Matt Hougan, the Bitwise Investment Officer with a focus on bitcoin, shared his perspective on the upcoming bitcoin halving event based on past trends and increasing demand for spot Bitcoin exchange-traded funds (ETFs).

During an interview with CNBC on the 19th of April, Hougan expressed his view that this year’s Bitcoin (BTC) halving presents a buying chance for investors drawn to the largest category of cryptocurrencies. In simpler terms, Hougan believed that the Bitcoin halving event in 2021 provided an excellent opportunity for investors to purchase this digital currency asset.

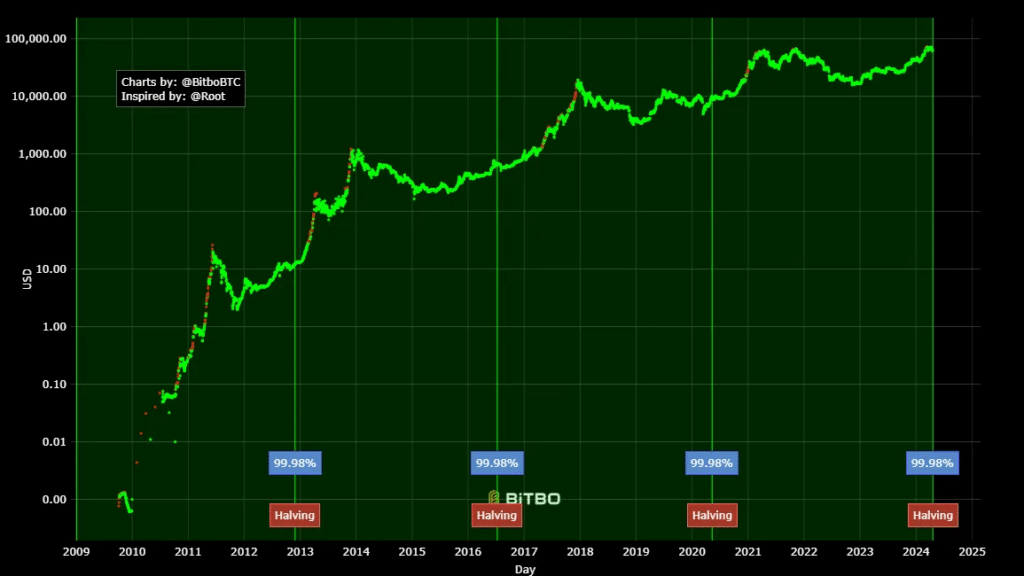

Based on historical analysis, the price movement of Bitcoin following a halving event may not show significant change within the first week or two. However, if we consider a timeframe of one year, the price has consistently surged after each of the previous three Bitcoin halvings. In my opinion, this trend is likely to continue.

Matt Hougan, Bitwise CIO

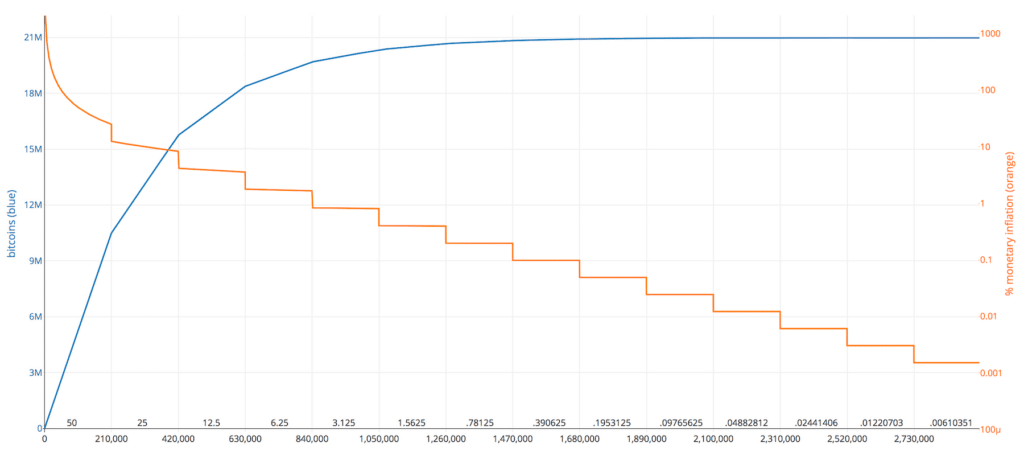

The halving is a built-in adjustment in Bitcoin’s codebase, engineered anonymously by Satoshi Nakamoto, that gradually reduces the reward given to miners to control inflation and preserve scarcity. Every 210,000 blocks or approximately every four years, mining rewards are automatically cut in half.

With each block reward halving, the number of new Bitcoins being released into circulation gets cut in half. Some analysts argue that this decrease in supply, coupled with growing demand from Bitcoin ETFs, could lead to price increases by the end of next year. Hodgson, a BTC ETF provider, shares this perspective.

“The introduction of new Bitcoin into the market is being reduced by half, which equates to a decrease in annual supply worth $11 billion. Looking at the bigger picture, this reduction should be beneficial for Bitcoin’s price and I anticipate that trend continuing over the next year.”

Matt Hougan, Bitwise CIO

Bitcoin halving to solidify spot BTC ETF demand

According to Jeff Hancock, the CEO of Coinpass, Bitcoin has evolved from being a pastime and a market for speculation into a valuable asset with institutional backing. This transformation is expected to set this cycle apart, particularly in an economy marked by high inflation and elevated interest rates.

In the current Bitcoin cycle, a significant market chance may emerge following the fourth halving event. The United States has already seen the launch of successful Bitcoin ETFs. Additionally, there are pending Bitcoin ETF applications in Hong Kong, and ETNs (Exchange-Traded Notes) are available on the London Stock Exchange. The price of Bitcoin is currently reaching new all-time highs prior to the halving, which is an unprecedented occurrence. In my view, Bitcoin’s market potential is virtually limitless.

Jeff Hancock, Coinpass CEO

According to Hancock’s perspective, the worldwide appeal of Bitcoin is expected to persist past the year 2024. Traditional finance (tradfi) is also anticipated to further expand within Bitcoin’s ecosystem. Notably, Spot Bitcoin ETFs have amassed more than $60 billion in assets in just under six months.

A head of a cryptocurrency company based in the U.K. commented that the approval of a Bitcoin ETF by the SEC in the U.S. could pave the way for a successful Ethereum ETF, despite initial resistance from the regulatory body.

The need for Bitcoin among institutions is persistent. It’s predicted that Ethereum ETFs may emerge as early as 2024, enabling institutional investors to reap the benefits of staking rewards and decentralized finance using specialized investment tools.

Jeff Hancock, Coinpass CEO

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Silver Rate Forecast

- USD CNY PREDICTION

- Black Myth: Wukong minimum & recommended system requirements for PC

- 10 Most Anticipated Anime of 2025

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Hero Tale best builds – One for melee, one for ranged characters

- Gold Rate Forecast

- “Golden” Moment: How ‘KPop Demon Hunters’ Created the Year’s Catchiest Soundtrack

2024-04-19 23:38