Ah, Bitcoin! The digital darling that recently pirouetted to a new all-time high (ATH), igniting a veritable bonfire of bullish enthusiasm among crypto aficionados. Yet, as the price flirts with these dizzying heights, a cloud of skepticism looms ominously overhead. ☁️

Some investors, like cautious squirrels hoarding acorns, are locking in profits, leaving us to ponder: can Bitcoin maintain its bullish ballet, or is this price action merely a prelude to a dramatic fall? 🎭

Bitcoin Investors: The Unsure Ballet Dancers

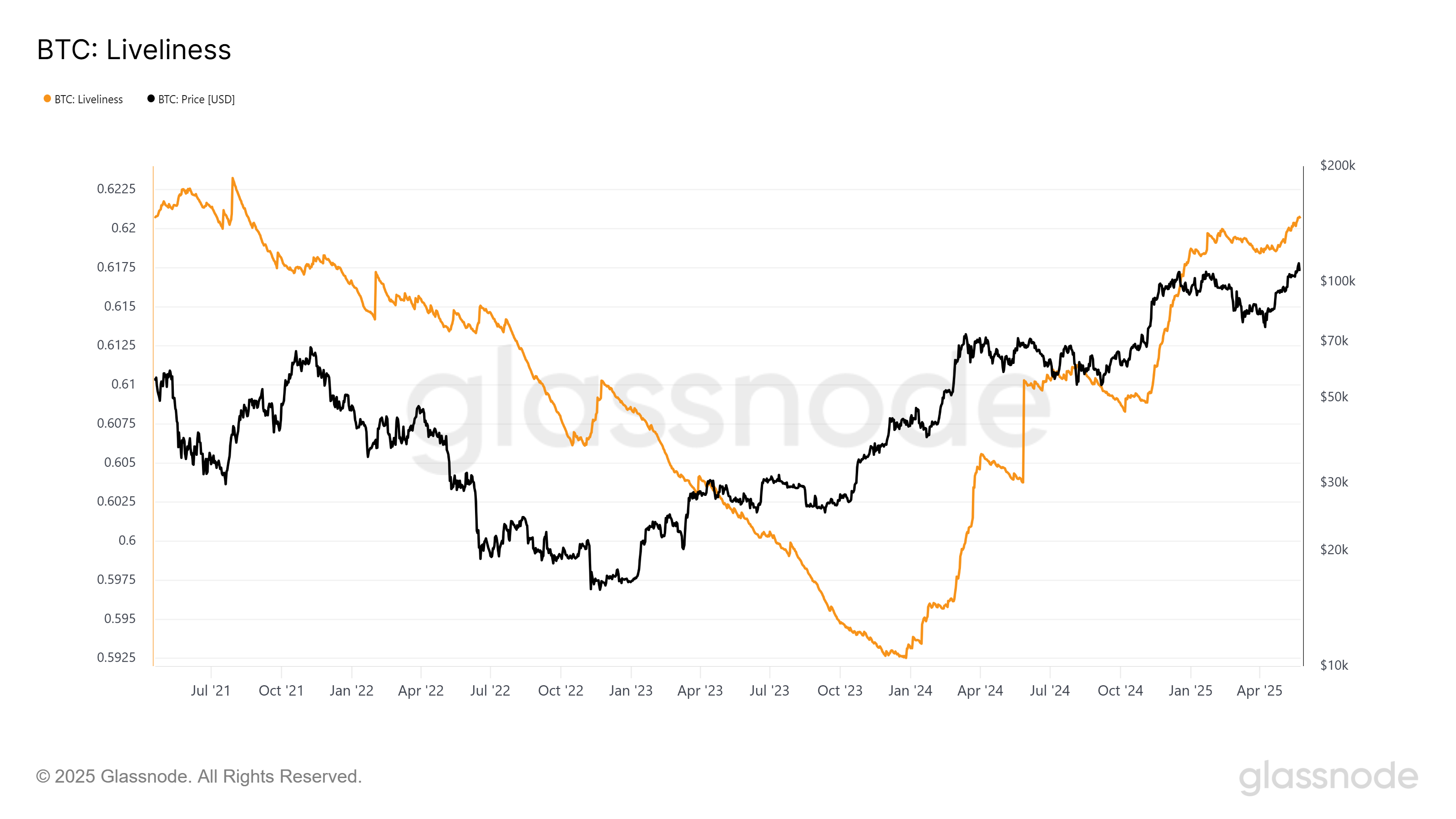

Bitcoin’s Liveliness—a metric that tracks the activity of long-term holders (LTH)—has reached a peak not seen in nearly four years. This surge in Liveliness suggests that our long-term holders are beginning to sell, perhaps securing their gains after Bitcoin’s recent price pirouette. 🩰

These LTHs, the stalwart sentinels of Bitcoin’s price stability, are now exhibiting behavior that hints at a shift toward skepticism. When they decide to sell, it’s like the curtain falling on a grand performance, often marking a turning point in the market. 🎭

As more LTHs exit stage left, Bitcoin faces the specter of increased market volatility and the potential for a price correction. With each departure, the pressure mounts, threatening to stifle any further price growth in the short term. 😱

