As a seasoned cryptocurrency researcher with over a decade of experience under my belt, I’ve witnessed the rollercoaster ride that is Bitcoin mining. The news about Bitfarms selling over 60% of its August production amid rising network difficulty is a testament to the strategic treasury management we often see in this sector.

Bitfarms sold over 60% of August Bitcoin production amid rising network difficulty.

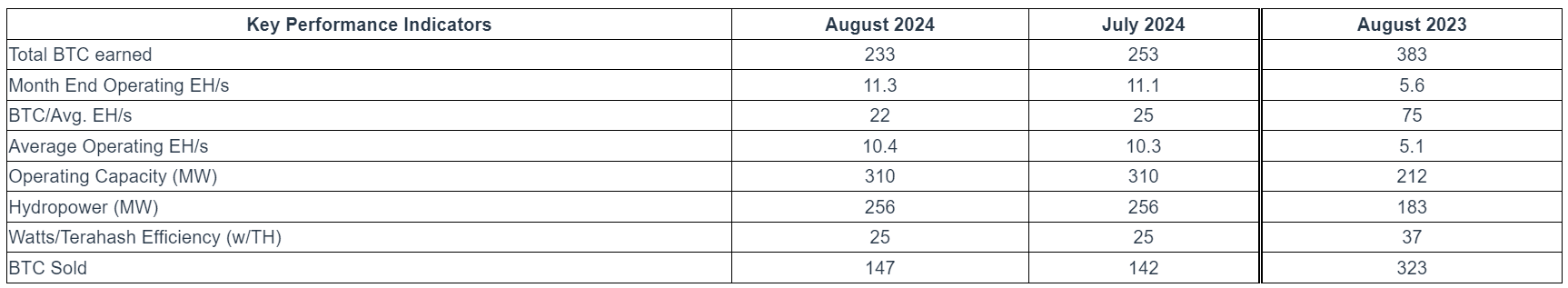

In a recent announcement, Bitfarms, a well-known Bitcoin miner based in Canada, revealed that they offloaded approximately 63% (or 147 bitcoins) of the digital currency they mined in August. This represents a portion of the total 233 bitcoins they successfully mined during the month.

In its August 2024 announcement, the Toronto-based firm emphasized this transaction as a continuation of their strategic approach towards proactive cash management, given the rise in the complexity of the average mining process.

The sale produced around 8.8 million dollars in income, which boosted Bitfarms’ cash reserves and enabled the expansion of its Bitcoin assets. Even amid tough circumstances, Bitfarms acquired an additional 86 Bitcoins, raising its total to 1,103 Bitcoins, worth approximately 65.1 million dollars as of August 31, 2024.

Last month was quite tough on Bitfarms, as the network’s difficulty level dropped by 1.3%, offering some relief after a series of mounting issues. This decrease in difficulty led to a drop in the company’s Bitcoin output, with only 233 BTC mined compared to 253 BTC in July, representing an 8% decrease. Furthermore, this figure represents almost a 40% drop when compared to the same period from August 2023’s production, which was 383 BTC.

Bitfarms managed to partially counterbalance the decrease in production by continuously improving their mining operations. They received and started installing 2,744 new T21 miners from Bitmain, swapping out underperforming units. By the end of August, Bitfarms had increased their operational capacity, reaching 111.3 Exahs (specifically, or more efficiently boosted:

Bitfarms braces for future prospects

In response to the changing Bitcoin network environment, Bitfarms intends to adjust its position accordingly. The efficiency in operation has remained at approximately 25 watts per terahash, as stated in the report. Yet, the decrease in BTC yield per average EH/s – from 25 BTC in July to 22 BTC in August – signifies the persistent challenge posed by increasing network complexity.

The statement encourages Bitfarms suggest that supporters of Riot Platforms attend the upcoming October 29th meeting to advocate for improvements in Riot Platforms’ management, expressing worries about “governance issues.”

In the statement, Riot expressed disapproval towards Bitfarms for what they termed as “protective” strategies aimed at securing the current board, such as the recent purchase of Stronghold Digital Mining Inc. The company further raised doubts about the timing and conditions of the $175 million deal, implying it was designed to advantage directors with a focus on preserving their own roles, who are primarily concerned with preserving their own positions.

Read More

- Silver Rate Forecast

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Gold Rate Forecast

- USD CNY PREDICTION

- Black Myth: Wukong minimum & recommended system requirements for PC

- Grimguard Tactics tier list – Ranking the main classes

- 10 Most Anticipated Anime of 2025

- Arknights celebrates fifth anniversary in style with new limited-time event

- Hero Tale best builds – One for melee, one for ranged characters

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

2024-09-03 17:56