As a seasoned crypto investor with a knack for recognizing potential gains and a penchant for spotting promising projects, I find myself intrigued by Binance Coin (BNB). With its strong fundamentals and impressive technical indicators, BNB appears to be on the cusp of significant growth in December.

The price of Binance Coin persisted in holding steady at a crucial resistance point, suggesting that the momentum from its recent surge may be slowing down.

On November 29th, the Binance Coin (BNB), the token associated with the BSC network, was being traded at $655. Compared to its lowest point in 2023, it has surged by a substantial 223%. However, during November alone, it only experienced a 9% increase, which is less than many leading cryptocurrencies.

It’s anticipated that the BNB coin could see more growth in December, given its robust underlying qualities and positive technical signals. Meanwhile, the Binance Smart Chain (BSC) ecosystem has been thriving, as the value locked within its DeFi system has risen by 18% to reach $5.53 billion over the last month.

In a similar fashion, the value of cryptocurrencies exchanged through its Decentralized Exchange (DEX) platforms like PancakeSwap (CAKE) and Uniswap surged beyond $34 billion during that timeframe. Notably, PancakeSwap accounted for close to $30 billion of this total volume.

The data indicates that the network is consistently decreasing the number of circulating coins by burning them. In just the past week alone, approximately 652 coins valued at $429,000 have been destroyed. To date, this process has resulted in the removal from circulation of coins worth a staggering $160 million. The ultimate goal is to decrease the total supply from 144 million coins to just 100 million, an action aimed at controlling inflation by reducing the overall coin supply.

Due to the continuous burning and increasing network earnings, the staking return on BNB has experienced a substantial increase, now sitting at 12.5%. This equates to around $12,500 in yearly returns for every $100,000 invested.

BNB price technicals mean $1,100 is reachable

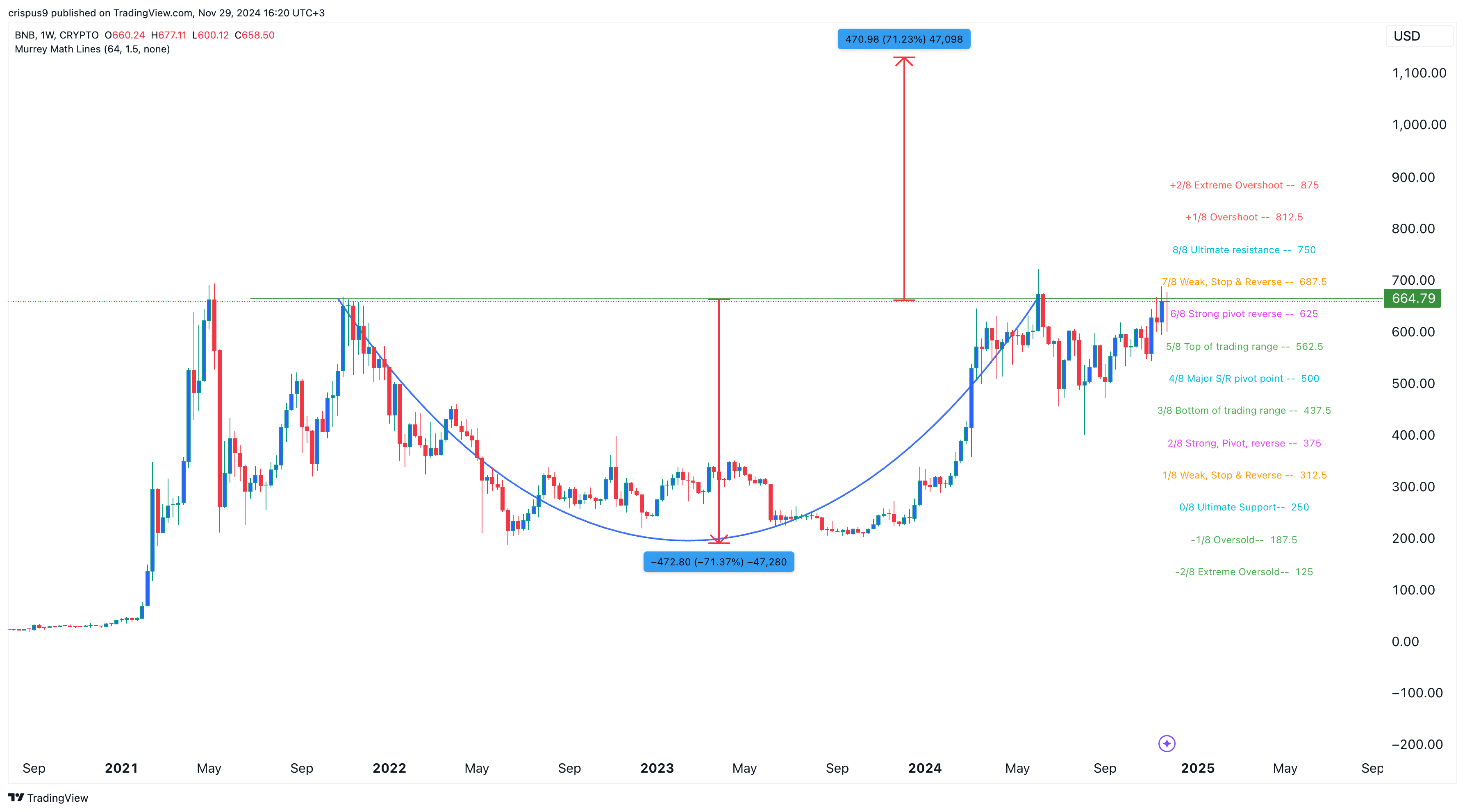

Looking at the weekly graph, it appears that Binance Coin might see further gains in the approaching weeks. Since October 2021, it has been exhibiting a ‘cup and handle’ formation, with a resistance level at around $665. This optimistic pattern is characterized by a horizontal line, a rounded base, and either consolidation or retracement.

As an analyst, I’m observing that the current depth of the BNB cup is approximately 70%. This measurement, if extrapolated from the $665 level, indicates a potential rise in the coin price to around $1,130 upon a breakout. However, for this upward movement to materialize, BNB needs to surpass significant resistance levels. These include the critical levels at approximately $875 (Murrey Math Lines extreme overshoot), and the psychological barrier at $1,000.

For this perspective, the key support level can be found at $437, which represents the lowest point within the trading range according to the Murrey Math Lines indicator.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- Silver Rate Forecast

- Maiden Academy tier list

- PUBG Mobile heads back to Riyadh for EWC 2025

- Castle Duels tier list – Best Legendary and Epic cards

- Mech Vs Aliens codes – Currently active promos (June 2025)

- USD CNY PREDICTION

- The 15 Highest-Grossing Movies Of 2024

2024-11-29 16:52