As an analyst with a background in both traditional finance and blockchain technology, I find the Texas Stock Exchange (TXSE)’s plans to disrupt the U.S. stock exchange market intriguing. The involvement of heavyweights like BlackRock and Citadel Securities adds credibility to their ambitious vision.

BlackRock and Citadel Securities have put their money into a collective intent on challenging the established order of the U.S. stock exchange industry.

James H. Lee, the head of Texas Stock Exchange, boasts a substantial financial backing of $120 million from more than 24 investors. Notable investors in this consortium include heavyweights such as BlackRock, the world’s largest asset manager, and Citadel Securities, a prominent market maker.

Are BlackRock and Citadel planning a blockchain move in stock markets?

Based on The Wall Street Journal’s report, the TXSE aspires to contest the dominance of established and possibly antiquated exchanges. Additionally, it aims to tackle escalating compliance expenses and listing charges.

Although BlackRock and Citadel have not disclosed any cryptocurrency-focused plans related to the TXSE investment, it is possible that they are exploring the use of blockchain technology to address the objectives outlined by Lee’s team.

Contrary to the criticism that blockchain networks consume large amounts of energy relative to the conventional financial industry, the evidence shows otherwise. While Bitcoin‘s proof-of-work system has been a subject of debate for its high energy requirements over the years, the data tells a different story.

As an analyst, I’d rephrase the given statement as follows:

Introducing on-chain mechanics to the global capital market could provide around-the-clock trading access and instant settlement, a significant enhancement over the stock market’s five-day weekly operation. By investing in cryptocurrencies like Bitcoin, Ethereum, or Solana, individuals worldwide can make transactions anytime, as long as the blockchain remains active.

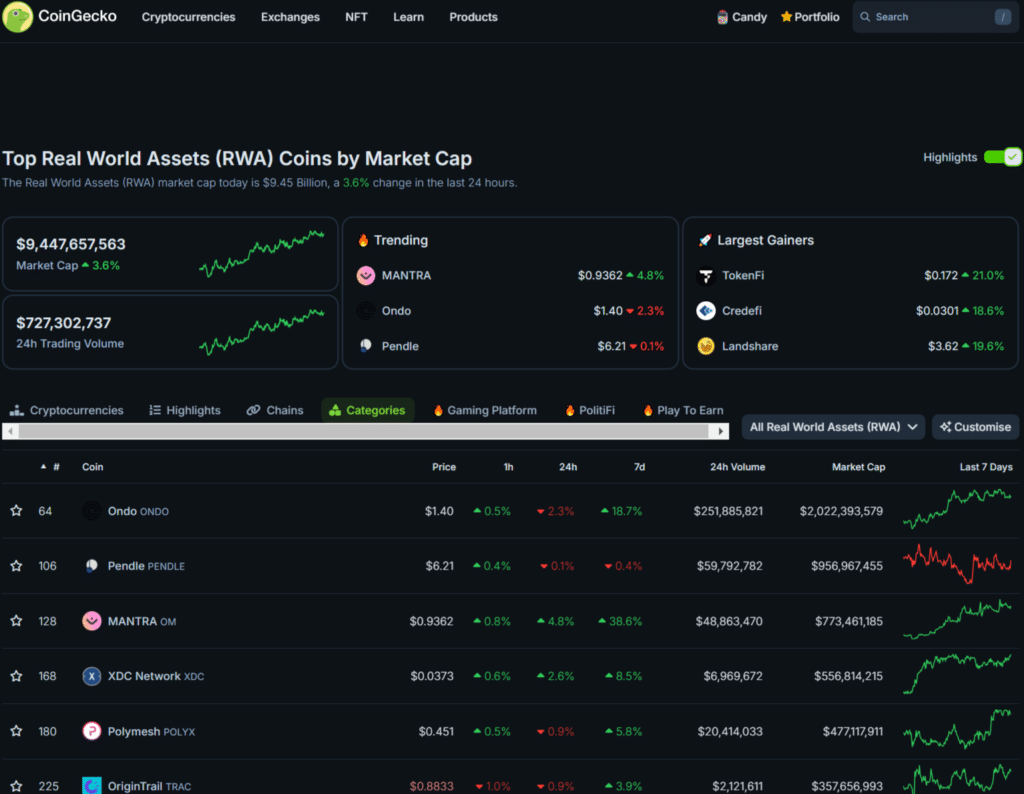

As an analyst, I would put it this way: Bitcoin has remained operational without interruption for over a decade now, setting it apart from other digital currencies. Among the blockchains, Ethereum holds a strong reputation in the decentralized finance (DeFi) sector with approximately $66 billion worth of assets locked as per DefiLlama. The tokenization trend has gained significant traction in recent times, reaching a market size of around $9.4 billion for real-world assets like bonds and equities. This surge indicates that the integration of stocks and securities into this space is not only feasible but also increasingly popular.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Silver Rate Forecast

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Castle Duels tier list – Best Legendary and Epic cards

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Maiden Academy tier list

2024-06-05 23:20