As a seasoned researcher with over two decades of experience in finance and technology, I find myself intrigued by the current state of Bitcoin and its potential future movements. The recent price consolidation seems to be a prelude to some significant shifts, as we eagerly await the U.S. Consumer Price Index report.

This week, the value of Bitcoin held steady as investors kept a close watch for the forthcoming U.S. Report on Inflation (Consumer Price Index).

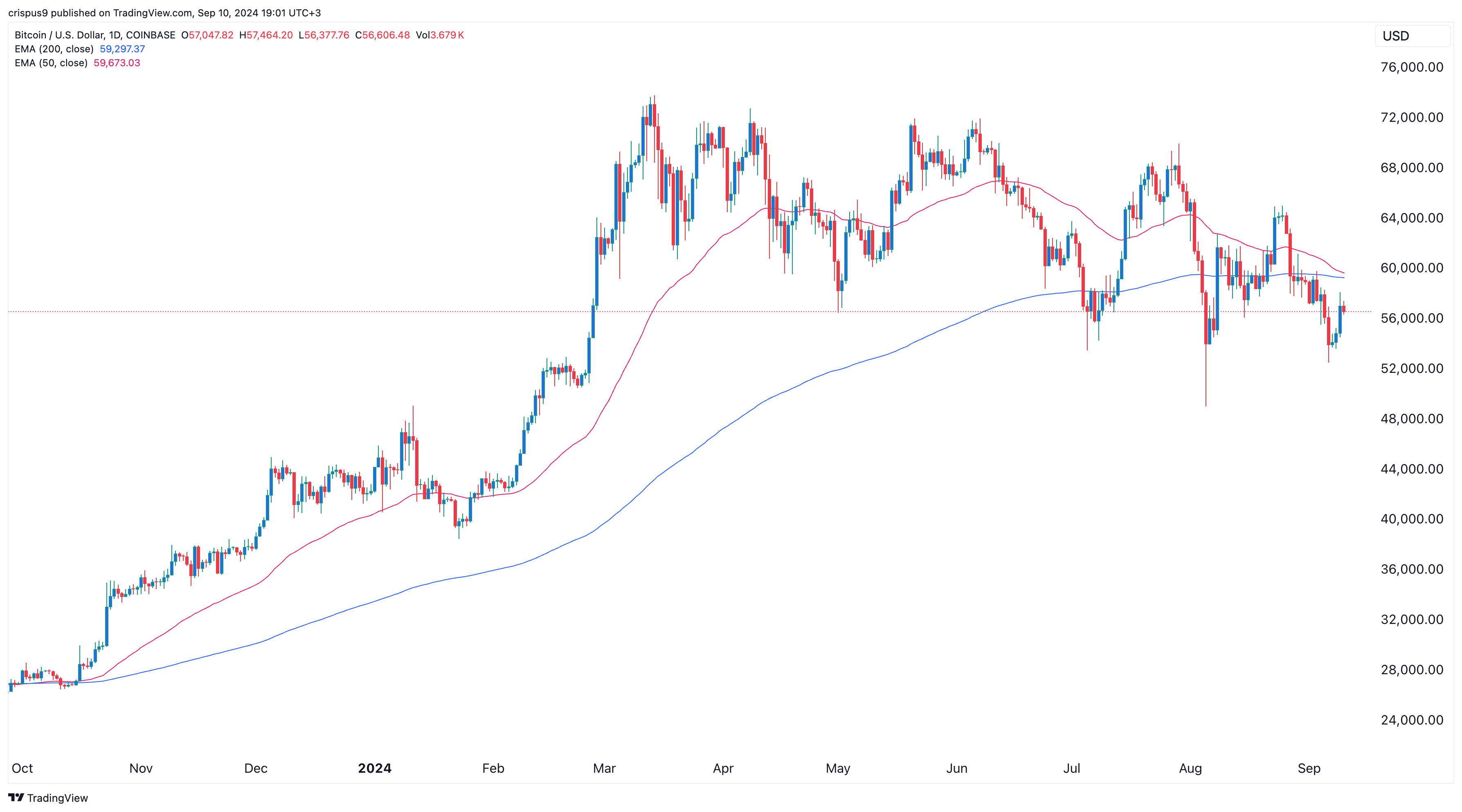

On Monday, Bitcoin (BTC) was being traded at around $57,000, which is substantially higher than its price on last Friday when it dropped to $52,000. The movement of Bitcoin’s price appears to align with the trend in American stocks, as the Nasdaq 100 and Dow Jones experienced growth on Monday and showed signs of uncertainty on Tuesday, September 10.

Bitwise explains why Bitcoin will rally

As a researcher, I’ve recently come across an interesting insight from the Chief Investment Officer at Bitwise Asset Management – a prominent player in the crypto investment landscape managing over $4 billion in assets. They predict a potential “significant rally” for Bitcoin within the upcoming months.

As a researcher, I’d like to highlight three primary factors that have historically influenced the performance of assets such as Bitcoin and tech stocks, specifically in the month of September. Firstly, it’s common to see these assets underperform during this period, a trend that has been observed over time. However, following the dip in September, there is often a subsequent rebound.

Based on his research, spanning from 2010 to 2024, September emerged as the least profitable month for Bitcoin, with an average return of approximately -4.5%. Moreover, he pointed out that this trend was also observed in the Nasdaq 100 index, a tech-heavy market, which usually experiences a decline of around 6% during this month.

This year, Matt Hougan has pinpointed three potential factors that could drive Bitcoin prices up in the near future. Initially, it’s anticipated that the Federal Reserve might start reducing interest rates from September onwards, and make additional two cuts before the end of the year. His forecast indicates a total reduction of 125 basis points by December, which may cause riskier assets like Bitcoin to increase in value.

