As a seasoned analyst with over two decades of experience in the financial markets, I have witnessed the evolution of investment products and strategies that cater to both institutional and retail investors alike. The recent filing by Nasdaq and BlackRock to start trading options on the spot Ethereum ETF is an exciting development that warrants closer scrutiny.

Major global players such as Nasdaq and BlackRock, known for managing the world’s largest assets, are considering initiating trades for options based on the immediate (spot) Ethereum Exchange-Traded Fund (ETF).

Table of Contents

As a crypto investor, I recently learned that officials from Nasdaq and BlackRock have requested the U.S. Securities and Exchange Commission to enable options trading for the iShares Ethereum Trust ETF (ETHA), the sole Ethereum-based ETF listed on the Nasdaq stock exchange. This potential development could significantly impact my investment strategy in this particular ETF and the overall Ethereum market.

The proposed document outlines a modification in the guidelines for listing and dealing with options related to the iShares Ethereum Trust. The exchange is willing to broaden its selection of ETFs available for trading, potentially incorporating the Trust as one of them.

The ETH held within a trust can be utilized for Ethereum’s proof-of-stake validation, earning extra ETH or generating revenue and other returns.

Feedback on the Nasdaq and BlackRock proposal can be submitted within the next 21 working days. However, according to James Seyffart, an analyst from Bloomberg Intelligence, a definitive ruling on this application might not be issued until as late as April 2025.

As a researcher, I have noticed that the joint application by Nasdaq and BlackRock to introduce options for Ethereum Exchange-Traded Funds (ETFs) has been uploaded onto the Securities and Exchange Commission’s (SEC) website. While the SEC serves as a crucial decision maker in this process, it is important to note that both the Options Clearing Corporation (OCC) and the Commodity Futures Trading Commission (CFTC) also play significant roles in granting their approval. I am anticipating a final decision from the SEC by around April 9th, 2025.

— James Seyffart (@JSeyff) August 6, 2024

As a crypto investor, I’ve learned that for BlackRock to start trading options on an ETH ETF (Exchange-Traded Fund), they require approval from three key entities: the Securities and Exchange Commission (SEC), the Commodity Futures Trading Commission (CFTC), and the Options Clearing Corporation (OCC).

As a researcher, I’m eagerly following the developments concerning Nasdaq’s application to facilitate trading options on spot Bitcoin Exchange-Traded Funds (ETFs). The U.S. Securities and Exchange Commission (SEC) has yet to grant its approval, citing the need for additional time to make a decision regarding this specific product class, as they did in July.

How does spot Ethereum ETF options trading work?

In simpler terms, an option is like a contract that gives its holder the right, but not the obligation, to purchase or sell a specific asset at a predetermined price within a certain time frame.

Retail investors often utilize options for both speculative purposes and short-term trades due to their high potential profitability and limited risk exposure. When purchasing an option, the maximum loss is restricted to the cost of the option itself because the most that can be lost is the premium paid. Additionally, options offer a way for investors to generate income whether the asset’s value increases or decreases.

BlackRock’s new service allows investors to acquire ETH easily at current prices, and it also serves as a protective measure to address their investment goals and risks.

Essentially, this new product provides an additional avenue for individuals interested in dealing with digital assets. Given its relatively affordable interaction costs, it’s likely that people will find these methods very appealing.

Ethereum spot ETFs receive approval

After securing the go-ahead for a Bitcoin ETF in January, multiple financial entities, including heavyweights like BlackRock and Fidelity, have been pursuing authorization to establish crypto-based exchange-traded funds. The aim is to enable investors to trade Ethereum indirectly through fund shares, thereby avoiding the need to handle the cryptocurrency personally.

On May 23rd, the U.S. Securities and Exchange Commission (SEC) gave its green light for a physical Ethereum exchange-traded fund (ETF) to debut in the United States. Companies such as BlackRock, 21Shares, Bitwise, Fidelity Investments, Franklin Templeton, VanEck, and Invesco Galaxy received approval from the regulatory body to proceed with their respective ETFs.

On July 23, trading for the ETH-ETF products officially commenced. Within the initial 15 minutes, a total of $112 million worth of trades were recorded within this sector.

In the first 15 minutes of trading, the total value traded for this group amounted to $112 million, which is significantly more than usual for an ETF launch but still falls short of the volume pace set by Bitcoin ETFs on their opening day. However, it surpasses expectations in my opinion. Notably, Bitwise has shown strong early performance.

