So, Bitcoin‘s just hanging out at $107,392 on June 9, 2025. You know, just casually supported by a market cap of $2.12 trillion and a trade volume of $19.68 billion. No big deal. It’s like the kid in school who always gets straight A’s but still complains about the cafeteria food. Trading between $105,112 and $107,499, Bitcoin’s showing some serious short-term bullish momentum. Who knew? 🤷♂️

Bitcoin

Now, the 1-hour chart is like that friend who suddenly gets a burst of energy after a nap. After days of just lying around between June 6 and 8, Bitcoin decided to wake up and shoot up to $107,499. The momentum is suggesting it might keep going, with the next psychological resistance at $108,000. You know, just a casual psychological barrier. No pressure! 😅

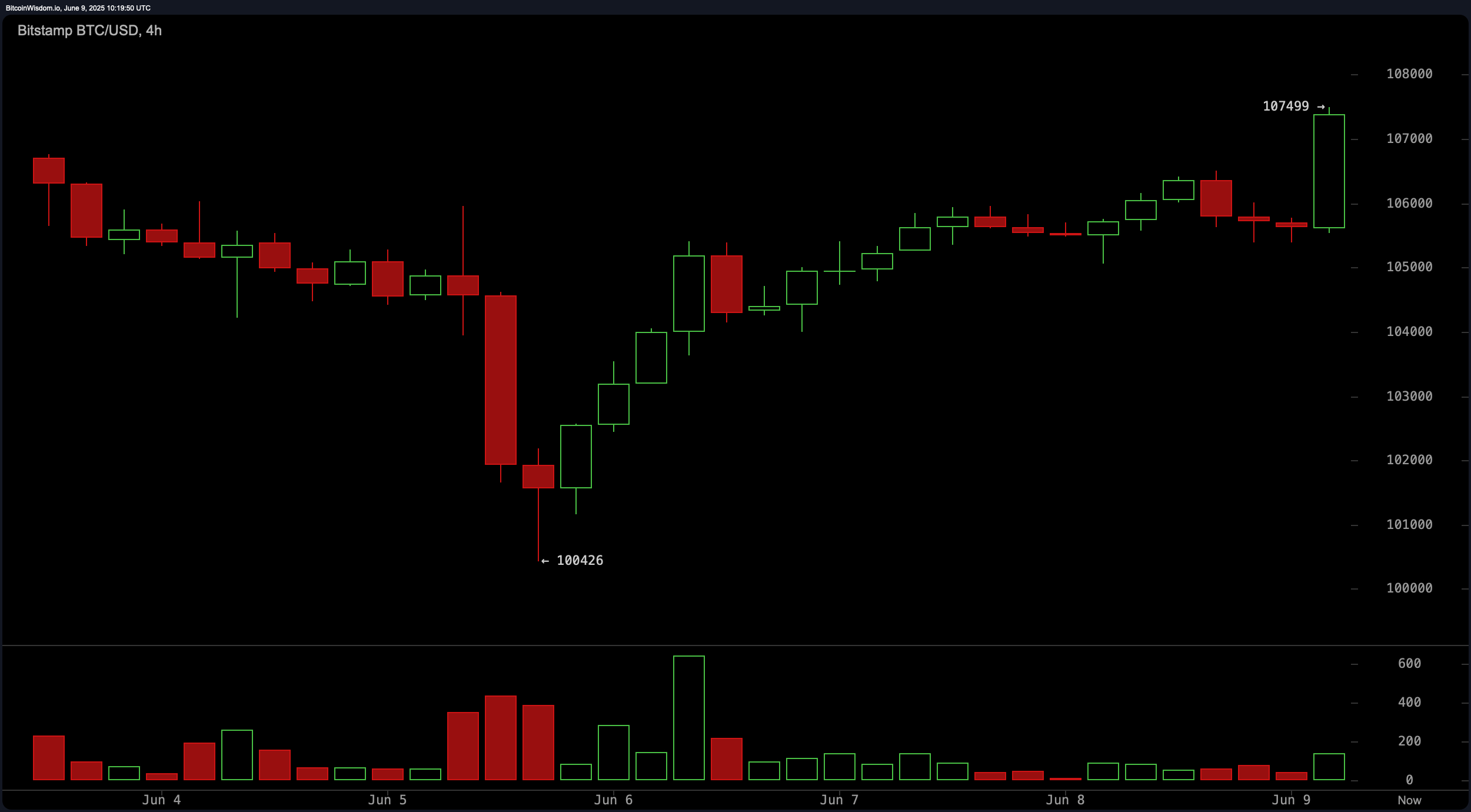

The 4-hour chart is giving us a classic V-shaped recovery. You know, like when you drop your sandwich and it miraculously lands butter-side up. Bitcoin bounced back from a support level at $100,426. If it can hold above $107,500, we might just see it break through to the $109,500 to $110,000 range. But hey, no pressure, right? 😏

