- Bitcoin‘s long-term aficionados [LTH] are still counting their coins, although the party seems to be winding down 🎉

- Short-term dreamers [STH] are the ones crying over spilled milk, hinting at a near-term demand that’s as shaky as a leaf in the wind 🍃

Ah, the grand saga of Bitcoin [BTC], where the script flips, and the short-term holders find themselves in the hot seat of realized losses. A tale as old as time, or at least as old as the last crypto winter.

Meanwhile, the long-term holders, those stalwart souls, are still in the green. Though, their selling frenzy is cooling off faster than a popsicle in the Arctic.

Short-term holders: The new kids on the ‘loss’ block

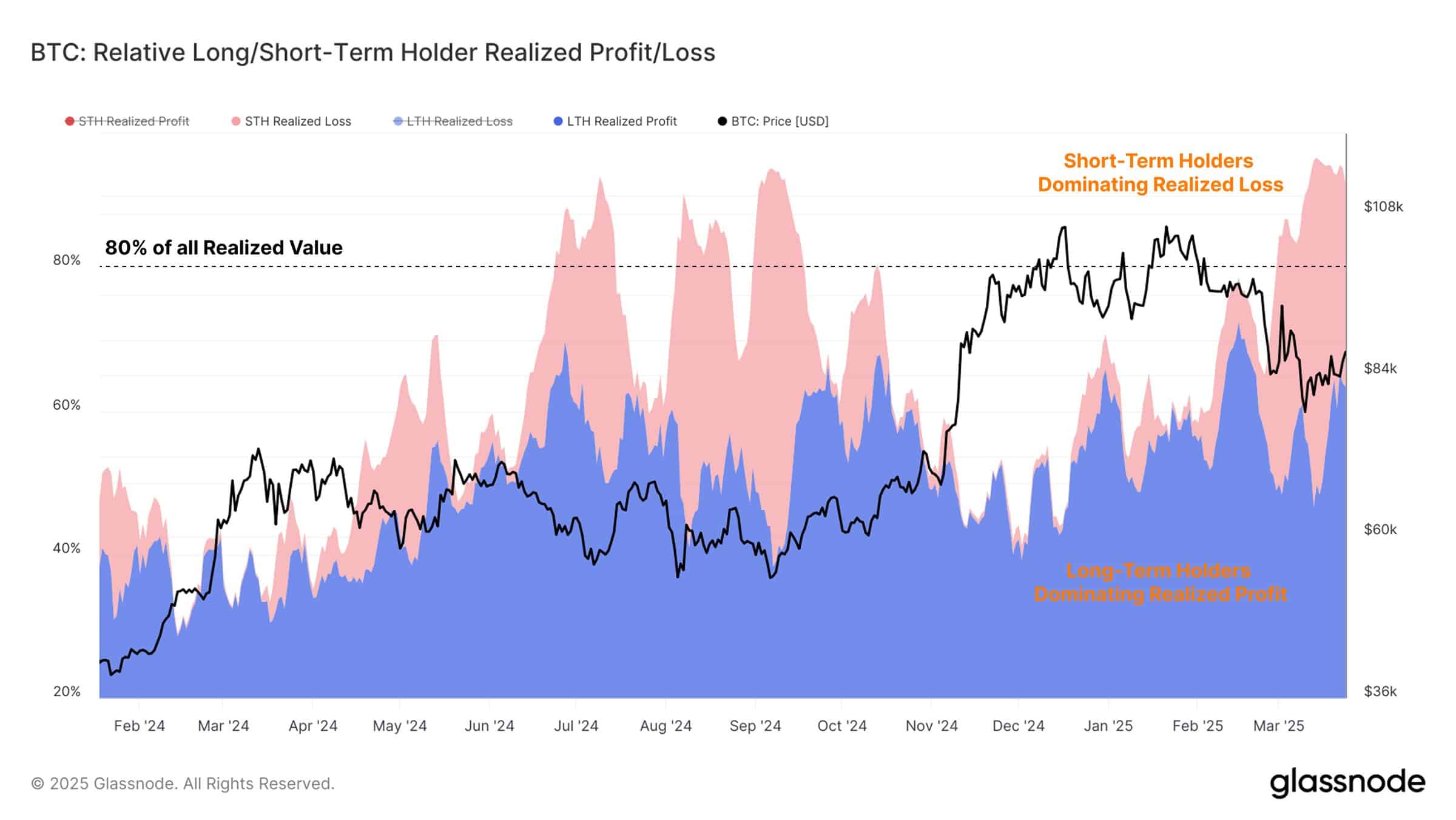

As per Glassnode, a whopping80% of the realized losses can be pinned on the short-term holders [STHs], those who hopped on the Bitcoin bandwagon in the last155 days.

Indeed, the charts are a spectacle of STHs’ losses skyrocketing, a direct consequence of Bitcoin’s nosedive from the stratospheric highs above $100k to a more ‘down-to-earth’ $83.7k.

