As a seasoned cryptocurrency investor with years of experience under my belt, I’ve witnessed the rise and fall of numerous digital assets. However, the recent surge of Solana against Ethereum has caught my attention like never before.

In the year 2024, Solana’s native token has soared by 70% compared to Ethereum. This digital currency, used on Solana’s smart contract blockchain, has proven itself as a formidable competitor against Ether. Despite its market capitalization being roughly a third the size of Ethereum’s, it continues to make waves in the cryptocurrency market.

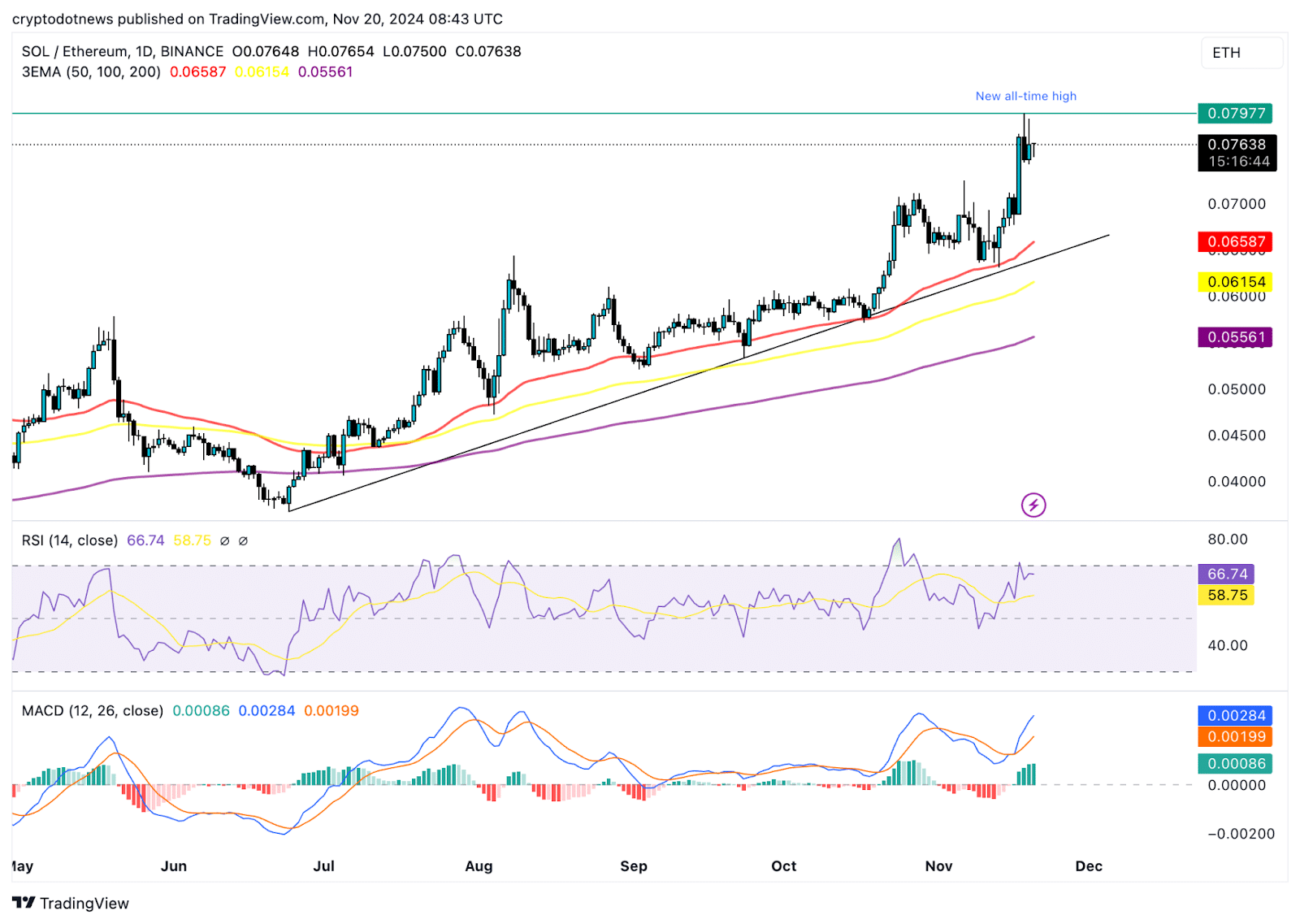

The ongoing debate in terms of Solana (SOL) overtaking Ethereum (ETH) is backed by bullish on-chain metrics, SOL’s dominance in DEX metrics, volume and protocol revenue. Solana hit an all-time high against Ethereum on Monday, November 18, when SOL/ETH climbed to 0.07977.

