Ah, the cryptic ballet of Bitcoin — an economic conundrum wrapped in digital mystery. As if a caffeinated squirrel orchestrated Wall Street’s latest chaos, the price fluttered wildly, leaving analysts clutching their agendas and trying to decipher the divine or perhaps devils behind it all. Meanwhile, the cunning institutions, quite unbothered by the melodrama, unleashed their inner bargain hunters, swooping in like caffeinated hawks at a discount sale. 📉💼

Institutions Load up on BTC As It Slips Under $115K

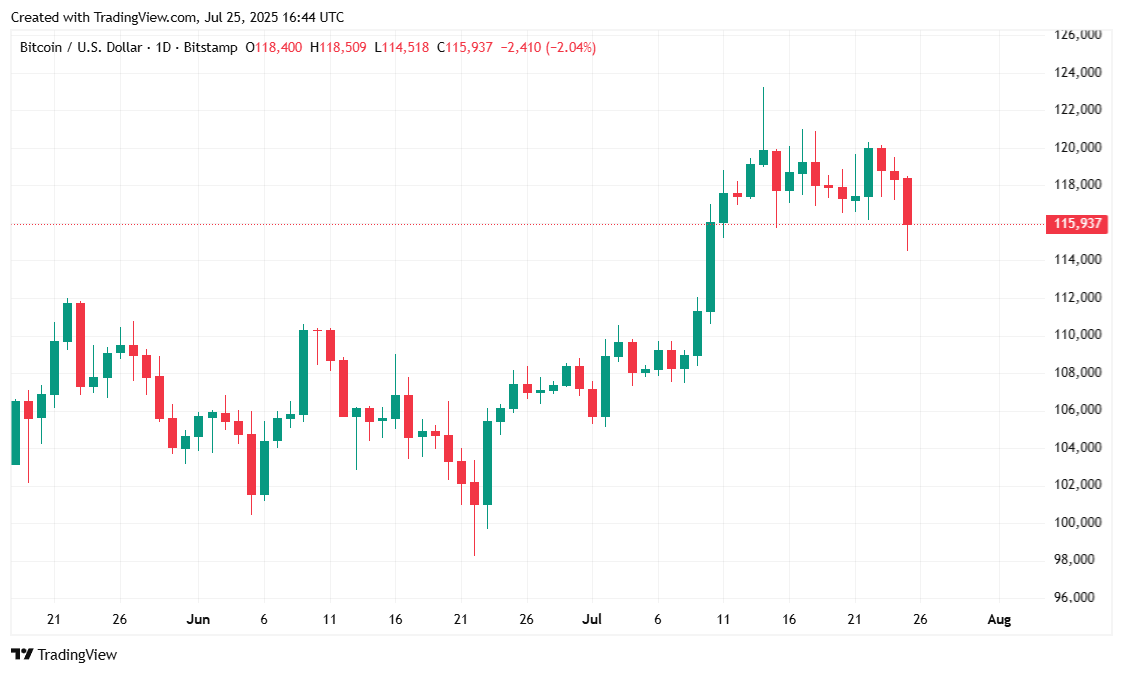

Ah, Bitcoin — the digital gold that’s known for its fiery temperament and penchant for causing sleepless nights. On Friday, it decided to surprise everyone with a 3% retreat, zigzagging between a glorious high of $119,535.45 and a modest dip to $114,759.82. The markets—ever the drama queens—whined about volatility, yet the sharp-eyed financial cats, the institutions, eagerly went crypto shopping. 🛍️

Electric vehicle (EV) darling Volcon, Inc. (Nasdaq: VLCN), in a move that screams “we’re serious,” snapped up 3,183.37 BTC at an average of $117,697 per coin. According to their grand proclamation—also known as a press release—this was a strategic, Rockstar-approved Bitcoin treasury play. 🚗🔋

Ryan Lane, Co-CEO and all-around crypto prophet, declared, “Our treasury strategy reflects our *undying* conviction in Bitcoin as a long-term treasure chest, because who doesn’t love digital shiny stuff?” He also hinted at leveraging their hedge fund smarts — because nothing screams confidence like “we know how to buy low and pretend it’s genius.”

