In the grand theater of finance, Bitcoin finds itself in a most peculiar predicament, trading at a hefty $77,346, with a market capitalization that could make a king blush—$1.53 trillion. Yet, like a stubborn mule, it grapples with a bearish momentum that seems to have taken a liking to it, across all timeframes. In the last 24 hours, this digital currency has danced between $74,604 and $82,859, all while a staggering $75.43 billion in volume swirls around it, hinting at a volatility that could make even the most seasoned trader clutch their pearls.

Bitcoin

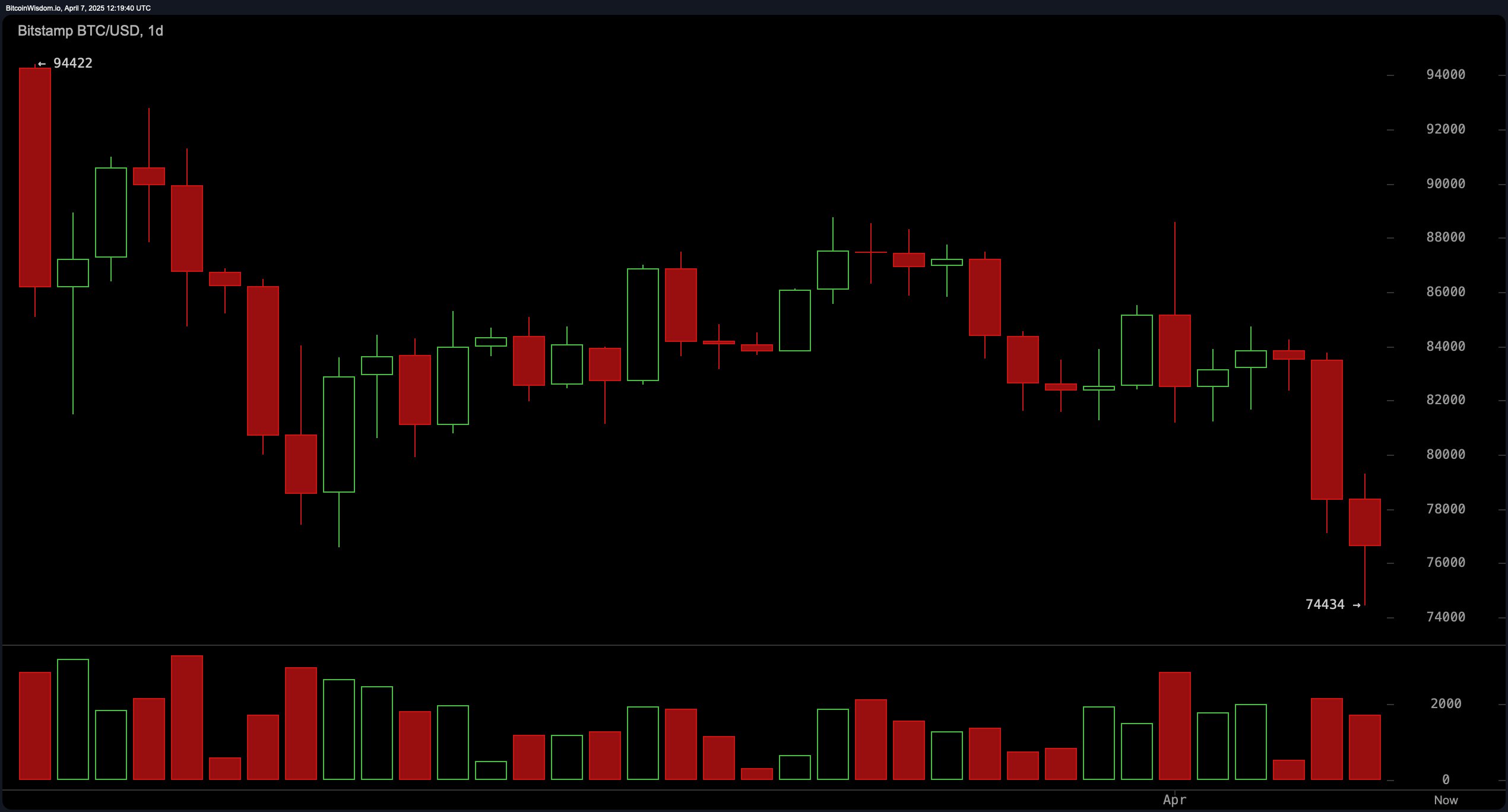

On the daily chart, Bitcoin’s price action has taken a nosedive, plummeting from a lofty high of $94,422 to a more humble abode at around $74,434. The chart is littered with bearish candles, like a graveyard of lost hopes, and the increasing volume of selling suggests that the bears are throwing quite the party. While there might be a psychological support lurking around the $74,000 mark, it’s as solid as a sandcastle at high tide—no technical bottom has formed yet. The chart screams bearish dominance, but who knows? An oversold bounce could pop up like a jack-in-the-box if momentum decides to take a breather. Traders, keep your eyes peeled for a bullish engulfing or a hammer pattern near $74,000; it could be your golden ticket, while failed rallies toward the $78,000–$80,000 zone might just be the perfect bait for shorting opportunities.

The 4-hour chart is no less dramatic, reinforcing the bearish sentiment with a massive bearish engulfing candle that appeared near $88,563, marking the start of a downtrend that’s as predictable as a soap opera plot—lower highs and lower lows. A short-term support zone seems to be holding around $74,434, but the volume has dwindled since the initial breakdown, hinting at potential exhaustion. Sure, there’s room for a temporary bounce to $78,000–$79,000, but unless that level is reclaimed with the fervor of a fan at a rock concert, the prevailing trend remains as bearish as a rainy day. Scalp longs might be feasible above $75,500 with tight stops, while shorts can be considered at the $78,000–$80,000 resistance zone, where the bears are likely to feast.

