Ah, the markets! They are like a circus, with warning signs flashing brighter than a neon sign in a dark alley. Long-term U.S. Treasury yields are spiking, bond auctions are stumbling, and prediction markets are whispering sweet nothings about impending economic doom. What a delightful mess! 🎪

The Treasury Market: A Comedy of Fiscal Errors

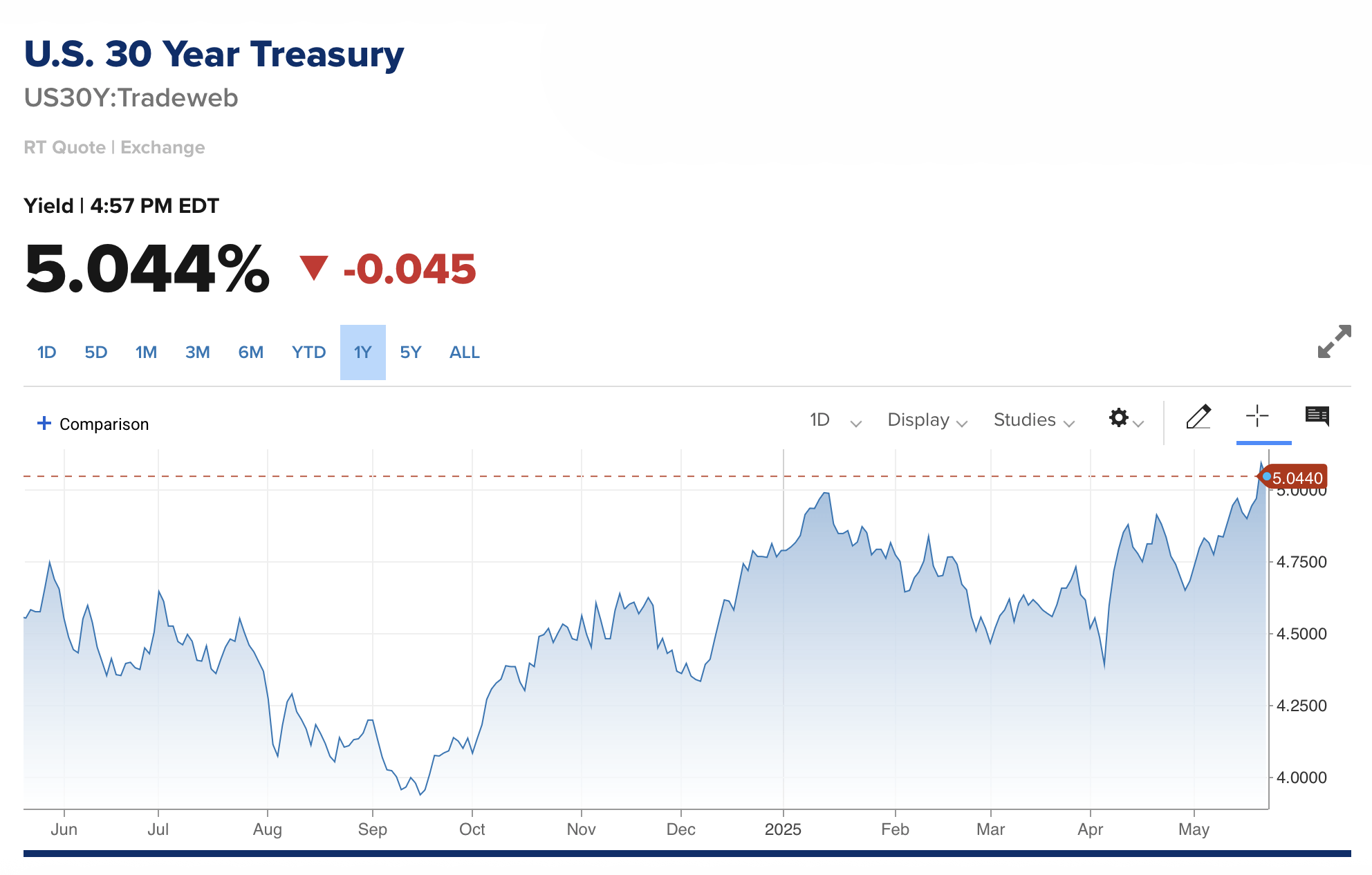

On this fine Thursday, the 30-year U.S. Treasury bond yield has surged to 5.18%—the highest it has been since 2023! It’s like watching a balloon float away, only to deflate slightly later. The 10-year yield also decided to join the party, climbing to 4.593%. These movements are significant, especially after a lackluster 20-year bond auction that left everyone scratching their heads. 🧐

The May 21 auction of $16 billion in 20-year bonds was met with a demand so tepid it could have been mistaken for a lukewarm cup of tea. The high yield of 5.047% was above expectations, but the bid-to-cover ratio fell to 2.46, the lowest since February. Investors seemed less than enthusiastic, and the market reacted like a cat thrown into a bathtub: yields on 20-year bonds jumped to 5.127%, stocks slid, and the Dow Jones Industrial Average plummeted nearly 800 points on Wednesday. Flat as a pancake, the Dow and three other major U.S. indexes remained unchanged on Thursday. 🥞

Investor sentiment is as shaky as a tightrope walker in a windstorm, rattled by soaring U.S. debt levels, a never-ending debate over a new tax-and-spending package, and recent credit downgrades by Moody’s, Fitch, and Standard & Poor’s. Confidence in long-term U.S. fiscal stability is waning, with some traders demanding higher returns to hold government debt. Who knew fiscal health could be so dramatic? 🎭