Table of Contents

Solana could overtake Ethereum, on-chain metrics suggest

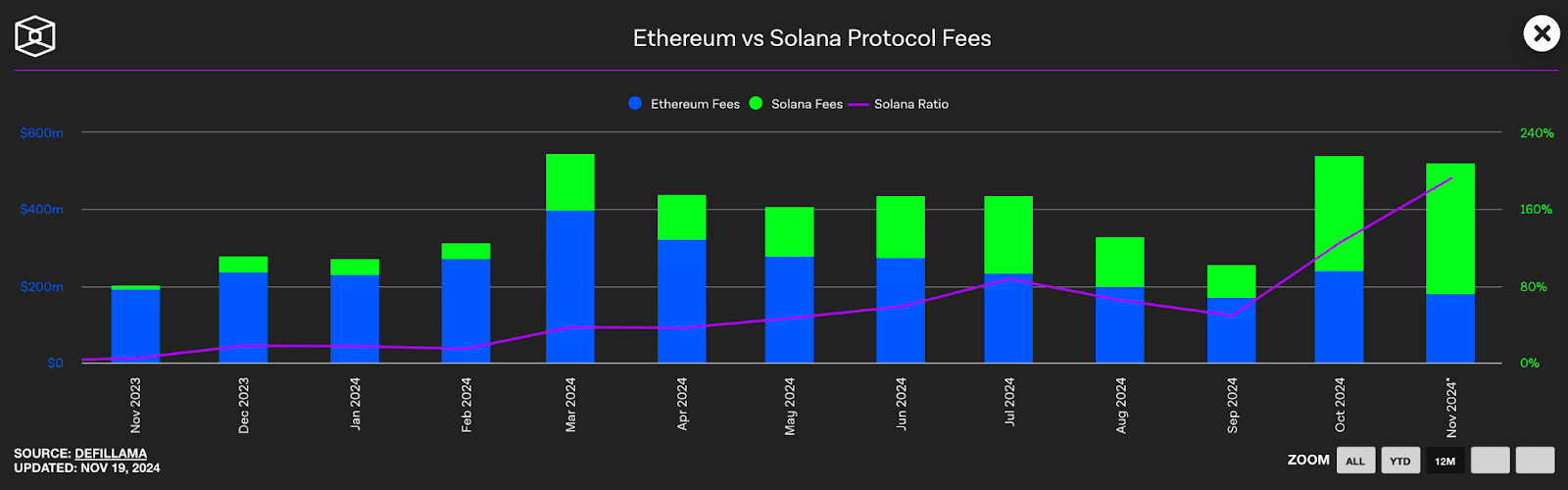

In simpler terms, the fee charged for transactions on Solana’s blockchain protocol, which helps manage and smooth trades, was almost double the fee on Ethereum in November 2024.

As of Tuesday, November 19, preliminary figures indicate that Solana has accumulated approximately $343.96 million in protocol fees compared to Ethereum’s $178.65 million. Once liquidity providers are compensated, these fees contribute significantly to the project’s earnings for a blockchain network.

The metric, therefore, suggests higher revenue for Solana, compared to Ethereum, in October and November 2024.

