As a crypto investor with a few years of experience under my belt, I find the increasing centralization of Bitcoin mining to be a cause for concern. The recent report from BitMEX analysts that one entity controls nearly half of the network’s hashrate is troubling, and the centralization trend seems to be continuing.

Bitcoin mining is becoming increasingly centralized, BitMEX analysts said.

One organization wields significant control over the mining process, as they currently manage approximately 47% of the network’s hashrate – a figure amassed from the combined output of the nine leading mining pools.

In the document, a user with the nickname mononaut mentions a publication of theirs regarding the amassing of bitcoins. They claim that this unidentified individual obtained these digital coins from various pools, which include AntPool, F2Pool, Binance Pool, Braiins, BTC.com, and SECPOOL, as well as Poolin.

A single custodian manages the access points for ULTIMUSPOOL and 1THash, in addition to collecting mining rewards from Luxor. Several pool members contribute their hashrate to the AntPool transaction facilitator, which has been utilized by this prominent custodian.

As a crypto analyst, I’ve brought up the significant level of centralization in Bitcoin’s mining process in an article for Bitcoin Magazine. To clarify, I mean that a few large mining pools are controlling a substantial portion of the network’s mining power. Regarding these pools, they’re aiming to modify their payout structures and eradicate income disparities entirely.

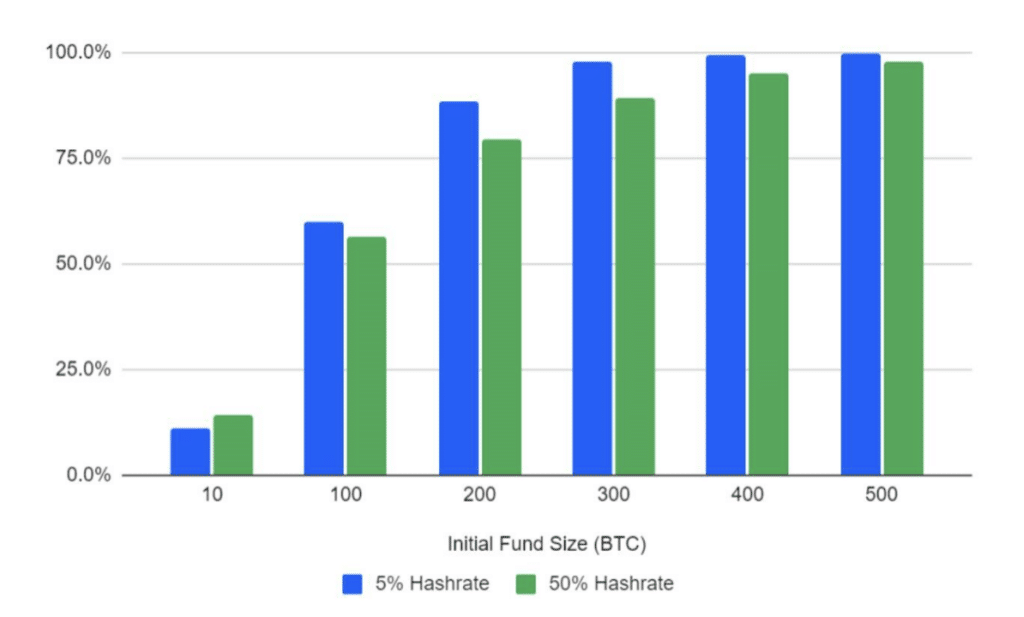

Researchers at BitMEX have determined that a mining pool needing to manage half of the total hashrate should maintain a minimum of 400 Bitcoins (BTC). This ensures approximately a 95% probability of survival within a year. For a pool overseeing only 5% of the capacity, it’s necessary to have a reserve of around 500 BTC for risk-free operation.

The CEO of CryptoQuant, Ki Young Ju, hasn’t detected any signs of Bitcoin miners giving up, despite the recent halving of block rewards. Based on his analysis, miners’ earnings have dropped down to the amounts seen in early 2023.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Silver Rate Forecast

- “Golden” Moment: How ‘KPop Demon Hunters’ Created the Year’s Catchiest Soundtrack

- Castle Duels tier list – Best Legendary and Epic cards

- Black Myth: Wukong minimum & recommended system requirements for PC

- Mech Vs Aliens codes – Currently active promos (June 2025)

2024-04-30 19:48