As a researcher with a background in finance and experience in the blockchain industry, I find the rapid growth of BlackRock’s BUIDL fund truly remarkable. Reaching a $500 million market cap in under four months is an impressive feat, especially for a tokenized treasury fund. The acquisition of a significant amount of BUIDL by Ondo Finance has bolstered its position as the world’s largest tokenized treasury fund.

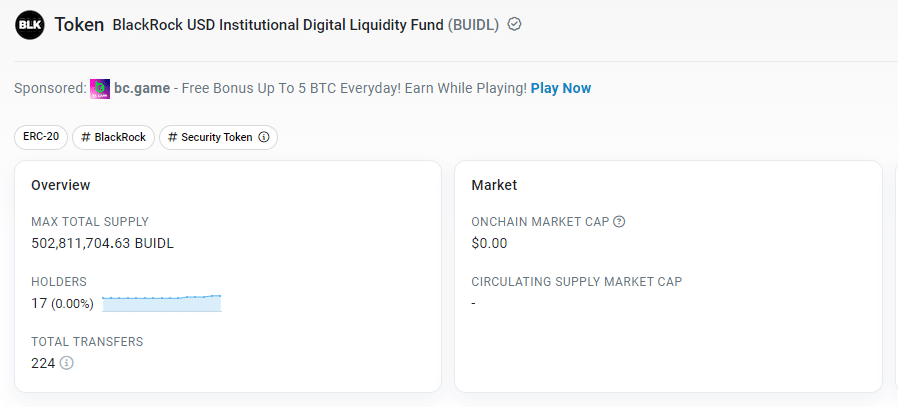

BlackRock’s BUIDL fund, the world’s largest asset manager in this space, has now reached a market capitalization of $500 million. This fund, which was launched just under four months ago, holds approximately $502.8 million worth of tokenized treasuries as of the latest Etherscan data.

As an analyst, I would rephrase it as follows: My analysis indicates that the significant expansion of the fund was fueled by a recent acquisition from the real-world asset tokenization company, Ondo Finance. Notably, Ondo Finance utilizes BUIDL as the collateral for its OUSG token.

As a crypto investor, I’m excited to share that back in late April, BUIDL managed to surpass the Franklin OnChain U.S. Government Money Fund (BENJI) and took the lead as the world’s largest tokenized treasury fund. Since its launch on March 15, I’ve been closely following this development, and it’s a significant milestone for the crypto community.

As a researcher studying BUIDL, I can explain that this platform maintains a consistent value equivalent to one US dollar. It achieves this stability by pegging its price to the U.S. dollar. Additionally, through its collaboration with Securitize, BUIDL distributes the accumulated dividends on a monthly basis directly to investors.

As a crypto investor, I’d put it this way: Among all the projects in the blockchain space, Ondo Finance currently holds the largest stake worth approximately $173.7 million in building and developing their platform, known as BUIDL. Not far behind is Mountain Protocol, which similarly has committed a significant amount of BUIDL to the tune of around $173.7 million. This BUIDL serves as the foundation for Mountain Protocol’s innovative permissionless yield-bearing stablecoin, USDM.

As an analyst examining data from Dune Analytics, I can report that the current on-chain value of tokenized treasury funds stands at a substantial $1.67 billion. Among all blockchains, Ethereum dominates this market with an impressive 75% share. Meanwhile, Stellar holds the second position with a 23.9% share.

As a crypto investor, I’ve been closely following the insights of industry leaders like Larry Fink, CEO of BlackRock, who has emphasized the transformative potential of blockchain tokenization in capital markets. According to Boston Consulting Group’s latest projections, this market is poised for significant growth, potentially reaching a staggering $16 trillion by 2030. This isn’t just about U.S. Treasurys; it encompasses a wide range of assets including stocks, real estate, and more.

In April 2024, the real-world asset market experienced its busiest period with a peak in transactions. However, more current figures from Dune Analytics indicate a decrease in transaction volume since then. Noteworthy entities such as WisdomTree and innovative blockchain firms like Ondo Finance, Backed Finance, Matrixdock, Maple Finance, and Swarm continue to explore the process of tokenizing real-world assets.

As a researcher studying the developments in the world of finance and technology, I’ve been closely following the surge in popularity of BlackRock’s BUIDL tokenized treasury fund. This fund, which is built on blockchain technology, has rapidly grown to a market capitalization of $500 million. The significant growth of this fund indicates a rising wave of investor interest in asset tokenization – the process of converting real-world assets into digital tokens that can be bought, sold, and traded on blockchain platforms. This trend could potentially mark a major turning point in global capital markets as we move towards a more digitized and decentralized financial system.

Read More

- Silver Rate Forecast

- Black Myth: Wukong minimum & recommended system requirements for PC

- Gold Rate Forecast

- USD CNY PREDICTION

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Grimguard Tactics tier list – Ranking the main classes

- Arknights celebrates fifth anniversary in style with new limited-time event

- Gods & Demons codes (January 2025)

- Maiden Academy tier list

- PUBG Mobile heads back to Riyadh for EWC 2025

2024-07-09 08:37