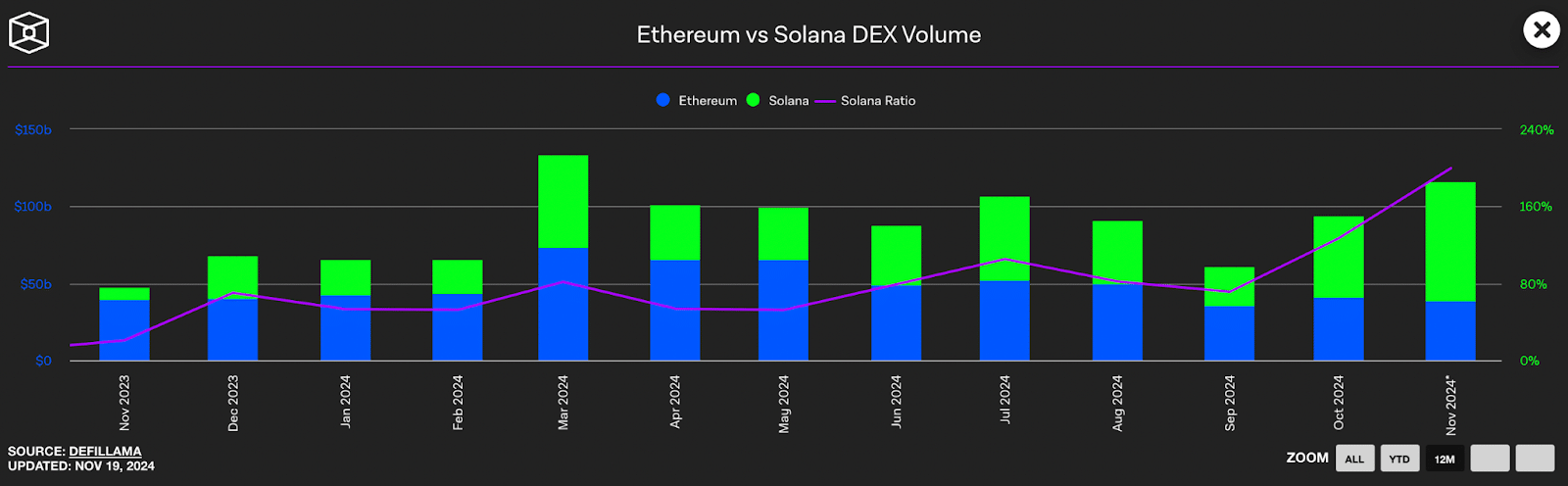

“One significant indicator is the number of transactions happening on decentralized exchange markets, often referred to as DEXes. For instance, in November, the transaction volume on Solana’s DEX was almost double that of Ethereum. In October, Solana led in this category, but the difference wasn’t as substantial.

Solana DEX volume is $77,51 billion against Ethereum’s $38,81 billion. For the month of October, Solana stood at $52.5 billion against Ethereum’s $41,4 billion.

A greater transaction volume on the Decentralized Exchange (DEX) of one chain indicates higher functionality and acceptance compared to another. It seems Solana has been favored by traders on DEXs, possibly because of the high number of new projects launched on Pump.fun’s platform, which are then listed on exchanges like Raydium following a significant milestone.

According to data from TheBlock, it appears that Solana stands out as the preferred choice for decentralized traders and platforms.

Ethereum holds a significant share of circulating stablecoin reserves, while the overall worth of digital currencies (Total Value Locked, TVL) is secured within its network.

Solana currently faces a significant gap compared to Ethereum in these performance indicators, largely due to Ethereum’s early lead, often referred to as its first-mover advantage. However, given continuous adoption and growing demand, there’s a strong possibility that Solana could eventually surpass Ethereum in these areas over the long haul.

How Solana could overcome challenges, and flip Ethereum

The Solana network is seeing an increase in stablecoins being introduced, which is expected to boost both the circulating stablecoin supply and TVL (Total Value Locked) figures. Previously known as Maker, a decentralized finance platform for lending and borrowing (Sky) has now made its USDS stablecoin available on Solana.

This signifies the debut of a stablecoin native to Decentralized Finance (DeFi) on Solana, potentially boosting its DeFi market liquidity and making it more competitive with Ethereum in this domain.