2. Subsequently, Hougan anticipates Bitcoin to recover once the market obtains a clearer picture regarding the election’s final result. Meanwhile, Polymarket indicates that Donald Trump has a greater likelihood of winning against Kamala Harris, though other popular polls suggest their chances are quite even and within the error margin.

3. He emphasized that Bitcoin ETF inflows remain robust, even following periods of outflows. Notably, he posits that financial advisors are incorporating Bitcoin funds at an unprecedented pace compared to any new ETF ever launched. Intriguingly, prominent hedge funds like Citadel, Millennium, and Bridgewater Associates have made investments in Bitcoin.

As a researcher delving into the world of finance, I’ve uncovered an intriguing fact: Over half of the leading 25 hedge funds are invested in Bitcoin! This points towards a rising institutional belief in Bitcoin’s enduring worth. To unearth more findings like this, be sure to explore The Bitcoin Report below. 👇👇👇

— Bitcoin Magazine Pro (@BitcoinMagPro) September 10, 2024

Bitcoin price faces risks

Still, the bullish case for Bitcoin comes with some risks. The most notable one is that Bitcoin is about to form a death cross, as the gap between the 200-day and 50-day Exponential Moving Averages continues to narrow.

The percentage of Bitcoin has decreased significantly from 4% the previous week, now sitting below 1%. Historically, Bitcoin often experiences a steep decline following such a crossover.

Another risk is that Bitcoin currently lacks a clear catalyst or narrative going forward. The last bull run was primarily driven by anticipation of halving and ETF approvals.

Read More

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- Grimguard Tactics tier list – Ranking the main classes

- USD CNY PREDICTION

- Castle Duels tier list – Best Legendary and Epic cards

- Silver Rate Forecast

- PUBG Mobile heads back to Riyadh for EWC 2025

- Cookie Run Kingdom: Lemon Cookie Toppings and Beascuits guide

- USD MXN PREDICTION

- Pi Network (PI) Price Prediction for 2025

2024-09-10 19:20