As a researcher with a background in finance and technology, I have closely followed Cathie Wood’s insights on cryptocurrencies, particularly Bitcoin and Ethereum, given her reputation as a leading voice in the industry. At Consensus 2024, Wood reiterated her strong support for Bitcoin over all other coins, emphasizing its potential, significance, and decentralized nature.

At the Consensus 2024 conference, I, as an ardent crypto investor, had the privilege of listening to Cathie Wood’s insights. She openly expressed her affinity towards Bitcoin among the cryptocurrencies.

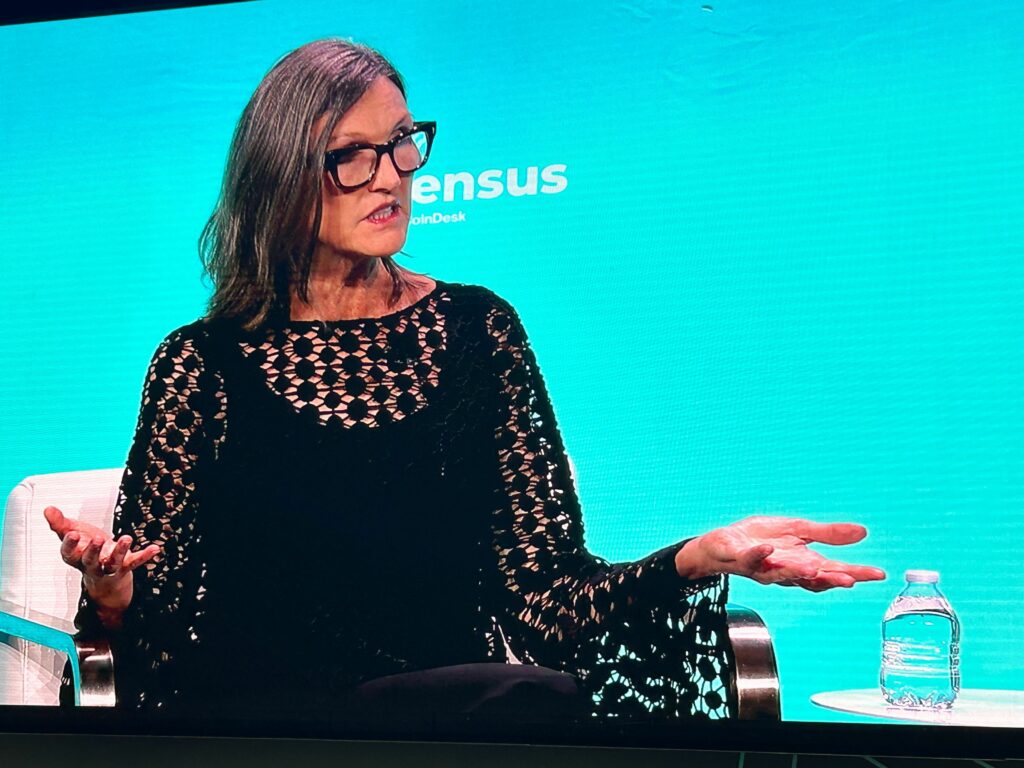

At the Consensus 2024 panel discourse, Cathie Wood, ARK Invest’s CEO, unequivocally voiced her approval for Bitcoin (BTC), openly favoring it above other digital currencies.

“Bitcoin is a substantial and relentless concept, according to Wood. Unlike when Facebook introduced Libra, there’s no weak point to constrict with Bitcoin.”

According to Wood, Bitcoin stands out among other cryptocurrencies for its immense potential and relevance. She emphasized the need to uphold Bitcoin’s core values, including its decentralized nature and users’ ability to hold their own keys.

As a researcher studying financial markets, I’d express it this way: “The pressure is mounting as Bitcoin signifies a novel asset class. It serves as a monetary system, yet it represents an innovative investment category.” (Regarding the recent approval of a spot Bitcoin ETF.)

Cathie Wood on the spot ethereum ETF

As an analyst, I was taken aback by the surprising approval of the Ethereum ETF by the regulatory body. This swift and uncomplicated process has undeniably fueled a positive shift towards cryptocurrencies within the US government.

“According to Wood’s assessment, the approval of the ETF was highly unlikely.”

During his speech, Wood hinted at the recent approval of FIT21 and former President Trump’s affinity towards cryptocurrencies, implying that the regulatory stance on digital currencies is a significant matter in upcoming elections.

“We were sure it was going to be denied,” Wood said.

The rising importance of cryptocurrencies in US elections is leading politicians and lawmakers to define their positions on regulation, which could influence the financial and tech spheres of tomorrow.

As a financial analyst, I would highlight that the voting populace, particularly those focused on finance and market stability, hold significant influence over policymakers. Their concerns regarding clarity in crypto regulations could potentially lead policymakers to strike a balance between fostering market growth and ensuring economic security.

The Federal Reserve

During a discussion on the role of the Federal Reserve, Wood shared his opinion that either it should be abolished or its influence should be diminished in light of Bitcoin’s rising significance and the evolving nature of money.

“It is time to dial it down dramatically and let market forces prevail,” Wood said.

As a crypto investor, I’ve expressed my concerns about the Federal Reserve’s outdated monetary policies in today’s rapidly changing financial landscape. In alignment with Wood’s perspective, I believe that the Fed’s traditional methods are no longer sufficient to address the challenges posed by global asset classes like Bitcoin.

Bitcoin over Ethereum

If given the choice between investing solely in Bitcoin or Ethereum (ETH), Wood would firmly opt for Bitcoin.

“Bitcoin, hands down. No question,” Wood said.

As a researcher studying the cryptocurrency market, I’ve consistently observed Bitcoin’s appeal due to its practicality and significant global worth compared to other cryptocurrencies.

As a crypto investor, I believe Ark Invest’s price target for Bitcoin is calculated under the hypothesis that Bitcoin will seize more than a 3% share of the total global money supply excluding those held in the US, UK, Japan, and Europe. According to Cathie Wood, the founder of Ark Invest, this forecast is considered conservative.

As a researcher studying the adoption of digital currencies by countries, I couldn’t help but express approval for El Salvador’s decision to welcome Bitcoin with open arms. This move has only strengthened my belief in the potential of cryptocurrencies as a viable alternative to traditional financial systems.

Read More

- 10 Most Anticipated Anime of 2025

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- USD CNY PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

- Castle Duels tier list – Best Legendary and Epic cards

- Maiden Academy tier list

- Cookie Run Kingdom: Lemon Cookie Toppings and Beascuits guide

- Silver Rate Forecast

- USD MXN PREDICTION

2024-05-29 20:46