Last week, Solayer introduced sUSD – a stablecoin pegged to real-world assets and built on the Solana blockchain. What sets this token apart is that its value is tied to a diverse portfolio of low-risk investments, including U.S. Treasury bills, distinguishing it from other existing stablecoins.

Developments akin to those on the Solana network might empower SOL to bypass the network dominance and initial lead held by Ethereum, co-founded by Vitalik Buterin. This could potentially set the stage for a shift or competition between the two blockchains in the future, often referred to as a “flippening”.

Why this matters, implications for your crypto portfolio

Data from CoinGecko indicates that meme coins built on the Solana platform surpassed a market value of $22 billion, and an impressive 70% of the top 10 meme tokens have seen double-digit growth over the past week.

The surge of Solana relative to Ethereum seems to have boosted its associated ecosystem tokens, sparking a trend in meme coin prices and increasing the total value of the meme token sector as a whole. This development benefits crypto investors who own dog and cat-themed, political, and other meme tokens along with Solana, enriching their portfolios.

As an analyst, I’m observing that Ethereum’s beta initiatives – specifically, the Layer 2 token ecosystem and Layer 3 projects – are currently facing challenges in terms of gaining momentum during this phase. These innovative areas seem to be struggling to carve out a significant space within the broader context.

Traders who possess tokens associated with staking, re-staking, Layer 2, and Layer 3 within the crypto market may find they have paper losses in their portfolios due to Ethereum’s challenges as it faces increasing competition from platforms such as Solana.