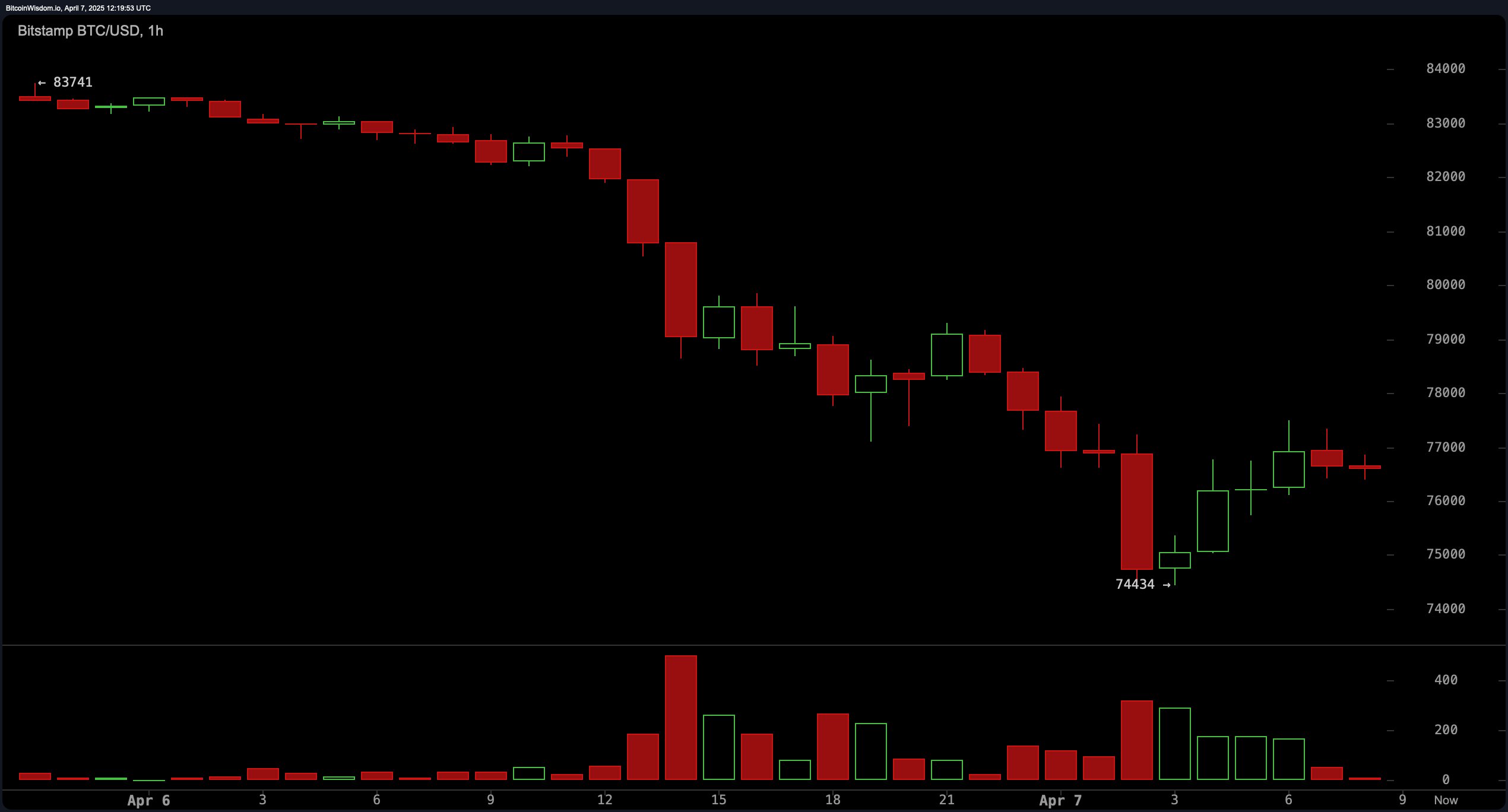

On the 1-hour chart, Bitcoin’s decline from $83,741 to the recent low of around $74,434 is like watching a slow-motion train wreck, followed by a weak relief rally that barely raises an eyebrow. The lack of volume accompanying this bounce signals a distinct lack of conviction from buyers, as if they’ve all decided to take a long lunch break. If the price action continues to form lower highs, particularly around $77,000, it could serve as a near-term short entry level. Conservative buyers might want to wait for a retest and confirmation bounce from $74,500–$75,000, while the more daring intraday traders could consider long entries above $77,500, but only if volume decides to join the party.

Oscillators are sending mixed signals, with the relative strength index (RSI) at 33.9, stochastic at 19.2, and commodity channel index (CCI) at −265.6—all hanging out in neutral territory, though hinting at potential oversold conditions. The momentum indicator registers −7,657.0, waving a little flag that says “buy,” while the moving average convergence divergence (MACD) level of −1,750.1 remains bearish, like a rain cloud over a picnic. This divergence suggests a possible but unconfirmed reversal opportunity, should the downward momentum decide to ease up.

If Bitcoin can hold support around the $74,000–$75,000 zone and print a clear reversal pattern with increasing volume, a recovery toward the $78,000–$79,000 resistance range becomes as plausible as a cat landing on its feet. Oscillator data showing potential oversold conditions supports the likelihood of a short-term bounce, giving bulls a narrow window to reclaim momentum, like a last-minute goal in a soccer match.

Bear Verdict:

With every major moving average aligned to the downside and volume confirming the bearish trend across all timeframes, Bitcoin remains under sustained selling pressure, like a piñata at a kid’s birthday party. Unless price action decisively reclaims and holds above the $78,000–$80,000 resistance, the bears retain control and could drive the price lower toward or below the $72,000 threshold, leaving traders to ponder their next move.

Read More

- Silver Rate Forecast

- Black Myth: Wukong minimum & recommended system requirements for PC

- Gold Rate Forecast

- USD CNY PREDICTION

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Grimguard Tactics tier list – Ranking the main classes

- Arknights celebrates fifth anniversary in style with new limited-time event

- Gods & Demons codes (January 2025)

- Maiden Academy tier list

- PUBG Mobile heads back to Riyadh for EWC 2025

2025-04-07 16:27