It was the best of times, it was the worst of times, but mostly just a very confusing time for the BNB Chain. The 32nd quarterly burn event, a ritual as regular as the changing of the seasons, saw the incineration of 1,595,599.78 BNB, a sum worth just over $1 billion at the current market rate. The circulating supply of BNB, now reduced to 139.29 million, seemed to whisper the promise of deflationary pressure, a siren song to the bulls who dreamt of pushing prices above the $700 mark. 📈

On the fateful Thursday, July 10, BNB’s price, like a stubborn mule, finally broke free from its chains and surged above the $670 mark, a 2% gain in the 24 hours following the token burn announcement. The market, it seemed, was in a mood to celebrate, or perhaps just to speculate. 🎉

The 32nd quarterly $BNB token burn has been completed directly on BNB Smart Chain (BSC).

1,595,599.78 BNB has been burned. 🔥

View burn details 👇

— BNB Chain (@BNBCHAIN) July 10, 2025

Historically, BNB’s price has responded to token burns with the enthusiasm of a child on Christmas morning. This time was no different, as the derivatives markets, those ever-watchful sentinels of the financial world, began to show signs of renewed capital inflows. 🤑

Derivatives Markets Show Renewed Capital Inflows

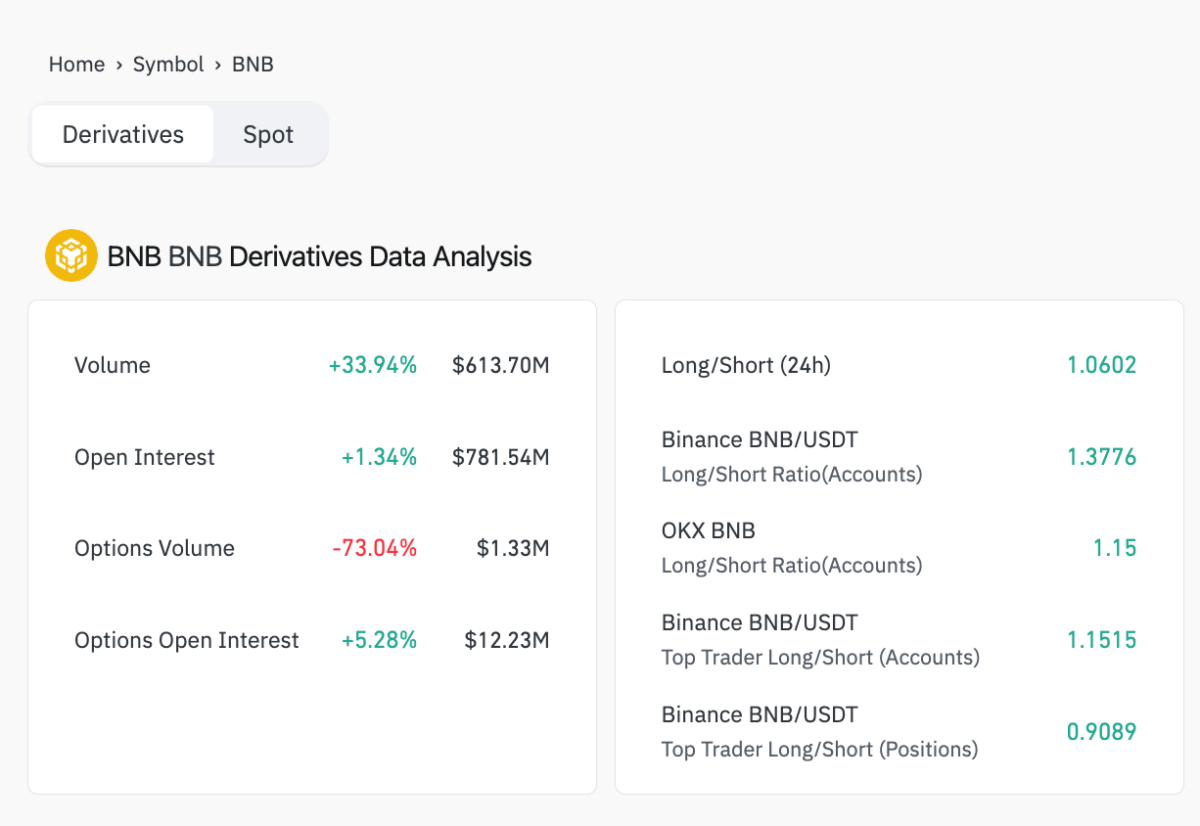

On Thursday, the derivatives trading volume for BNB saw a sharp increase of 33.94%, reaching a staggering $613.7 million. Open interest, a measure of the total number of outstanding contracts, also rose by 1.34% to $781.5 million, a clear indication that the leveraged markets were once again in full swing. 📊

BNB Derivatives Markets Analysis | Source: Coinglass, July 10, 2025

The long-to-short ratio across major exchanges, a metric that often tells the tale of market sentiment, reflected a bullish bias. On Binance, the ratio of long to short accounts stood at 1.3776, while OKX reported a similar positive outlook at 1.15. Among top traders on Binance, the long-to-short account ratio was 1.1515, though the position-based ratio remained slightly below parity at 0.9089, suggesting that larger players were still exercising caution despite the optimistic mood among retail investors. 🤔

BNB Eyes $700 Breakout Above Key Support

At the time of writing, BNB was trading at $676, a price that seemed to dance above all the major moving averages: the 50-SMA ($656), 100-SMA ($632.79), and 150-SMA ($628.33). This alignment, a bullish moving average setup, hinted at the continuation of an uptrend. 📈

The MACD momentum, a technical indicator that often foretells market direction, had also turned decisively bullish. The MACD line was now above the signal line (5.06 vs. 2.51), and the histogram bars were on the rise, suggesting that sustained buying pressure could push prices toward the resistance band between $700 and $720. 🚀

BNB Price Forecast | Source: TradingView

If BNB manages to flip $680 into support this week, a near-term breakout toward $700 appears likely. A daily close above $710 could activate the next leg higher toward the $740, $750 zone. However, should the price fail to hold $660, a correction back to the $640 support at the 100-day SMA may ensue. 🌊

Solaxy Presale: BNB Whales Shift Eyes to Solana’s First Layer 2

As BNB’s burn narrative continued to fuel a bullish breakout, the attention of investors, particularly the whales, turned to Solaxy ($SOLX), Solana’s first Layer 2 chain. The presale, a beacon of hope for those seeking high-yield diversification, had already attracted significant interest from multi-chain whales, including BNB holders. 🐳

Solaxy, with its multi-chain compatibility, 71% staking rewards, and seamless scalability, offered features that were conspicuously absent from most existing Solana projects. The project, now preparing for major exchange listings, invited users to visit the official website to claim and stake SOLX tokens using supported wallets. 🌐

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- USD CNY PREDICTION

- Silver Rate Forecast

- Black Myth: Wukong minimum & recommended system requirements for PC

- “Golden” Moment: How ‘KPop Demon Hunters’ Created the Year’s Catchiest Soundtrack

- Castle Duels tier list – Best Legendary and Epic cards

- Mech Vs Aliens codes – Currently active promos (June 2025)

2025-07-11 02:19