Solana hits ATH against Ether, expect this from SOL price

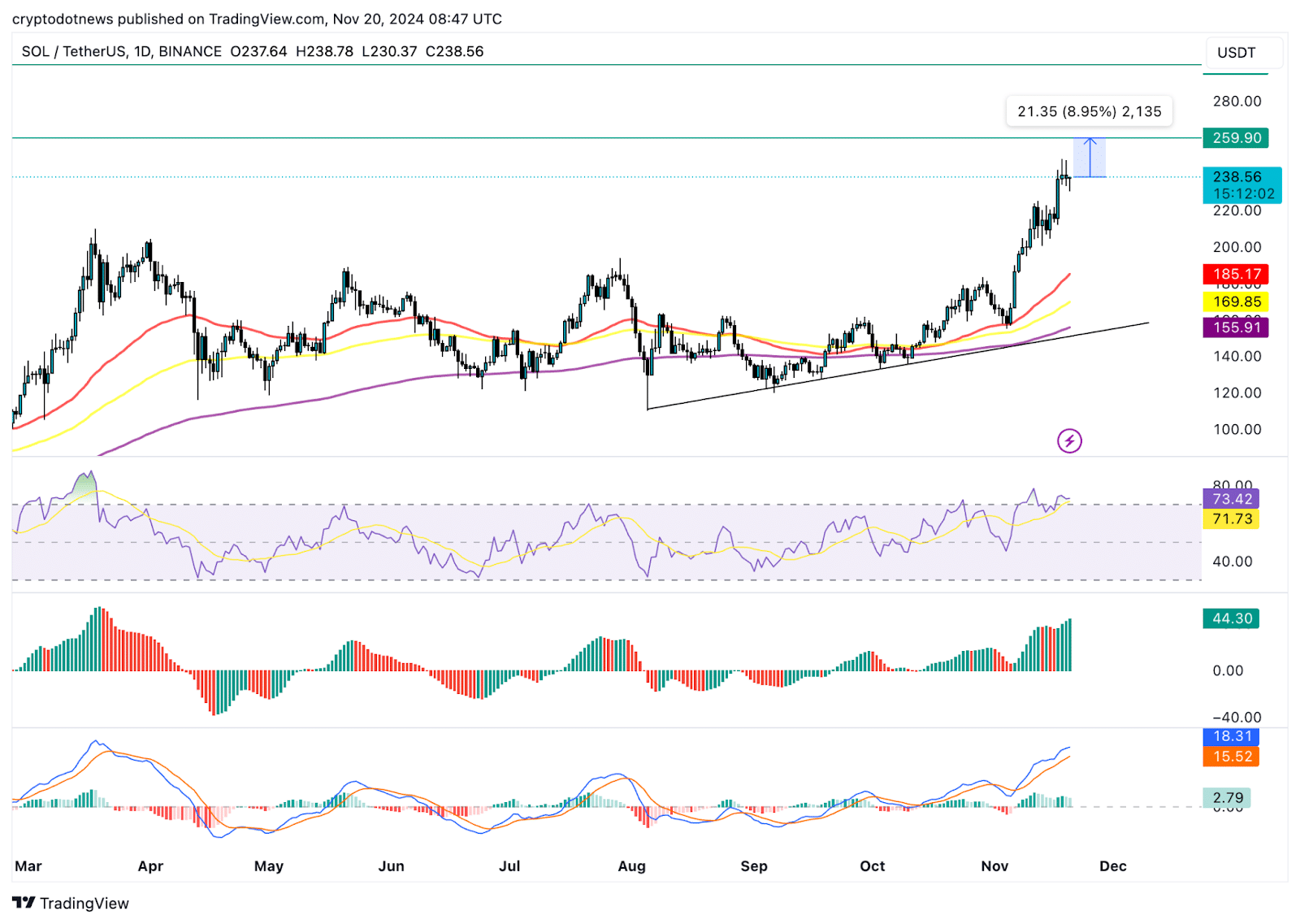

On November 18th, Solana reached a new peak when exchanged with Ethereum, specifically at 0.079770. This significant achievement is noteworthy as the SOL/USDT pair is only about 10% short of its previous all-time high of $259.90, which it attained in November 2021.

The potential exists for additional growth in the SOL/ETH exchange rate, with a possible revisit to its record high of 0.079770 – a jump of approximately 5% from the current price. At present, Solana (SOL) is trading above all three of its exponential moving averages for periods of 10, 50, and 200 days, indicating an extended upward trend that has persisted for almost five months.

In simpler terms, when we look at the technical analysis of Solana (SOL) versus Ethereum (ETH), the Relative Strength Index (RSI) is at 66 and the Moving Average Convergence Divergence (MACD) shows green histogram bars above the baseline. This pattern suggests a positive outlook, or “bullish” sentiment, for the SOL/ETH pair.

Should Solana surpass its previous peak and continue its upward trend, it’s possible that the SOL/ETH exchange rate might aim for approximately 0.090000, representing a 13% rise beyond its current record high.

On November 20th, Wednesday, the value of a SOL/USDT exchange is approximately $238.56. This is 8.95% lower than its peak historical value. Technical indicators hint at potential future growth for this pair, suggesting that Solana (SOL) may revisit its record high once more.

If this level is successfully re-tested again and a significant breakthrough occurs, Solana might surge past the psychologically significant price point of $300, representing a 15% increase over its previous all-time high of $259.90.

In simpler terms, the Relative Strength Index (RSI) is currently at 73, which some traders interpret as a signal to sell. However, the Awesome Oscillator indicates a strong bullish trend by displaying increasingly tall green bars, and the Moving Average Convergence Divergence (MACD) doesn’t show any indication of a change in direction yet.

The momentum underlying SOL price trend is likely positive, supporting further gains in Solana.

The three EMAs could act as support in the event of a market correction.

As I delve into the intricacies of cryptocurrency markets, it’s fascinating to note that Solana’s correlation coefficient with Bitcoin, as per Macroaxis.com, stands at an impressive 0.98. This suggests a strong relationship between these two digital currencies. Consequently, if there’s a correction in the Bitcoin market, we might expect a similar downward trend for Solana (SOL). As diligent traders, it’s crucial to factor this into our decisions when considering additional investments in both assets.

Read More

- Silver Rate Forecast

- Black Myth: Wukong minimum & recommended system requirements for PC

- Gold Rate Forecast

- USD CNY PREDICTION

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Grimguard Tactics tier list – Ranking the main classes

- Arknights celebrates fifth anniversary in style with new limited-time event

- Gods & Demons codes (January 2025)

- Maiden Academy tier list

- PUBG Mobile heads back to Riyadh for EWC 2025

2024-11-20 16:34