Prediction markets are also signaling rising anxiety. According to Polymarket, traders now place a 40% probability on a U.S. recession in 2025—a jump of 21 percentage points in recent weeks. It seems the fear of higher borrowing costs, tariff-related inflation, and government spending risks is enough to make anyone clutch their pearls. 💎

Despite these ominous signals, Polymarket speculators expect the Federal Reserve to keep rates unchanged in June. With a 92% chance of holding steady, only a 7% chance of a 25 basis point cut, and less than 1% odds of a larger cut or rate hike, it’s like watching a game of poker where everyone is bluffing. 🃏

Reports noted that foreign investors showed solid participation in the latest bond sale, accounting for 69% of indirect bids. But alas, the 20-year bond’s lower liquidity and benchmark status compared to 10- or 30-year maturities may have contributed to the weaker overall demand. It’s a classic case of “you can’t have your cake and eat it too.” 🍰

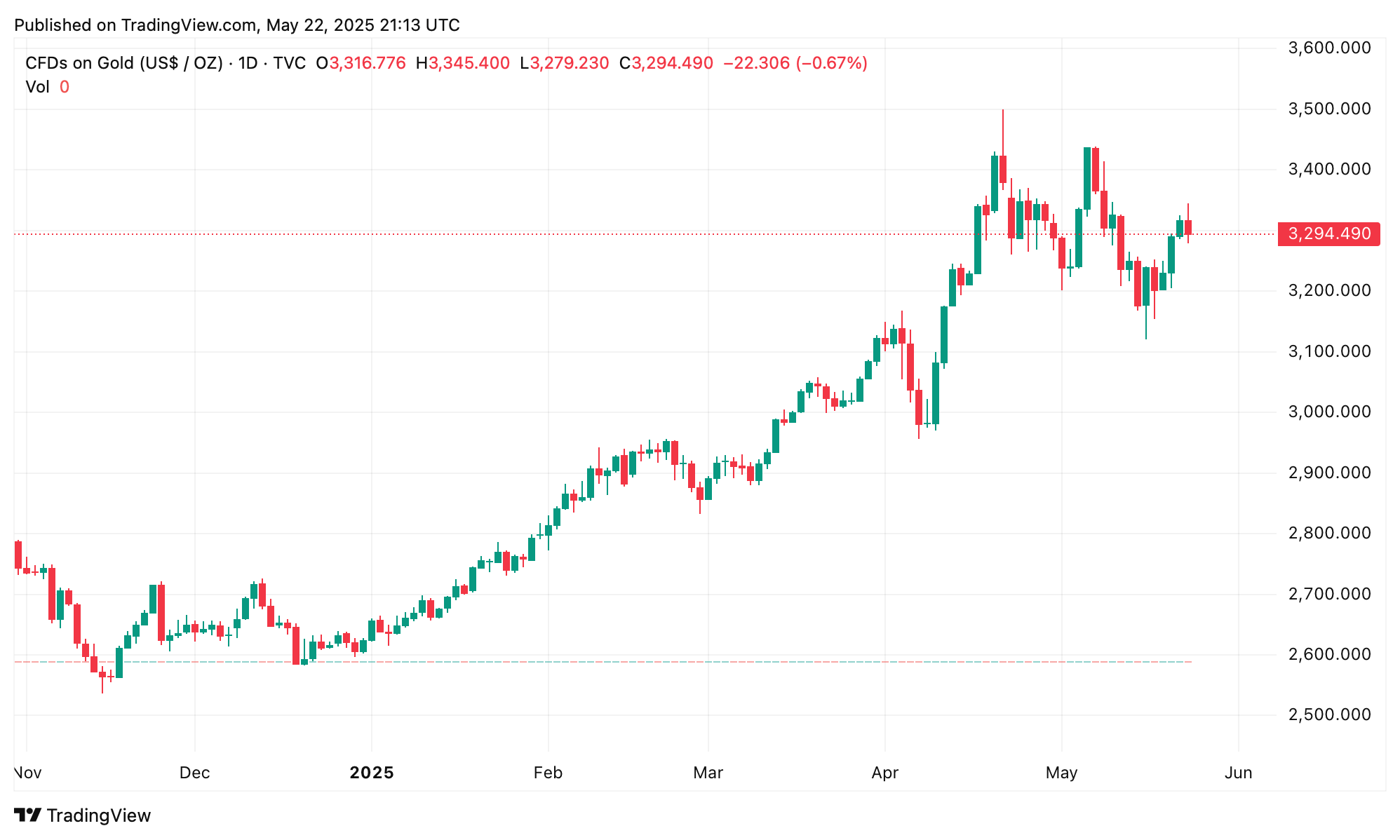

As borrowing costs rise and fiscal pressures mount, both markets and forecasting tools are hinting that the economic foundation may be less stable than it appears. Meanwhile, both bitcoin and gold have held their ground in the aftermath of the lackluster 20-year Treasury auction—gold gleaming in its usual safe-haven role, while bitcoin proved sturdier than stocks, even if its path was a bit bumpier. Who knew the apocalypse could be so shiny? ✨

Gold’s climb to record highs and bitcoin’s knack for dodging steep drops amid market chaos hint that both assets are managing the economic jitters with surprising poise, though they carry distinctly different levels of risk. It’s a wild world out there, folks! 🌍

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Grimguard Tactics tier list – Ranking the main classes

- USD CNY PREDICTION

- Castle Duels tier list – Best Legendary and Epic cards

- PUBG Mobile heads back to Riyadh for EWC 2025

- Cookie Run Kingdom: Lemon Cookie Toppings and Beascuits guide

- Silver Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- Maiden Academy tier list

2025-05-23 01:09