This mass exodus suggests that the latest recruits, lured by Bitcoin’s meteoric rise, are now making a hasty retreat, their pockets lighter and their dreams dimmer amidst the crypto tempest.

The lopsided profit/loss ledger screams of a market where emotion trumps logic, and the faith in Bitcoin’s immediate future is as stable as a house of cards in a hurricane.

Long-term holders: Riding the profit wave, but not for long?

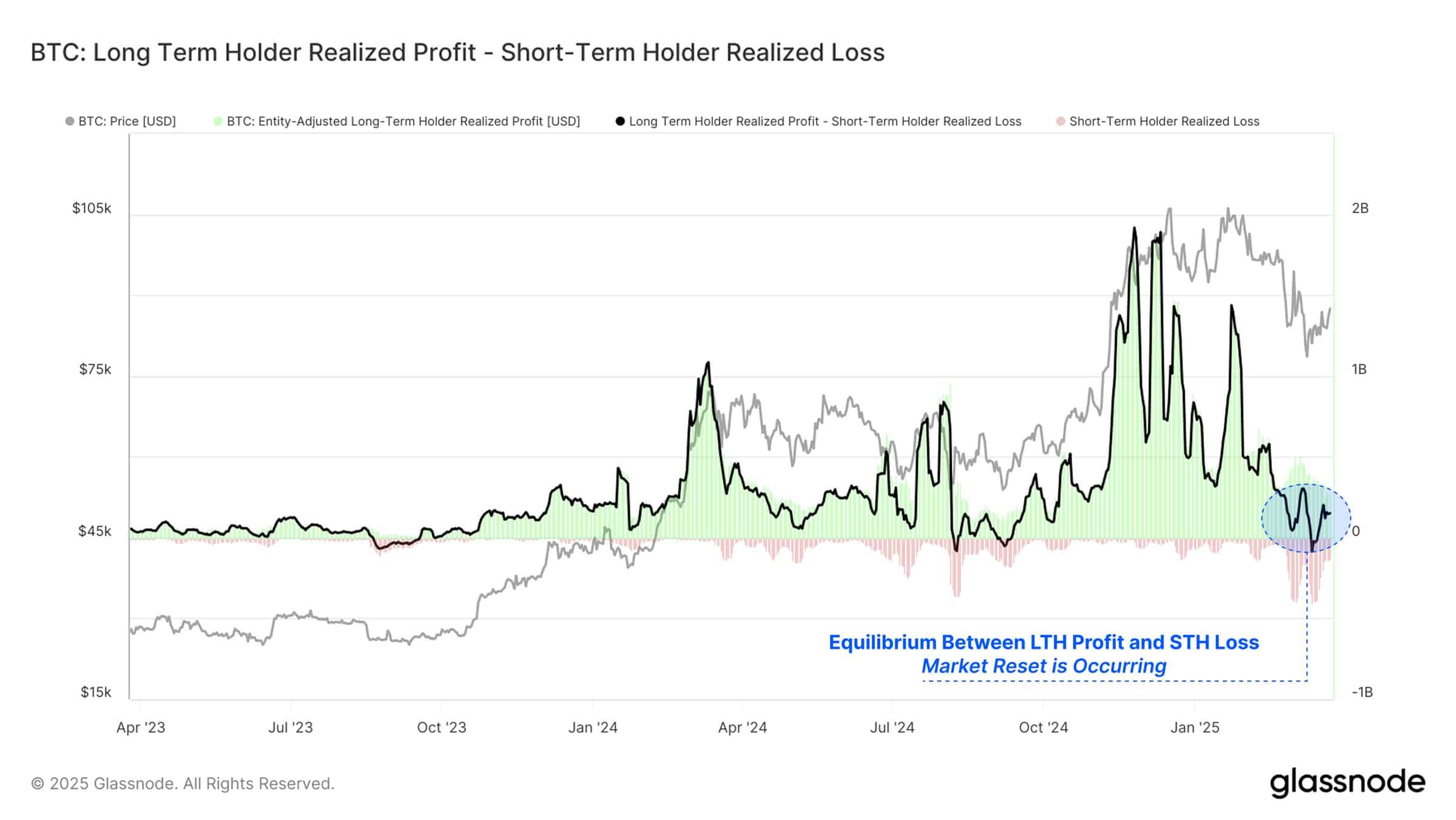

Despite the STHs’ woes, long-term holders [LTHs] are still basking in the glow of profits. Yet, the tide is turning, and their selling momentum is waning.

The gap between long-term profits and short-term losses is shrinking, a phenomenon vividly captured in the second chart.

This “profit-loss equilibrium” is a twilight zone where inflows dry up, demand dwindles, and price movements grind to a halt.

History buffs will recall such periods often herald consolidation phases or minor market hiccups.