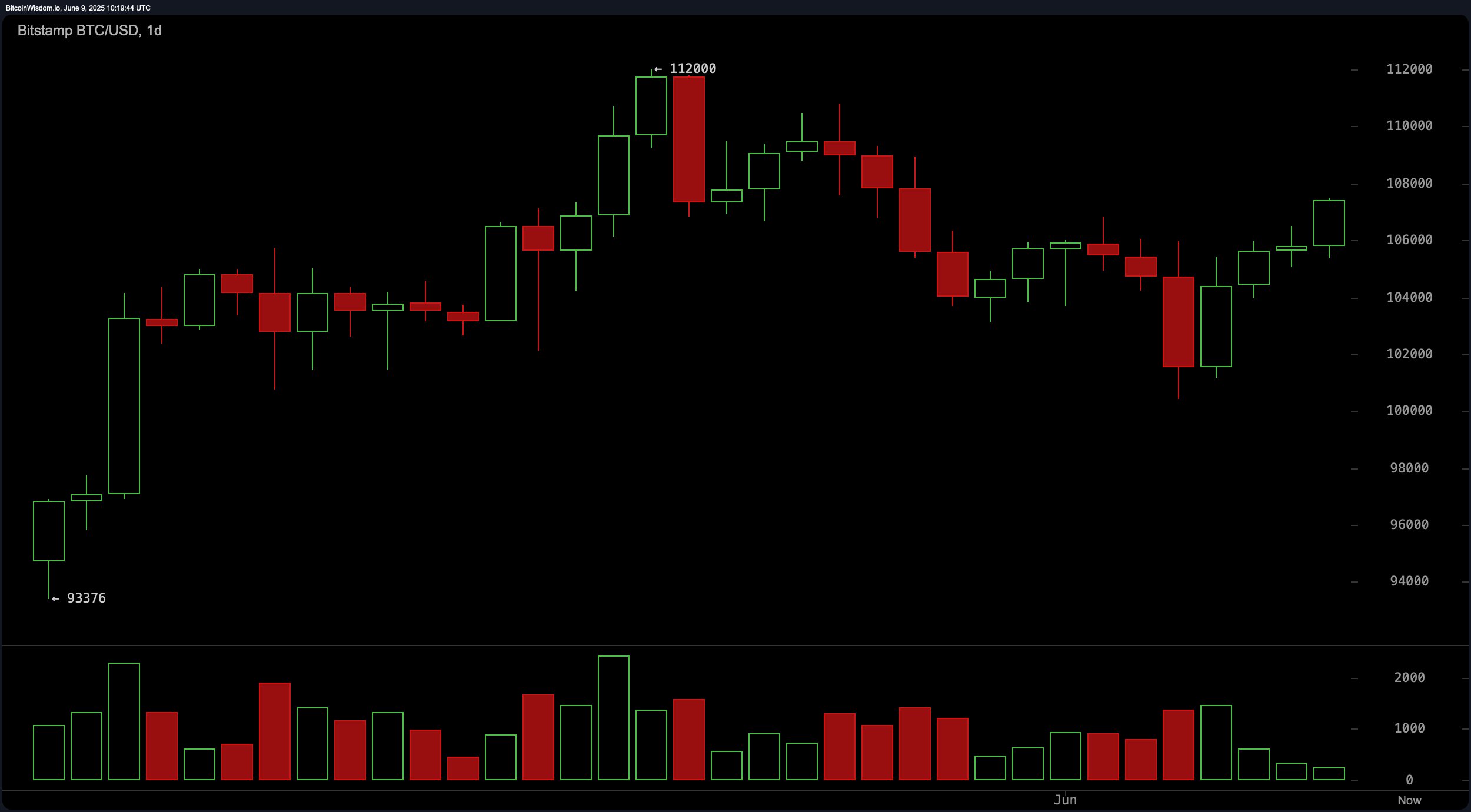

Looking at the daily chart, it seems Bitcoin is trying to recover after a drop from $112,000. It found support near $100,000, which is like finding a $20 bill in your old jeans. It’s showing bullish candlestick formations, but with volume that’s like a shy kid at a dance. The price is creeping up to local resistance at $108,000. If it closes above that, we might just see a retest of $112,000. Fingers crossed! 🤞

Oscillators are showing a neutral sentiment, like that one friend who can’t decide where to eat. The RSI is at 58, and the Stochastic is at 56. But hey, momentum is giving a buy signal of 3,335. So, there’s that! The MACD level of 879 is still bearish, which is like that nagging voice in your head saying, “Are you sure about this?” 😬

Moving averages are flashing bullish signals, like a neon sign saying, “Buy me!” The 10-period EMA and SMA are at $105,591 and $105,118, respectively. They’re well below the current price, which is a good sign. The 200-period EMA and SMA are at $91,916 and $95,352. So, as long as nothing crazy happens, we should be good. Right? 🤔

Bull Verdict:

Bitcoin’s current trajectory, with strong moving average signals and breakout momentum, suggests it might keep climbing. If it closes above $108,000, we could see a retest of $112,000. It’s like the little engine that could, but with more zeros. 🚂💰

Bear Verdict:

But hold your horses! Despite the short-term bullish signals, there are lingering concerns from the recent high-volume sell-off. If it can’t hold above $107,500 or gets rejected at $108,000, we might be looking at a reversal back to the $104,000 to $100,000 support zone. So, keep your eyes peeled! 👀

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- USD CNY PREDICTION

- Silver Rate Forecast

- Black Myth: Wukong minimum & recommended system requirements for PC

- “Golden” Moment: How ‘KPop Demon Hunters’ Created the Year’s Catchiest Soundtrack

- Castle Duels tier list – Best Legendary and Epic cards

- Mech Vs Aliens codes – Currently active promos (June 2025)

2025-06-09 15:04