— Eric Balchunas (@EricBalchunas) July 23, 2024

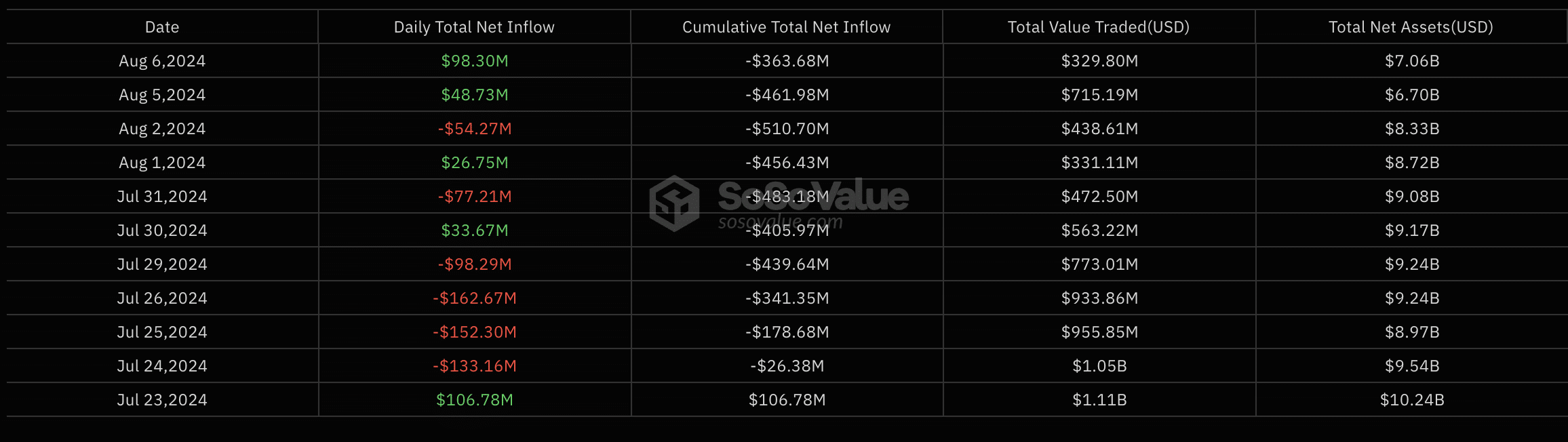

On August 6th, when the cryptocurrency market was experiencing a downturn, a total of $98.3 million was poured into Ethereum (ETH) Exchange-Traded Funds (ETFs). This is the second largest inflow since these products were authorized, as reported by SoSoValue.

BlackRock options strategies

In the spring, BlackRock launched two Exchange-Traded Funds (ETFs) that employ options strategies. These innovative funds implement a covered call strategy specifically on U.S. equities.

One option for rephrasing: The IVVW ETF, which is the first in its kind, primarily invests in large-cap US stocks. This fund follows a strategy that involves owning 500 of these large-cap stocks while also selling one-month call options to generate income, mirroring the performance of an index with this approach.

The second option under consideration is the iShares Russell 2000 BuyWrite ETF, often referred to as IWMW. This is a type of exchange-traded fund that focuses on small-cap companies in the United States. The unique aspect of this fund lies in its strategy: it holds approximately 2,000 small-cap U.S. stocks while simultaneously selling one-month call options to generate income, effectively tracking the performance of an index reflecting this strategy.

As a researcher, I’ve been reaping the benefits of our newly introduced products. Monthly, I’m collecting option premiums as part of my investment strategies, while also keeping an eye on potential growth in the value of the stocks I’m monitoring – all within a predefined ceiling.

Should BlackRock approve the new product?

As a crypto investor, I find it compelling that BlackRock, with its impressive track record of over $9 trillion in managed assets and minimal history of turning down ETFs, has expressed interest in launching a new crypto-based tool. Given this company’s success rate, it seems highly likely that the introduction of this tool will be a triumph, drawing clients and their capital towards the burgeoning cryptocurrency industry.

Read More

- Silver Rate Forecast

- Grimguard Tactics tier list – Ranking the main classes

- USD CNY PREDICTION

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- Black Myth: Wukong minimum & recommended system requirements for PC

- Hero Tale best builds – One for melee, one for ranged characters

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Mech Vs Aliens codes – Currently active promos (June 2025)

2024-08-08 19:10