Ah, the fourth quarter of 2024! A time when Cardano (ADA) decided to don its finest attire and strut about, boasting a staggering price increase of 126%. One might say it was a success, but let us not forget the market cap, which gallantly reached $30.3 billion, as if it were a noble steed galloping into the sunset.

In this grand spectacle, our dear token ascended from the 11th to the 9th position among cryptocurrencies, much like a clumsy dancer stepping on toes at a ball. This delightful rally coincided with the U.S. elections, proving once again that politics and crypto are the best of friends—who knew?

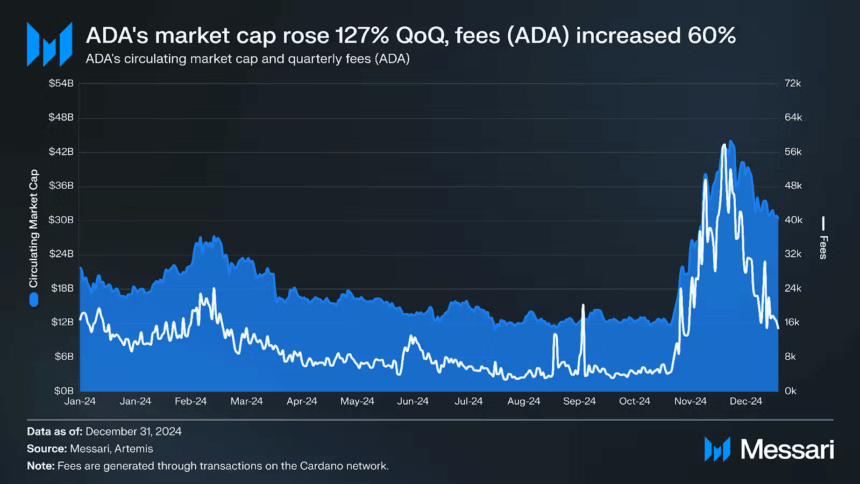

According to the esteemed Messari, transaction fees on the Cardano network soared by 254% quarter-over-quarter, reaching a princely sum of $1.8 million. A staggering 95% increase compared to the previous year! Yet, in a twist of fate, the average transaction fee in ADA fell by a mere 2% to 0.34 ADA. It seems the network, like a seasoned juggler, managed to handle the extra activity with grace.

Moreover, daily volumes surged by 65%, reaching 71,500, while active addresses blossomed by 58% to 42,900. Meanwhile, average USD transaction fees climbed by 80% to $0.23, as if ADA’s price were a hot air balloon rising into the sky.

In the realm of DeFi, the total value locked (TVL) increased by 13% from the last quarter, now standing at $231.6 million. Liquid Finance, in a dramatic twist, overtook Minswap, growing by 141% to $113.6 million. Minswap, however, did not sulk in the corner, achieving a respectable 69% growth, reaching $98.9 million in TVL.

Smaller protocols, like Splash Protocol and Aada, decided to join the party, boasting growth rates of 253% and 105% quarter-over-quarter, respectively. It’s as if they were all competing for the title of “Most Dramatic Growth.”

Decentralized exchanges (DEXs) on Cardano also performed admirably, with daily trading volume skyrocketing by 271% to $8.9 million. Minswap led the charge, attracting over 200,000 traders and amassing a total volume of $3.1 billion. WingRiders and SundaeSwap, like loyal sidekicks, contributed to the overall DEX trading volume, increasing by 40% year-over-year.

Lastly, Cardano’s stablecoin market cap experienced a delightful 66% increase quarter-over-quarter. The most popular stablecoins, iUSD and DJED, grew by 20% and 41%, while MyUSD increased by 17%. Alas, USDM was the lone wolf, declining by 5%. Such is the fickle nature of fortune!

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- PUBG Mobile heads back to Riyadh for EWC 2025

- Honor of Kings returns for the 2025 Esports World Cup with a whopping $3 million prize pool

- Kanye “Ye” West Struggles Through Chaotic, Rain-Soaked Shanghai Concert

- Arknights celebrates fifth anniversary in style with new limited-time event

- USD CNY PREDICTION

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Every Upcoming Zac Efron Movie And TV Show

- Superman: DCU Movie Has Already Broken 3 Box Office Records

2025-02-19 19:17