As a seasoned researcher with a keen interest in the ever-evolving world of finance and technology, I find the recent report by BlackRock on Bitcoin particularly intriguing. With my background in understanding global economic dynamics and the role of asset diversification, I am struck by the unique characteristics that Bitcoin presents.

As an analyst, I’ve recently delved into a detailed exploration of Bitcoin, following its publication by Blackrock – the global titan in asset management.

In their recent analysis, BlackRock’s team members Samara Cohen, Robert Mitchnick, and Russell Brownback highlighted that Bitcoin (BTC) could serve as an exceptional investment for portfolio diversification.

Bitcoin solves core money problems

This report is notable because of the roles of the authors at BlackRock. Cohen is the Chief Investment Officer of ETF and index investments, Mitchnick is the company’s head of assets, and Brownback heads global positioning for fixed income.

Initially, it was pointed out that Bitcoin differs from traditional currencies in that it has a maximum supply of only 21 million coins. In contrast, the U.S. dollar supply can be increased without limit because the Federal Reserve decides how many notes to print. Notably, during its last quantitative easing program, the Fed expanded its balance sheet from nearly $5 trillion to $8.9 trillion.

In second place, BlackRock argues that Bitcoin facilitates international money transfers more conveniently. However, it’s important to note that Bitcoin transactions can be costlier compared to sending traditional currencies. This has led to the rise of popular digital assets like Tether (USDT) and USD Coin (USDC) for cross-border payments, as they are often less expensive than Bitcoin.

Furthermore, they pointed out that Bitcoin functions as a globally distributed monetary system without any central control or governance.

BTC is uncorrelated with stocks and gold

BlackRock suggests that Bitcoin is an asset with a unique correlation profile, boasting a robust history of excellent returns. Its value has skyrocketed more than 807,000 times since its creation. In periods when global uncertainties heighten, Bitcoin tends to surpass conventional investments such as the S&P 500 and gold.

During the U.S.-Iran tensions in January 2020, Bitcoin’s two-month return was 20%, whereas the S&P 500 fell by 7% and gold prices surged by 6%. However, after the Covid outbreak in March 2020, Bitcoin experienced a growth of 21%, while the S&P 500 and gold saw more moderate increases of 2% and 3%, respectively.

Furthermore, Blackrock considers Bitcoin a sound investment given the escalating US public debt. Recent statistics from the National Debt Clock reveal that the nation’s total debt exceeds $35.2 trillion, with over $1 trillion being used to manage it annually. In an editorial for The Wall Street Journal, there are growing concerns about an impending national debt crisis.

Additionally, Bitcoin showed superior performance compared to conventional investments during significant occurrences such as Russia’s incursion into Ukraine and the recent unraveling of the yen carry trade.

BlackRock’s perspectives on Bitcoin hold significance due to its influence within the global financial landscape. With a staggering $10.7 trillion in assets under management, which equates to approximately 41% of the U.S. Gross Domestic Product, BlackRock is a dominant force in the economy. Furthermore, it leads the way in the spot Bitcoin ETF market, managing over $21 billion in assets.

