In the chaotic straightjacket of the market, the token finds itself tangled ever so comfortably near a support line, like a cat deciding whether or not to leap from its perch. 🤔 Traders, ensnared in their own anticipation, hold their breath—what will this next move be?

Squinting through the fog of light pullbacks, behind the curtain, volume patterns and moving averages hum a cheerful tune of bullish possibilities. Eyes are now fixed on pivotal zones that promise to reignite the flames of fervor, pushing towards those lofty heights we once knew so well. 🔥

The Price Rides High on Moving Average Support

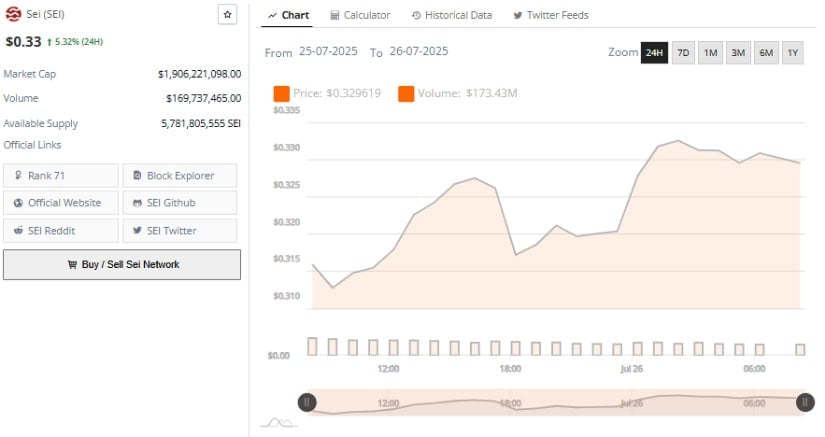

Feast your eyes upon the SEI/USDT daily chart, where the price meanders above its 30-day moving average (MA30) of $0.3106 after a calculated dip, as if it knows a secret dance move. Currently trading at $0.3296—a stylish 1.11% decline from its last soirée—it’s playing coy, but we see through the act. 😏

Like a sturdy chair at a grand feast, the price remains steadfast above the proud 60-day moving average (MA60) and cozies up to the 10-day MA. Such a gathering suggests today’s pullback is a well-orchestrated retreat following a valiant charge that peaked near $0.39 back in July, where it surely feasted on aplomb.

The recent price action reveals a tapestry woven with small candle bodies and tighter ranges—akin to the market’s indecision masquerading as a cool demeanor rather than an all-out assault. This (often) meek preparation foreshadows an impending climactic reveal when the price remains unfettered above its breakout zones.

A structural framework of higher lows since May further confirms that demand persists, even if it may not be throwing a wild party. Should SEI reclaim the esteemed $0.342 with the thundering applause of volume, one could anticipate a grand encore at the revered resistance level of $0.39.

Volume Signals Accumulation Amidst a Brief Intermission

The 24-hour performance chart—our faithful bard—confirms accumulation dances on, even as the ballroom has quieted down from those dizzying July bashes. On July 26, trading volume tickled at 33.33 million SEI, a stark contrast to the earlier jubilation that saw volumes above 100 million. 😳

While this decline hints at a traditional fatigue, it’s a reminder that there’s no dramatic exit yet. In fact, this lull resembles more of a consolidation phase rather than an outright trend at the edge of a cliff.

Throughout this performance, SEI recorded a dizzying 5.32% rise before cooling its heels, opening near $0.31 and gallantly striding through several resistance thresholds, eventually resting at around $0.33. Talk about a workout! The uptrend played out against a background of surging volume, peaking at a dazzling $169.73 million during those riveting intraday breakouts. 🎉

The market cap, bright-eyed with ambition, leaped to $1.91 billion. A glimpse of confidence—both institutional and retail cohorts have not abandoned ship yet! If volume decides to rejoin the fun and align with price above $0.35, consider the momentum renewed and the stage set for another act.

RSI Holds Its Ground Amidst Market Curiosity

As I pen this, SEI finds itself at $0.3299. The Relative Strength Index (RSI), that ever-watchful guardian, sits at 55.55, with its moving average standing tall at 63.82—an indication that while momentum may have taken a breather from its recent highs, it hasn’t thrown in the towel just yet.

When the RSI flirts with numbers between 50 and 60, it often suggests a party intermission amid a broader trend. Should the RSI find its flair and begin to ascend once more, we might just catch wind of an energetic bullish reincarnation. 🚀

The enlightening chart from MEXC, our ever-reliable oracle, presents a less frenetic daily volume during this pullback, devoid of any signs of sharp distribution—nobody’s throwing vegetables at this show. The 5-day and 20-day volume moving averages tower above current levels, affirming a mere moment of respite in our ongoing performance.

If the price graciously holds above the 30-day MA and the RSI takes flight, eyeing a reprise towards $0.36—$0.39 feels very much within reach. But a tumble below $0.31? That may lead us to a haunting retread into the $0.28—$0.29 corridor. 🎭

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Honor of Kings returns for the 2025 Esports World Cup with a whopping $3 million prize pool

- PUBG Mobile heads back to Riyadh for EWC 2025

- USD CNY PREDICTION

- Kanye “Ye” West Struggles Through Chaotic, Rain-Soaked Shanghai Concert

- Arknights celebrates fifth anniversary in style with new limited-time event

- Every Upcoming Zac Efron Movie And TV Show

- Hero Tale best builds – One for melee, one for ranged characters

- Mech Vs Aliens codes – Currently active promos (June 2025)

2025-07-26 22:32