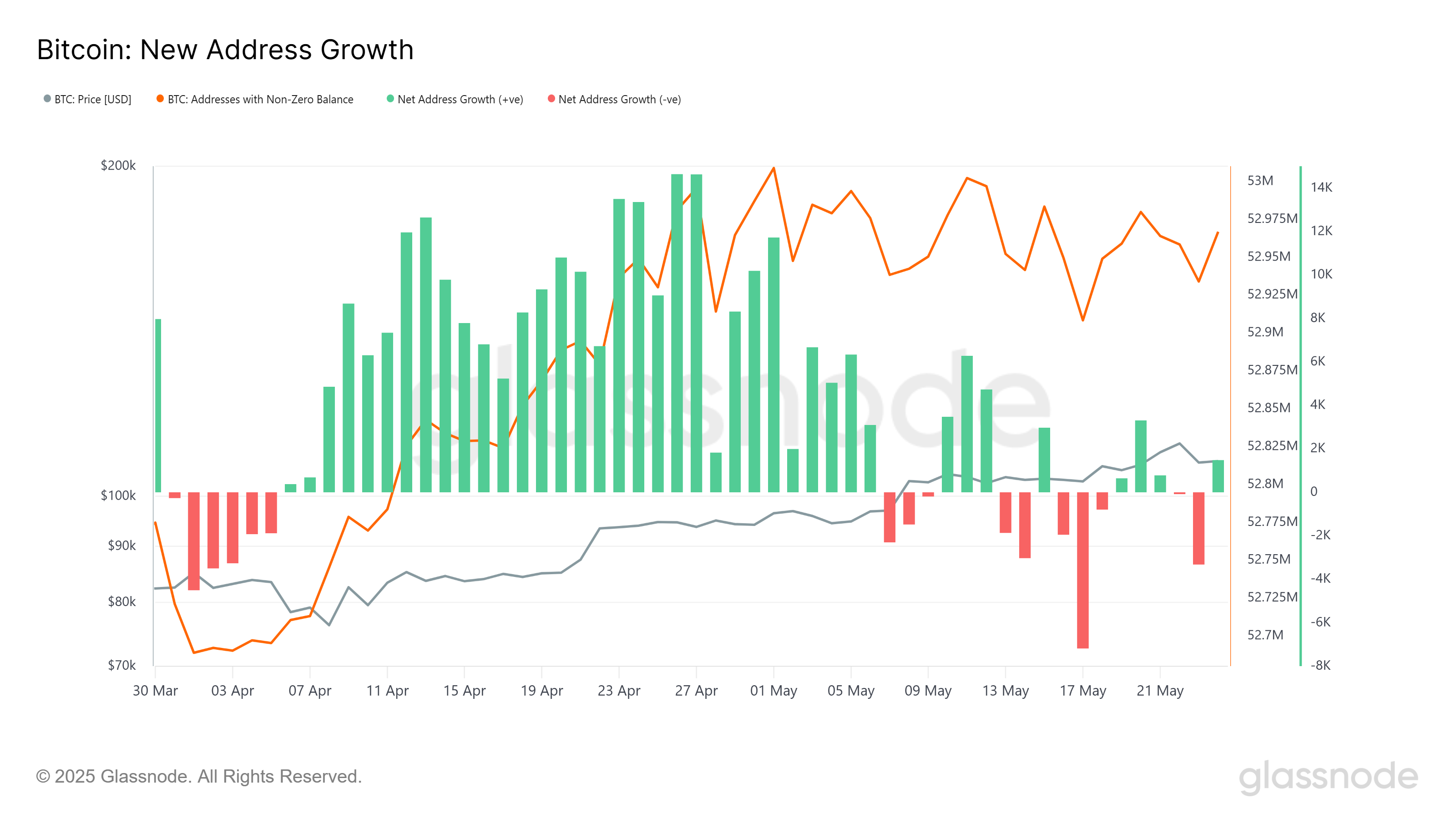

This month, the growth of new Bitcoin addresses has been as erratic as a cat on a hot tin roof. Earlier, the number of new addresses soared to new heights, but now, ominous red bars on the chart signal a sharp decline. 📉

This slowdown in address growth suggests that fewer new investors are entering the fray, while some existing holders are choosing to exit, perhaps in a dramatic wallet purging reminiscent of a soap opera plot twist. 📺

Compared to April, address growth has become a rollercoaster of erratic behavior. As Bitcoin’s price ascends, investors are becoming more cautious, fixated on securing their profits like a squirrel with its stash. 🐿️

The volatility in new address growth mirrors the uncertainty surrounding Bitcoin’s future price action, with investors remaining wary of the long-term sustainability of this rally. 🤔

BTC Price: A Hair’s Breadth from ATH

Currently, Bitcoin’s price stands at a tantalizing $106,708, a mere 5% shy of its ATH of $111,980, achieved just last week. However, the road to reclaiming this lofty perch hinges on how investors respond to the current market conditions. 🚦

If skepticism and selling persist, Bitcoin may find itself in a quagmire, struggling to regain its bullish momentum. 🐢

Should the price continue its descent, Bitcoin might face a rocky recovery. A break below the support level of $106,265 could lead to further declines, potentially dragging the price down to $105,000 or even $102,734 in the short term. 😬

However, if Bitcoin manages to cling to the support above $106,265 and witnesses a resurgence of buying interest, it could easily invalidate the bearish outlook. A breach of the $110,000 resistance level would provide the momentum needed to catapult through $111,980, paving the way for yet another ATH. 🚀

Read More

- Silver Rate Forecast

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Gold Rate Forecast

- USD CNY PREDICTION

- Black Myth: Wukong minimum & recommended system requirements for PC

- Grimguard Tactics tier list – Ranking the main classes

- 10 Most Anticipated Anime of 2025

- Arknights celebrates fifth anniversary in style with new limited-time event

- Hero Tale best builds – One for melee, one for ranged characters

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

2025-05-26 02:07