Bitcoin is stuck in a range

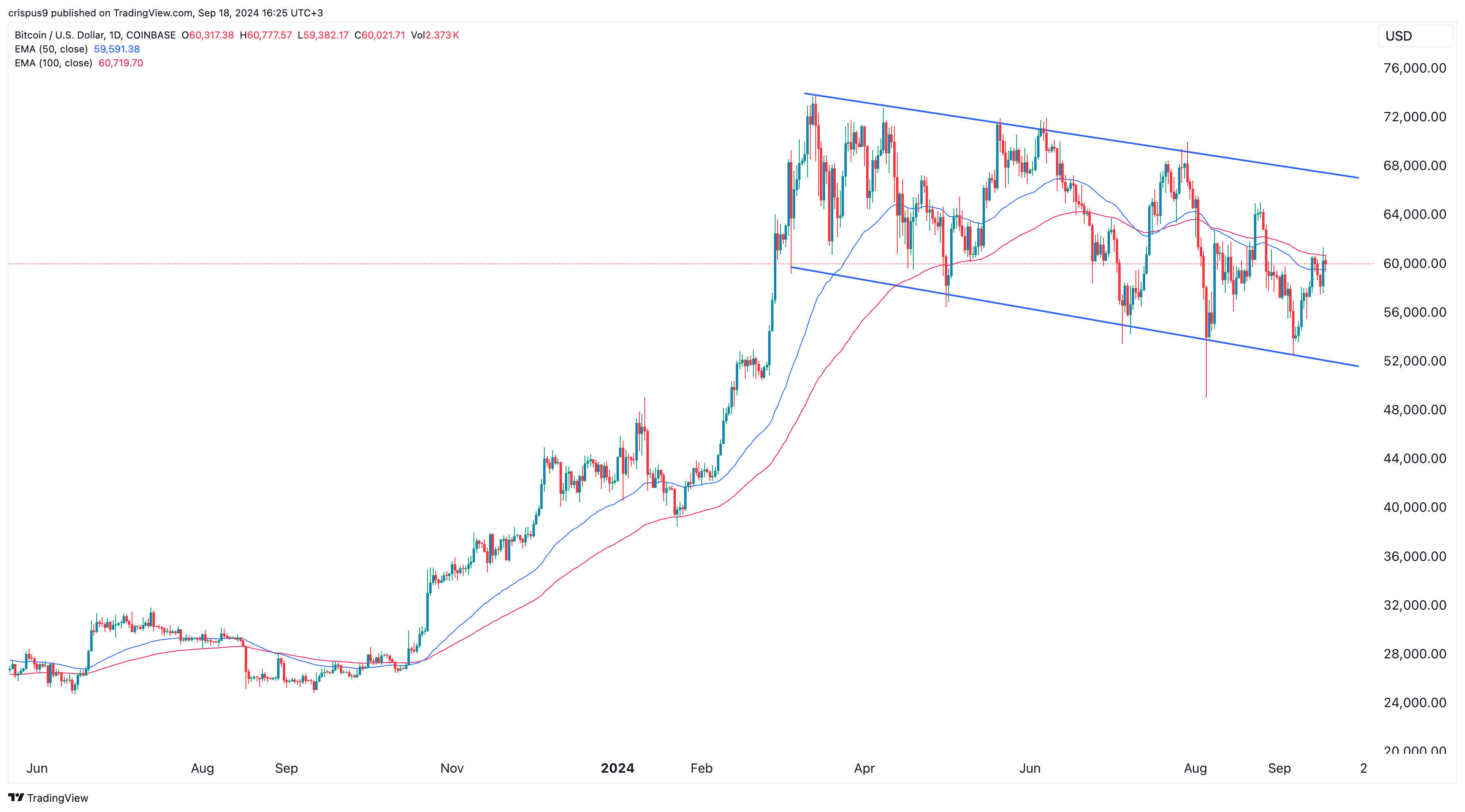

BlackRock’s announcement emerged while Bitcoin was holding steady near the $60,000 level, as investors kept a watchful eye on the upcoming decision from the Federal Reserve.

currently, Bitcoin is holding steady near its 50-day and 200-day moving averages, and has been creating a pattern of lower peaks and troughs. This suggests a neutral short-term forecast for Bitcoin. If it manages to break through the upper boundary of this downward trend, we could see a bullish trend emerging. On the other hand, if Bitcoin falls below $52,000, further price decreases might follow.

Read More

- Silver Rate Forecast

- Gold Rate Forecast

- PUBG Mobile heads back to Riyadh for EWC 2025

- Honor of Kings returns for the 2025 Esports World Cup with a whopping $3 million prize pool

- Kanye “Ye” West Struggles Through Chaotic, Rain-Soaked Shanghai Concert

- Arknights celebrates fifth anniversary in style with new limited-time event

- USD CNY PREDICTION

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Every Upcoming Zac Efron Movie And TV Show

- Superman: DCU Movie Has Already Broken 3 Box Office Records

2024-09-18 16:49