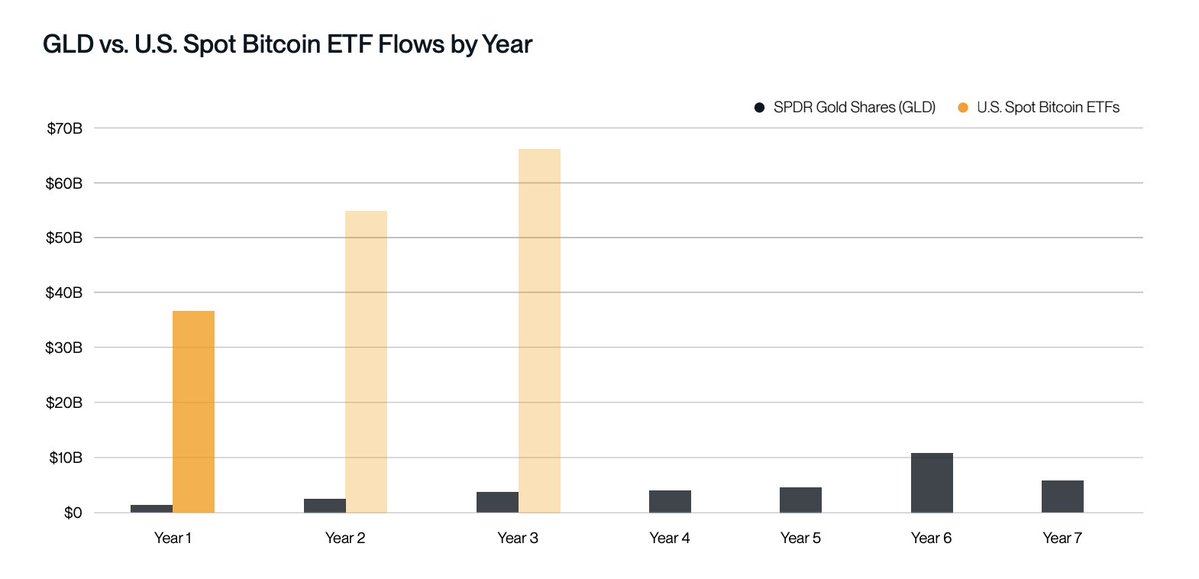

Behold the chart, dear audience! It compares the U.S. Spot Bitcoin ETF flows with the venerable SPDR Gold Shares (GLD) over a seven-year span. What a spectacle it is!

- In the first three years, Bitcoin ETFs have seen inflows swell from a modest $35 billion to a dazzling $65 billion! 🎉

- Meanwhile, our dear GLD has maintained a rather stable, yet paltry, annual inflow — typically under $10 billion per year. Poor thing! 😢

- As we venture into Year 4 and beyond, GLD’s inflows remain consistent, while Bitcoin ETF projections suggest a tapering off — perhaps a conservative estimate or merely a reflection of front-loaded demand. Who can say? 🤷♂️

Indeed, the institutional appetite for Bitcoin is already eclipsing what we have historically witnessed with gold ETFs, especially in the early adoption phase. If this momentum continues, Bitcoin may very well ascend to the status of a new macro-asset class in the portfolios of our esteemed financial institutions! 🏦

Conclusion: The Setup for Bitcoin’s Next Move

This delightful data paints a portrait of a maturing Bitcoin market, where our deep-pocketed institutional investors are quietly building their exposure. With regulatory clarity improving and accessible vehicles like ETFs now in play, the stage is set for a grand influx of capital! 🎭

If history is to repeat itself — as it did with gold’s ETF-led rally in the 2000s — then Bitcoin may be on the cusp of its most magnificent growth cycle yet! Let us raise our glasses to this potential future! 🥂

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Silver Rate Forecast

- PUBG Mobile heads back to Riyadh for EWC 2025

- Castle Duels tier list – Best Legendary and Epic cards

- Maiden Academy tier list

- Cookie Run Kingdom: Lemon Cookie Toppings and Beascuits guide

- USD MXN PREDICTION

2025-05-24 13:49