Bitcoin’s dance with numbers reflects a mood swing

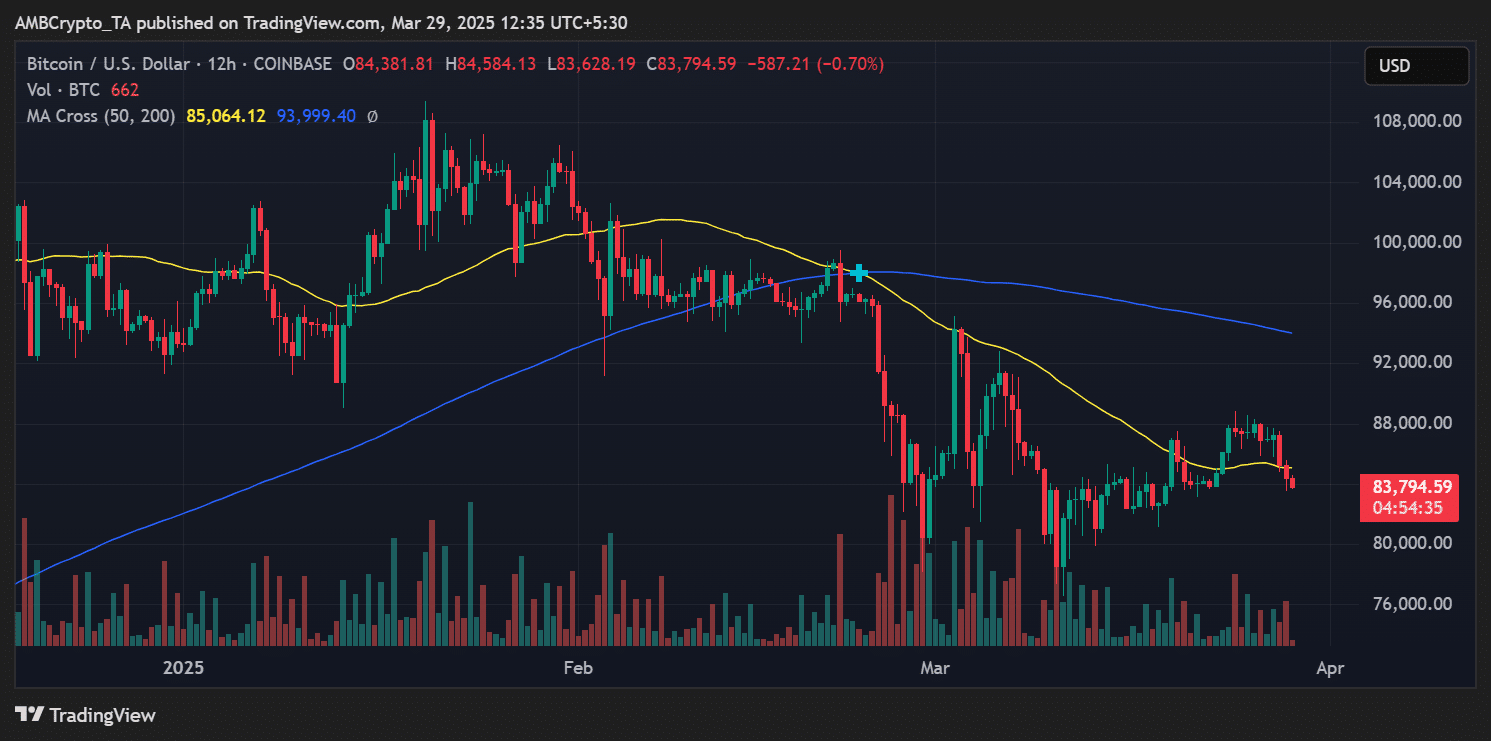

On the12-hour chart, Bitcoin has ducked below the50-day MA of $85,064, flirting with $83,794 at the time of writing.

The technical breach, coupled with a volume that’s thinner than a supermodel, corroborates the on-chain narrative of a market losing its bullish fervor.

Should the market continue to digest its gains with dwindling capital inflows, Bitcoin might just knock on the door of the $80k support zone. But, if LTHs keep their profit-taking steady without triggering a sell-off, Bitcoin might just catch its breath before attempting another leap.

Conclusion

The current state of Bitcoin, with short-term losses taking the spotlight and long-term profit-taking losing its steam, signals a market in transition. No dramatic collapse yet, but the signs of a cooling cycle are as clear as day.

Thus, market participants might want to buckle up, exercise some caution, and perhaps, grab some popcorn. The show’s not over yet 🍿

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Silver Rate Forecast

- USD CNY PREDICTION

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Black Myth: Wukong minimum & recommended system requirements for PC

- Hero Tale best builds – One for melee, one for ranged characters

- Mech Vs Aliens codes – Currently active promos (June 2025)

2025-03-30 03:08