As a seasoned crypto investor with a knack for spotting trends and interpreting market signals, I find myself intrigued by the recent turn of events surrounding Optimism (OP). The steep drop in its price has indeed stirred a sense of unease among many investors, but it has also created an opportunity that long-term holders like me can’t ignore.

The decrease in the cost of Optimism has brought back a robust buying indication for long-term investors, as they are holding at all-time low prices.

In the last day, there’s been a 9.6% drop in Optimism (OP), currently priced at $1.33. It’s worth noting that this asset has been steadily decreasing from its peak of $4.85, which it reached on March 6.

At the moment, the market value of OP stands at approximately $1.57 billion, placing it as the 48th largest cryptocurrency. Interestingly, its daily trading volume experienced a boost of 23%, culminating in a volume of around $145 million.

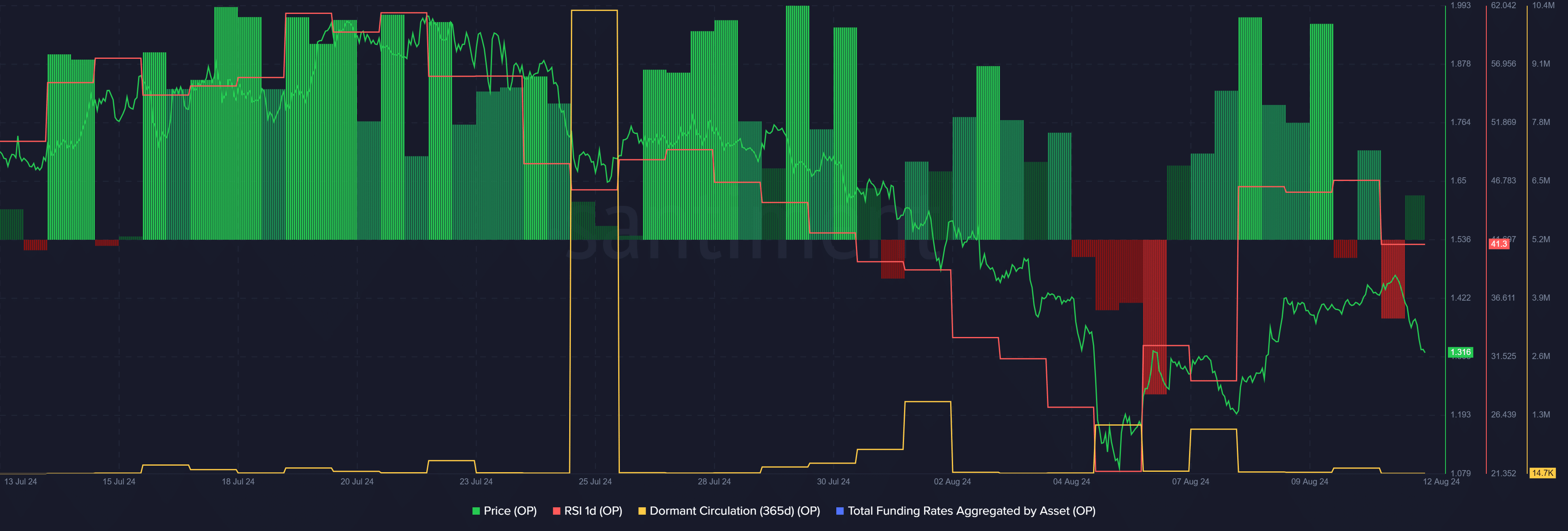

Based on information from Santiment, the Optimistic Sentiment Strength Indicator stands at 41 as of the current report. This suggests that optimism might be slightly overbought or undervalued at this specific price level.

According to market data, long-term owners of OP have not been active in the market despite a recent drop in price. In fact, as reported by Santiment, the number of Optimism tokens that have been dormant for a year has dropped significantly within the last day, from 132,510 to 14,701 tokens – reaching its lowest point in a month.

Based on Santiment’s data, the daily active address disparity for OP currently stands at 114%, suggesting a robust buying opportunity for this coin. Moreover, the increased trading activity indicates potential for significant price fluctuations.

Over the last 24 hours, the combined funding rate on Optimism increased from a rate of -0.003% to 0.002%. This uptrend has sparked optimism among traders who are betting on the rise in OP‘s price as well.

While positive signals may be present in financial markets, including cryptocurrencies, it’s crucial to remember that broader economic developments can exert a substantial influence. Analysts at Coinbase Research predict that these macroeconomic pressures could create tension within the crypto sphere during the upcoming weeks.

Read More

- 10 Most Anticipated Anime of 2025

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- USD CNY PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

- Castle Duels tier list – Best Legendary and Epic cards

- Maiden Academy tier list

- Cookie Run Kingdom: Lemon Cookie Toppings and Beascuits guide

- Silver Rate Forecast

- USD MXN PREDICTION

2024-08-12 13:14