Amid the bustling Solana meme coin market, data from Dune reveals a sinister plot: trading bots are inflating volume on Pump.fun, raising fears of manipulation. 🤖💰

Pump.fun, the trailblazer in the Solana meme coin launchpad, is now facing stiff competition from emerging rivals. The market is set to become a battleground of innovation and strategy. 🚀💥

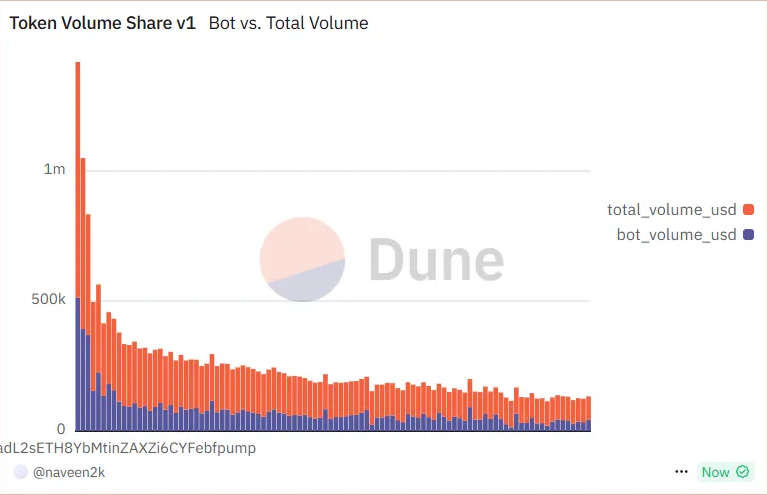

Bot-Driven Volume on Solana’s Pump.fun Tokens?

Analysts have uncovered a web of deceit, where “Proxies” are flooding Pump.fun token markets with volume-farming bots. These high-frequency trades are designed to create a false sense of momentum, exploiting retail traders’ fear of missing out (FOMO). 🤯

On-chain data, which tracks these bots in action, reveals them as proxies masquerading as regular market participants. They execute dozens of small trades on new token launches, often within seconds, to create the illusion of surging interest. 🕵️♂️

According to the data, these bots generate a staggering 60–80% of trading volume on some Pump.fun tokens. The result is a self-reinforcing feedback loop, where fake volume sparks real FOMO, fueling price pumps that the bots can exploit for exit liquidity. 📈📉

DeFi researcher Naveen, in a post on X (Twitter), dubbed this practice the “Proxy Paradox.” He highlighted broader implications, noting that it artificially distorts market signals and undermines the reliability of volume-based indicators. This can lead to unsustainable price movements, leaving genuine investors in the lurch. 🤷♂️

Some argue that the influx of bot-driven trades stress-tests Solana’s scalability and adds temporary liquidity. Critics, however, warn that it jeopardizes the ecosystem’s long-term health. 🚧🚫

Sustainability Concerns Beneath the Meme Coin Mania

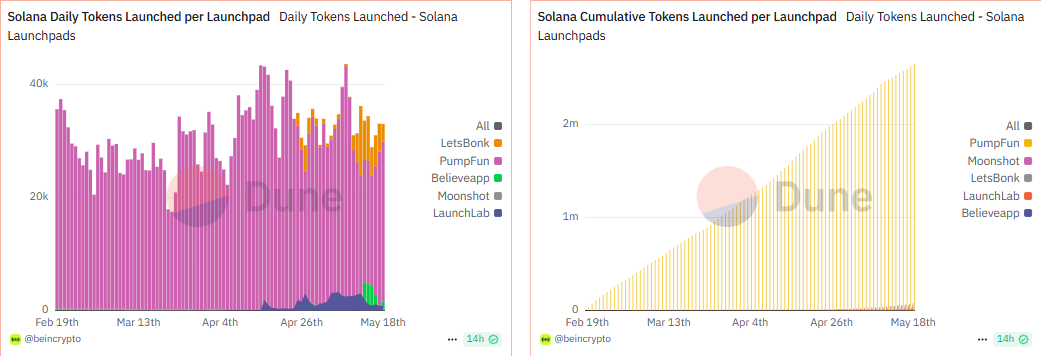

The meme coin sector is booming, but Pump.fun, once Solana’s dominant launchpad, is losing ground. BeInCrypto reported that the platform’s market share is slipping as new launchpads like LetsBonk gain momentum with faster listings, better user engagement, and broader developer participation. 🏆🏆

This evolution occurs during a volatile yet pivotal moment for the Solana ecosystem. According to Solana’s Q1 2025 report, network revenue surged while transaction fees dropped, indicating efficiency gains. However, DeFi total value locked (TVL) declined, raising concerns about sustainability beneath the meme coin mania. 🤔

“Not all volume = real demand. Next time you see explosive volume on new meme coins, ask yourself: Is this hype… or Proxy farming?” — Analyst

As Solana’s meme coin ecosystem matures, transparency and smarter system design will be crucial. Volume farming bots may temporarily boost metrics, but long-term resilience requires data over deception. 📊🚫

Solana’s infrastructure is under strain, and competition among launchpads is intensifying. The race is on to launch the next viral token and ensure the system beneath it remains credible. 🏃♂️🏆

Read More

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- Grimguard Tactics tier list – Ranking the main classes

- USD CNY PREDICTION

- Castle Duels tier list – Best Legendary and Epic cards

- PUBG Mobile heads back to Riyadh for EWC 2025

- Cookie Run Kingdom: Lemon Cookie Toppings and Beascuits guide

- Silver Rate Forecast

- USD MXN PREDICTION

- Pi Network (PI) Price Prediction for 2025

2025-05-20 11:50