And Volcon, clearly undeterred by Bitcoin’s rollercoaster, plans to “buy more at $115K, $116K, and $117K,” because obviously those are the real hot buy numbers. Who needs sleep when you can chase dips like a caffeinated fox? ☕🦊

Meanwhile, the British web wizards at The Smarter Web didn’t want to be left out of the ‘buy-the-dip’ mania, announcing a lovely purchase of 225 Bitcoin, bringing their total treasure to 1,825 coins. All this, despite being a company that deals in pixels and web design, because apparently, they believe in digital assets as much as they believe in responsive layouts. 🖥️✨

If institutional buying the dip becomes as common as cats knocking things over, the idea of a “Bitcoin winter” might become just another faded Folie à Deux and not the cold cruel thing we once feared. ❄️🙃

Market Snapshot: The Glamorous and the Not-So-Glamorous

Bitcoin currently lounges at $115,890, down 2.74% in a day, and a charming 1.72% over a week. Its price wobbling between $114,759.82 and $119,472.65 — like a drunkard on a tightrope without a safety net. 📉🎪

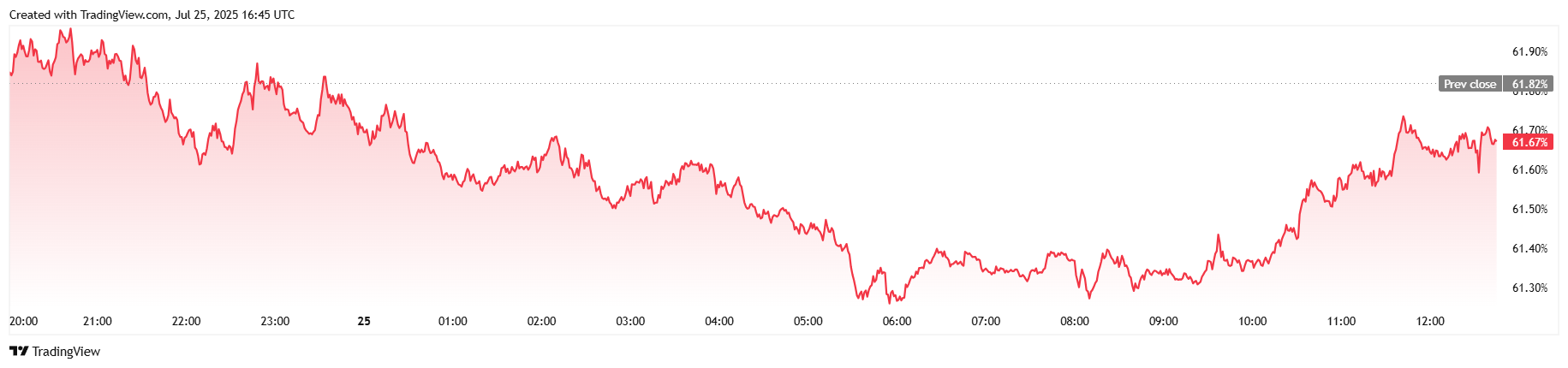

Trading volume shot up nearly 40%, reaching a staggering $102.42 billion, all while market cap dipped gently to $2.3 trillion. Bitcoin’s dominance in the crypto realm slipped 0.21% to 61.67%, maybe feeling the pressure of its own volatility. 💸📊

Futures are still hot with open interest climbing to $87.55 billion, while liquidations—those delightful moments when traders realize they bet wrong—totaled $162.08 million. Longs got wiped out with the enthusiasm of a dessert lover at a pastry competition, while shorts suffered a mere pinch. 🍰🔪

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Honor of Kings returns for the 2025 Esports World Cup with a whopping $3 million prize pool

- PUBG Mobile heads back to Riyadh for EWC 2025

- USD CNY PREDICTION

- Kanye “Ye” West Struggles Through Chaotic, Rain-Soaked Shanghai Concert

- Arknights celebrates fifth anniversary in style with new limited-time event

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Every Upcoming Zac Efron Movie And TV Show

- Hero Tale best builds – One for melee, one for ranged characters

2025-07-25 20:27