In these peculiar hours of dawn, we gather for the US Morning Crypto Briefing—clutching our coffee cups as if they were lifeboats, bracing for the day’s digital tempest. ☕🤯

Some say Bitcoin’s fragile recovery teeters on a wire as it weathers Sunday’s storm. Others muse that $1 billion in liquidations rattled the market with the gentle subtlety of a marching army. Meanwhile, Jamie Dimon and Max Keiser exchange words on tariffs with all the warmth of two bears fighting over a single salmon. Short-term holders, dear friends, might want to pray for calmer seas after the gale of correction. 😏

Uncertainty Galore and a Billion Dollar Earthquake

Four walls of volatility enclose Bitcoin, leaving analysts to bicker like distant cousins: does this shake-up herald a deeper winter, or merely a temporary chill? In the midst of global jitters over new tariffs and geopolitical unrest, some experts still see a phoenix rising from the ashes. 🪶🔥

Geoff Kendrick of Standard Chartered murmured that, despite Sunday’s tumble, Bitcoin still strides admirably alongside the likes of Microsoft and Google. One might say it’s the stalwart soldier that refuses to surrender in the trenches of market warfare.

“Should crypto’s Sunday mood predict Monday gloom, we might see an ugly dawn. Yet if the whispers of the FX market hold steady, this dip could vanish like a faint nightmare, and BTC shall wander back to its proud Friday perch of $84,000,” says Kendrick, looking like a soothsayer in a world craving signs. 💫

He scoffs at the new tariff talk, insisting Bitcoin will stand as a lonely fortress against US isolationism and fluttering fiat. Kevin Hassett, in contrast, tries to calm the swarm, claiming up to 50 countries stand ready to shake hands on tariff deals—because clearly nothing soothes chaos like 50 eager visitors at your door. 🤨

Meanwhile, Nic Puckrin from Coin Bureau wags a cautious finger, pointing out that although a V-shaped comeback could dazzle the crowd (thanks to those massive liquidations), it might just be a “dead cat bounce” ready to mock unwary newcomers.

“Macro’s in the driver’s seat now, and if you’ve ever trusted a blindfolded driver, you’d know it’s not exactly a comfort,” Puckrin warns with an almost fatherly smirk. 😬

So the horizon remains as foggy as a distant tundra. Survival, it appears, hinges on the ever-swirling winds of global conditions.

Proclamations of Dimon, Tariff Troubles, and Bitcoin’s Last Laugh

Enter Jamie Dimon of JPMorgan, bearing tidings of structural woes that might stretch their tendrils across wallets everywhere. One cannot help but feel we’re huddled in the dank corridors of history’s cyclical absurdities.

“We must brace for infrastructure demands, shifting supply chains, and the specter of stickier inflation,” he writes, like a strangely poetic headline from a newsletter nobody asked for. 🏗️

Apparently, the fresh tariffs spell more political theatrics, fueling chatter of a potential recession. Not to be outdone, Max Keiser chirps that tariffs will morph Bitcoin into a radiant safe haven—a veritable comedic twist in a tragedy where everything collapses except that one digital friend who just keeps shrugging off the gloom. 🤖🪙

