As a seasoned crypto investor with a knack for spotting promising opportunities, this recent development with Bitwise and the Solana ETF has piqued my interest. With Bitwise’s proven track record of success, particularly with its Bitcoin ETF drawing over $2 billion in inflows, their foray into Solana seems like a smart move given Solana’s impressive performance this year.

Bitwise Asset Management has established a legal trust specifically for their planned Bitwise Solana (SOL) Exchange-Traded Fund, and this registration was done with the state of Delaware.

Based on this submission processed by CSC Delaware Trust Company, it appears that Bitwise could be preparing to submit a formal request to the U.S. Securities and Exchange Commission (SEC) for authorization to introduce an ETF in the near future.

To have their ETF officially listed, Bitwise must first submit both a registration statement (S-1) and a 19b-4 filing to the Securities and Exchange Commission (SEC), awaiting their approval.

However, it’s important to note that Bitwise isn’t the sole contender seeking approval. Both VanEck and Canary Capital are also aiming for a position within the Solana ETF market. Despite the registration of the trust, the Securities and Exchange Commission (SEC) has yet to make its final decision.

When the Solana ETF is introduced, it will enable investors to track the price fluctuations of Solana’s native digital asset using conventional brokerage accounts. Although the particular exchange and trading symbol for this product have not been disclosed yet, it’s plausible that Bitwise’s Bitcoin and Ethereum ETFs are listed on the New York Stock Exchange Arca, implying a possibility that the Solana ETF could also be listed there.

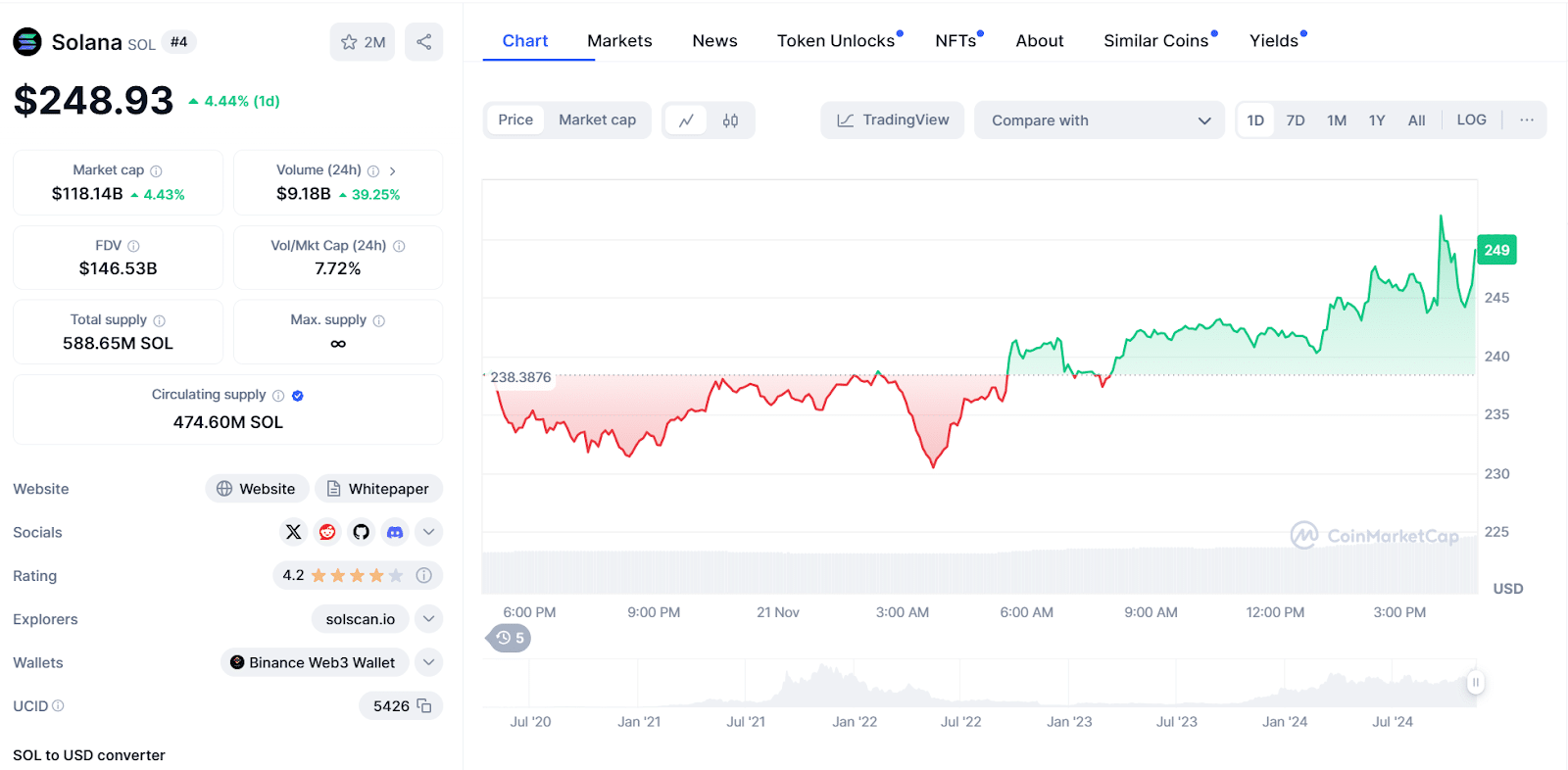

Recently, Solana has experienced significant growth, with its price soaring over 2300% this year alone. This impressive rise has pushed it past Binance‘s BNB token, placing it as the fourth-largest cryptocurrency in terms of market capitalization. This remarkable performance is one of the factors attracting firms like Bitwise to consider creating an ETF focused on Solana.

Currently, I’m observing that Solana is priced at $248.93, marking a 4.44% growth over the past 24 hours. Notably, its market capitalization has also climbed by 4%, reaching an impressive $118 billion. Furthermore, the crypto’s 24-hour trading volume has surged by 39.35%, amounting to a substantial $9.18 billion.

Furthermore, Bitwise has experienced significant growth this year, with its assets increasing an impressive 400%. The success of its Bitcoin ETF, which attracted more than $2 billion in investments, has put Bitwise in a position to capitalize on the growing interest in Solana and broaden its cryptocurrency offerings.

The company additionally applied for a spot XRP ETF in Delaware on October 1, having previously incorporated the Bitwise XRP ETF at the end of September.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Silver Rate Forecast

- USD CNY PREDICTION

- 10 Most Anticipated Anime of 2025

- Black Myth: Wukong minimum & recommended system requirements for PC

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Hero Tale best builds – One for melee, one for ranged characters

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Gold Rate Forecast

- “Golden” Moment: How ‘KPop Demon Hunters’ Created the Year’s Catchiest Soundtrack

2024-11-21 19:48