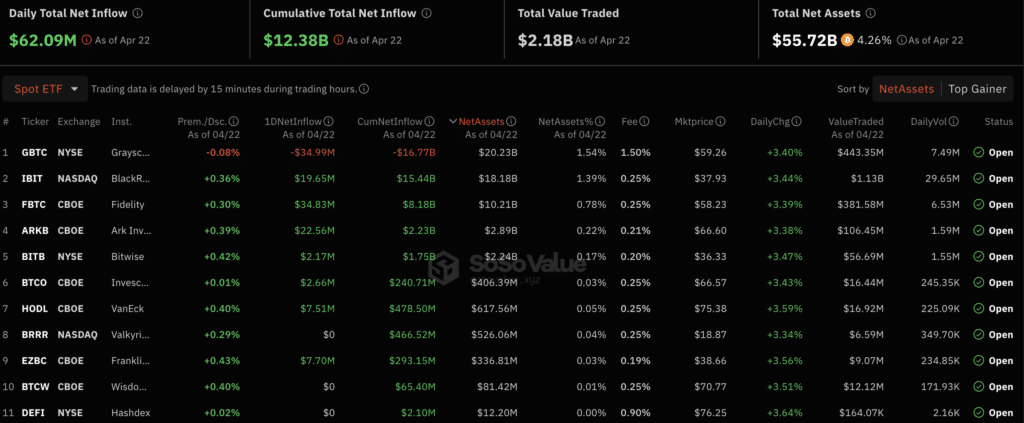

On April 22, the net daily capital inflow into spot Bitcoin ETFs was $62.09 million.

Based on SoSo Value’s data, the Fidelity Bitcoin Spot ETF (FBTC) crypto fund secured the leading position in terms of capital inflows on April 22, with a net addition of $34.83 million to its assets. This boosted its total assets under management to an impressive $8.18 billion.

Approximately $22.56 million was invested in the Bitcoin products from ARK Invest and 21 Shares, while IShares Bitcoin Trust (IBIT) received around $19.65 million. The remaining Bitcoin ETFs amassed approximately $20.04 million in investments.

For 69 consecutive days, IBIT has witnessed an uninterrupted inflow of investments as observed by Bloomberg analyst Eric Balchunas, resulting in this fund ranking 11th in terms of longest streaks of inflows.

The current run of positive days for $IBIT now stands at 69. With just one more day, it will join the Top 10 longest streaks and match that of $JETS. It’s intriguing, but if this streak were to end tomorrow, it would add an amusing twist – a reminder that even financial markets can have their humorous moments. (Source: @thetrinianalyst)

— Eric Balchunas (@EricBalchunas) April 22, 2024

According to economist Alessandro Ottavani’s observations, IBIT saw a consistent addition of assets at the start of the week. This fund is among the ten investment tools that have experienced persistent investments for an extended duration.

On April 19th, Bitcoin ETFs experienced a significant inflow of approximately $59.56 million. This sector took the lead in terms of volume, accumulating an additional $54.77 million. The total amount of assets under management for these funds now stands at around $8.14 billion.

On April 19th, IBIT took in $29.28 million in new investments, while ARK Invest and 21 Shares each brought in a total of approximately $12.53 million.

Read More

- Silver Rate Forecast

- Black Myth: Wukong minimum & recommended system requirements for PC

- Gold Rate Forecast

- USD CNY PREDICTION

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Grimguard Tactics tier list – Ranking the main classes

- Arknights celebrates fifth anniversary in style with new limited-time event

- Gods & Demons codes (January 2025)

- Maiden Academy tier list

- PUBG Mobile heads back to Riyadh for EWC 2025

2024-04-23 17:42