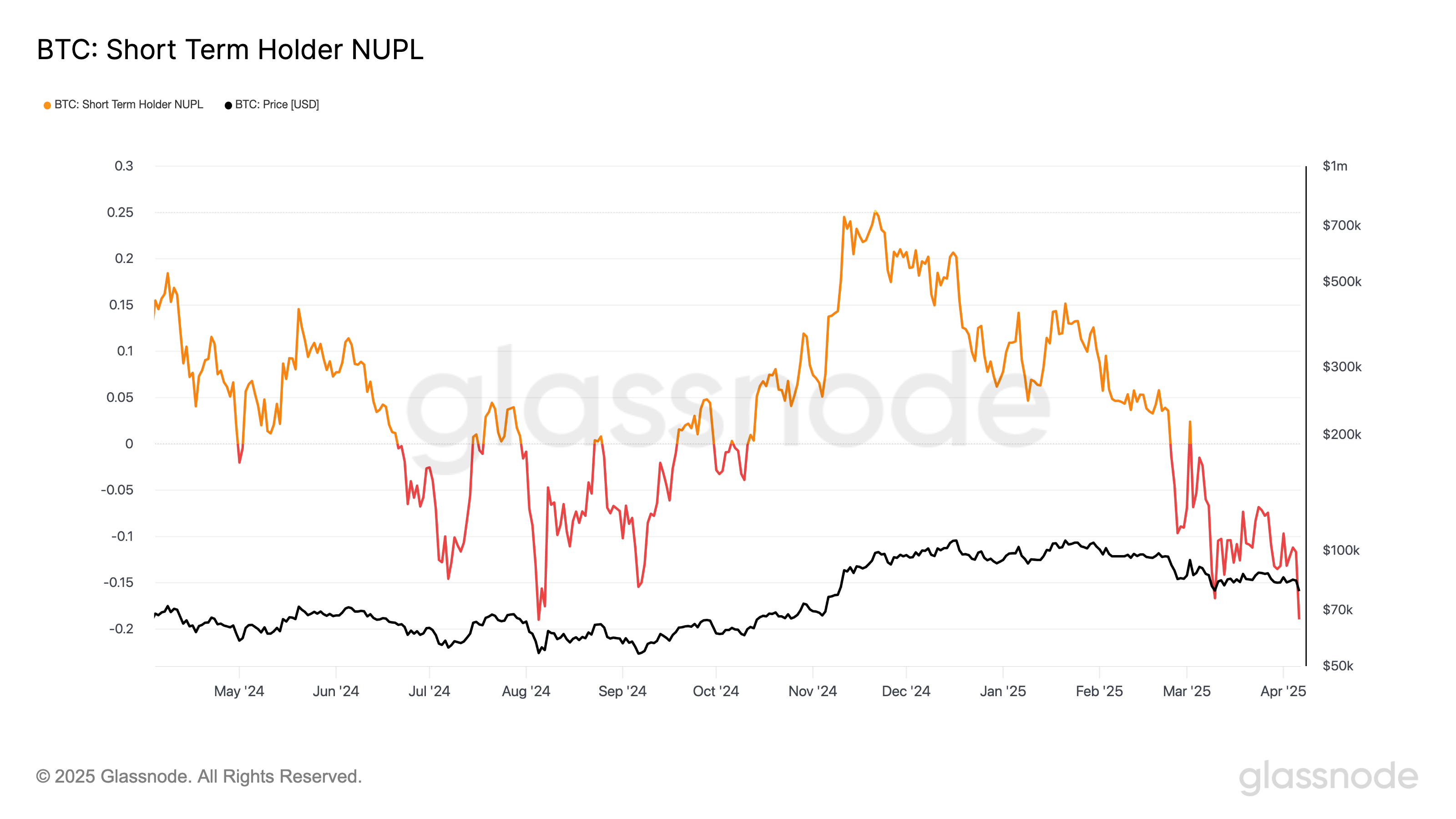

Crypto Chart of the Day

When the correction struck, BTC Short-Term Holders NUPL plunges to depths not seen since August 2024. Like Siberian exiles, these holders must learn to endure the unrelenting cold forever looming on the horizon. 🥶

Byte-Sized Alpha

– The SEC now reconsiders its crypto rulebook under Trump’s directive, potentially redrawing the boundary lines of the already-confounding Howey Test.

– FOMC minutes, CPI, jobless claims—these are the weary stepping stones that might jerk Bitcoin’s price up or down like a puppet on a cosmic string.

– Analysts recall the 2020 crash (one of Earth’s finer comedic episodes) and suggest the recent slip below $80,000 could be the sweet cradle of opportunity for the brave.

– Solana, once a darling, stumbles below $100—perhaps reminiscent of banana peels in a cartoon. Yet there’s a whiff of support from believers who fancy themselves wise contrarians.

– Bitcoin waltzed gracelessly below $75,000, with a 7% plunge that might prompt some to weep—though veteran hodlers smirk in calm defiance. 😎

– The so-called “Black Monday” scythed $1 billion in crypto positions, sending XRP and Ethereum spinning. Still, optimists insist a quick rebound lingers in the wind.

– Justin Sun accuses First Digital Trust of “worse-than-FTX” antics, alleging they snatched assets in broad daylight. He even waves a $50M bounty around, like a carrot on a stick, hoping to sniff out the culprits. 🥕

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Silver Rate Forecast

- USD CNY PREDICTION

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Black Myth: Wukong minimum & recommended system requirements for PC

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Hero Tale best builds – One for melee, one for ranged characters

2025-04-07 16:32