Ah, the eternal optimists, always ready to proclaim the arrival of a new era, a new dawn, a new Bitcoin boom 🌟. The cryptocurrency, that great liberator of humanity, is up 7% over the last two weeks, a sure sign that the masses are once again ready to surrender their hard-earned cash to the whims of the market 🤑.

But, as the great Soviet sage once said, “The line between good and evil is in the human heart.” And in the heart of the Bitcoin market, a different story is unfolding. The Bitcoin Network Value to Transaction (NVT) Golden Cross, that trusty indicator of market sentiment, is on the rise ⬆️. A sign of strength, you might ask? Ah, but beware, dear comrades, for this upward movement may signal the beginning of the end, the canary in the coal mine, the harbinger of doom 🐦.

For those uninitiated in the dark arts of cryptocurrency analysis, the NVT Golden Cross is a technical indicator that compares short-term and long-term moving averages of the NVT ratio to identify potential market tops or bottoms 🔍. When the short-term NVT crosses above the long-term average, it often signals that Bitcoin is becoming overvalued and may face a short-term correction 📉.

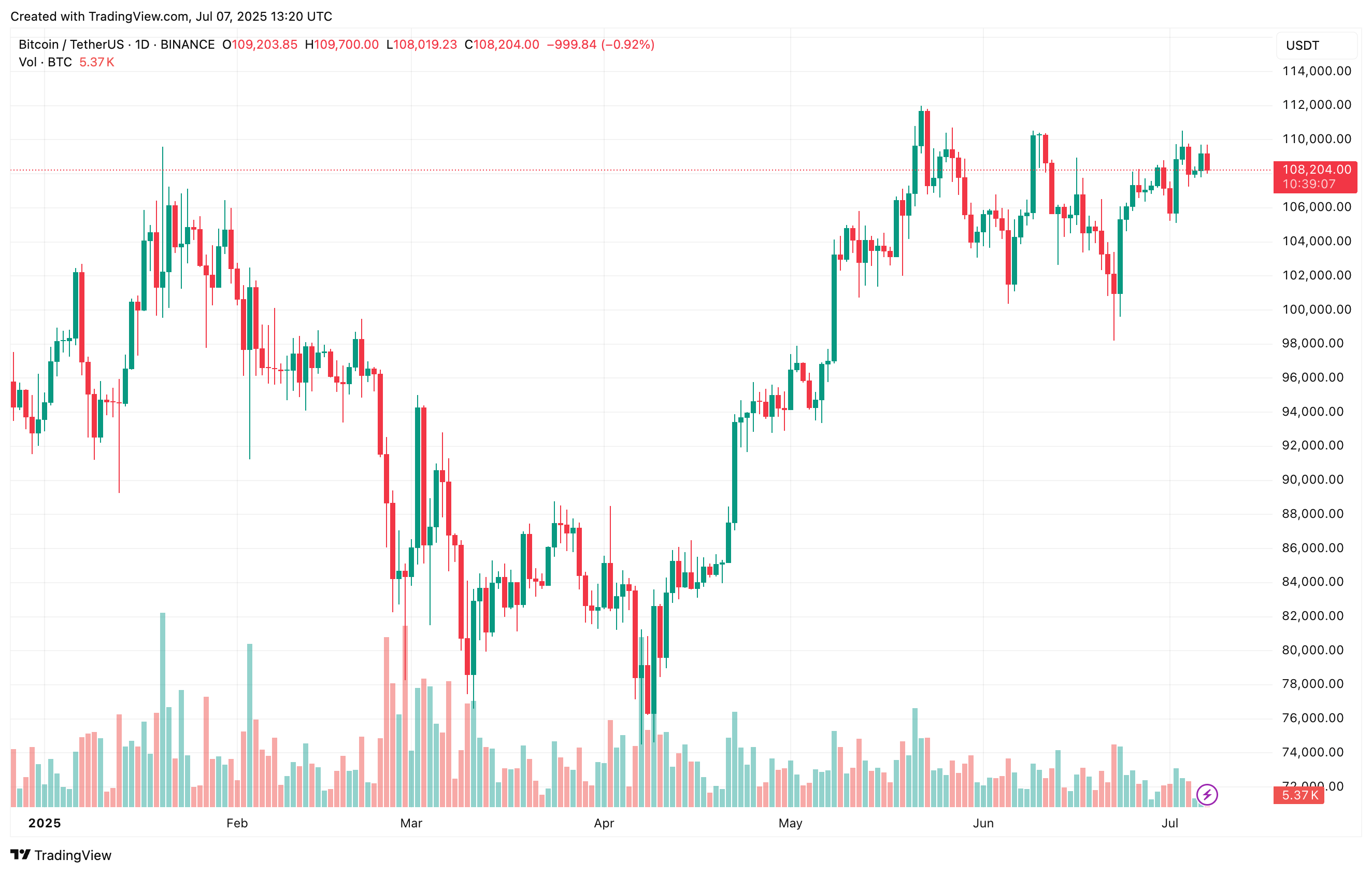

And what does the historical record show us? Ah, the NVT Golden Cross has successfully predicted three local tops so far in 2025 📊. The first occurred on February 5, when the NVT Golden Cross hit 2.68 while BTC traded at $97,600, followed by a 23.65% correction 📉. The second on March 24, the indicator peaked at 2.87 with BTC around $87,500, leading to a subsequent correction of 16.06% 📉. And most recently, on June 16, it rose to 2.21 with BTC trading at $106,800, which was followed by a 9.87% price dip 📉.

Currently, the NVT Golden Cross stands at 1.98. Although it hasn’t crossed the key 2.2 threshold yet, its upward trajectory suggests that market overheating could be brewing ⚠️. The CryptoQuant analyst explained:

Breaking its previous high is moderately bullish and shows momentum is building. If the metric crosses 2.2 again, it may hint at a local top. But don’t rush to exit – historically, the metric has stayed above 2.2 for several days 🕰️.

Ah, the eternal conundrum of the cryptocurrency investor: to buy or to sell, to hold or to fold 🤔. The NVT Golden Cross suggests that BTC may still have room to rally before hitting a potential local top 🚀. But, as the great Soviet sage once said, “The truth is not for all men, but only for those who seek it.” And what do the analysts say? 🤔

Some foresee a short-term pullback before Bitcoin reaches new highs 📉. Noted crypto analyst Chistian Chifoi described the current BTC price action as a “deceptive setup,” warning it may trap bulls before a possible surge toward a new all-time high (ATH) of $160,000 🚀.

Meanwhile, on-chain analytics firm Glassnode forecasts BTC’s short-term peak at $117,000 🔮. At press time, BTC trades at $108,204, down 0.1% in the past 24 hours 🕰️.

Read More

- Gold Rate Forecast

- Grimguard Tactics tier list – Ranking the main classes

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Castle Duels tier list – Best Legendary and Epic cards

- Silver Rate Forecast

- PUBG Mobile heads back to Riyadh for EWC 2025

- Cookie Run Kingdom: Lemon Cookie Toppings and Beascuits guide

- USD MXN PREDICTION

- Pi Network (PI) Price Prediction for 2025

2025-07-08 02:53