Oh, the audacity of Bitcoin, to rise so magnificently amidst the crumbling edifice of traditional economic indicators! The U.S. dollar, weakened and weary, and the ever-rising deficits, seem to have no sway over this digital darling, according to the insightful analysis from the ever-so-savvy The Kobeissi Letter.

Deficit Spending Drives Bitcoin Rally Into ‘Abnormal’ Territory, Kobeissi Letter States

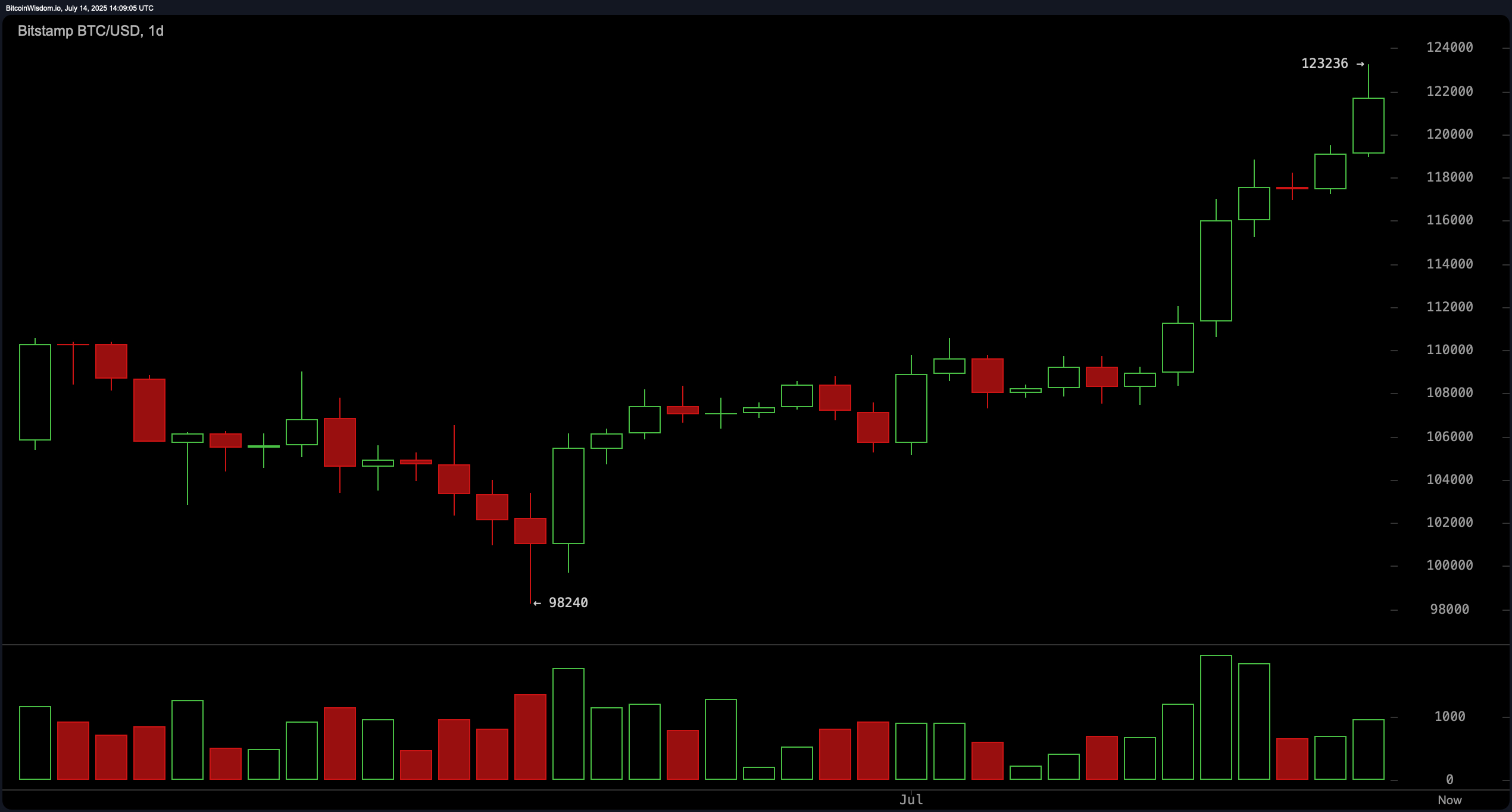

The Kobeissi Letter, a beacon of wisdom for investors and institutions, cast its discerning eye upon Bitcoin’s meteoric rise in a July 14, 2025, X thread. The cryptocurrency, with the grace of a swan and the tenacity of a bull, gained approximately $15,000 after July 3rd, when the U.S. House, in a moment of legislative brilliance, passed a significant spending bill known as the “Big Beautiful Bill.”

Kobeissi, with the wit of a seasoned observer, noted that this rally occurred despite the U.S. deficit for May 2023 alone reaching a staggering $316 billion, the third largest on record at that time. The divergence, he observed, began on April 9th, following a tariff pause, and intensified after the spending bill’s passage. Bitcoin, it seems, has been making new highs multiple times daily, while the U.S. Dollar Index (DXY) has fallen 11% over six months. A true tale of two currencies, one might say.

Kobeissi stressed that Bitcoin’s rise was not a solitary journey, but rather a grand procession, with gold and rising yields joining the parade. The combined movement, he described, was nothing short of abnormal. The Ishares Bitcoin Trust (IBIT) reached a record $76 billion in assets under management in under 350 days—a feat that took the largest gold exchange-traded fund (ETF) over 15 years. Clearly, the times, they are a-changin’.

According to the analysis, institutional investors, including family offices and hedge funds, are increasingly allocating capital to bitcoin (BTC), with even the most conservative funds considering a ~1% allocation. Kobeissi’s analysts attributed the surge to the market pricing in ongoing U.S. deficit spending, suggesting a significant rotation of capital. A revolution, if you will, in the financial world.

“Furthermore, when we say bitcoin has entered ‘crisis mode’ this isn’t necessarily a bearish call for other assets,” Kobeissi said on X. The thread added:

“In fact, risky assets will continue to run higher as the short-term effects of more deficit spending are ‘bullish.’ The long-term effects, however, are a different story altogether.”

The Kobeissi Letter, ever the opportunist, capitalized on the trend, buying BTC dips at $80,000, $90,000, and $100,000, and raising its target to $120,000+ after initially calling for $115,000. It also observed record-high leverage shorts on ether, a condition reminiscent of a market bottom, raising the tantalizing possibility of a major crypto short squeeze. Ah, the drama of it all!

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Silver Rate Forecast

- USD CNY PREDICTION

- Black Myth: Wukong minimum & recommended system requirements for PC

- 10 Most Anticipated Anime of 2025

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Hero Tale best builds – One for melee, one for ranged characters

- Gold Rate Forecast

- “Golden” Moment: How ‘KPop Demon Hunters’ Created the Year’s Catchiest Soundtrack

2025-07-14 18:27